I have been involved, full-time, in the commodity and financial markets for over 40 years. I’ve seen a lot of remarkable and highly unexpected price action in that time. The most remarkable and unexpected market price action has to be Nymex crude oil futures dropping to minus $40.32 a barrel in April 2020 during the COVID-19 pandemic. Another shocker was lumber futures prices spiking to a record high in May 2021 — also due to high demand during the pandemic. Cocoa futures come to mind, too. For 40 years the cocoa market traded in a range of $700 to $3,800 a ton — until its stratospheric spike to $12,931 in December 2024. Pork belly futures (now de-listed), orange juice futures, and natural gas futures also had monstrous rallies to record high prices that beforehand seemed unfathomable.

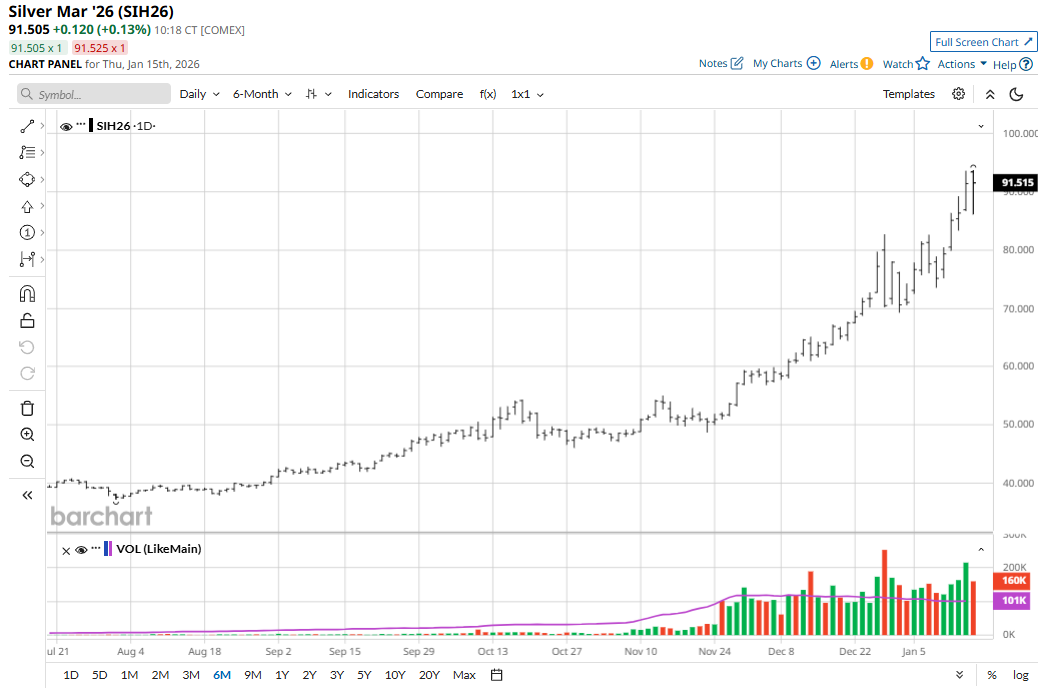

Silver’s (SIH26) recent price explosion to the upside falls into my top five most remarkable and unexpected market developments in my long career in commodities. In August 2025, silver futures were trading at $36 an ounce. By November, the $50 handle was achieved, and prices reached a record high. Last fall I wrote that silver being able to hold above $50 for a couple weeks would be key for the metal’s longer-term price trajectory. I had my doubts that such could occur, and in fact, silver futures prices fell to a low of $45.51 in late October (after hitting a record high of $53.765 in mid-October). Indeed, in late October it looked like the silver bulls had run out of gas after what was even then an extraordinary bull run.

Many long-time metals market observers, including myself, reckoned in late November that the major bull run in silver had run its course. Little did I know then that the silver market was just pausing to catch its breath before embarking on a new and even more powerful rocket thrust that would see prices double in a little over two months’ time. As the old saying goes: “You can’t make this stuff up!”

When markets like silver go parabolic, most logic and technical indicators go right out the window.

