Oakland, California-based