Fundamentals That Are Driving Silver Prices Sharply Higher

Safe-haven demand is the main driver propelling silver and gold prices north and to record highs. A very aggressive U.S. foreign policy that has seen President Donald Trump take out the Venezuelan president, state the U.S. needs to own Greenland for national security purposes, and signal Iranian citizens to continue to protest and take over Iranian institutions, is the main driver pushing traders and investors to continue to own gold and silver. And that’s just what has occurred the past month. The marketplace anxiously wonders what and where the next shoe will drop in U.S. foreign policy.

The rush by major industrialized nations to stockpile “rare earth” minerals that include precious metals will continue amid the need for critical metals to build out the energy demand needed for artificial intelligence applications.

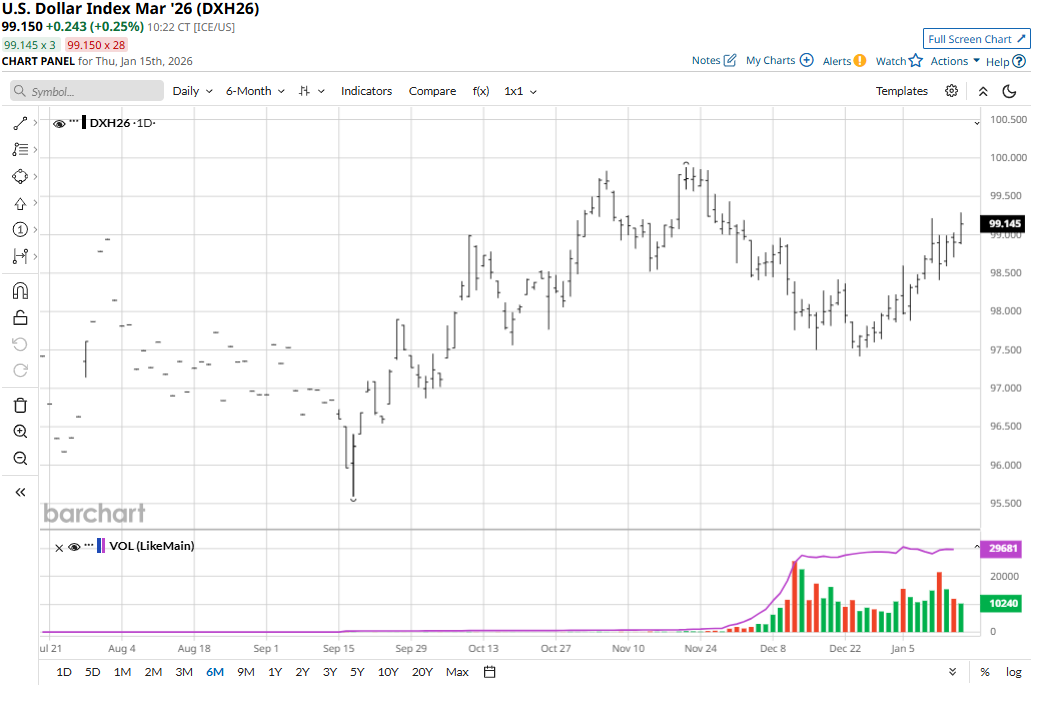

Also, the new Federal Reserve chief coming on board in the next few months is very likely to be a U.S. monetary policy dove. Lower U.S. interest rates likely mean a depreciating U.S. dollar ($DXY) on the foreign exchange market. That’s a bullish scenario for gold and silver, which have historically tended to trade in general inverse relationships to the greenback on a daily basis.

Where to from Here for Silver?

I would be surprised if silver does not reach $100 an ounce, and maybe as soon as the next several trading sessions. The metal has entered a new trading plateau that will likely remain in place for years to come. Forecasting commodity market prices can be like throwing darts, especially when a market’s price is in uncharted territory.

My bias at present is that a new, longer-term price floor for silver is $50. That means when the silver market finally tops out, the farthest it would drop would be back to the $50 area. How high can silver prices get before the bulls finally run out of gas and the boom cycle turns into a bust cycle? I have no idea, but I expect to continue to be surprised by this moonshot in prices.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart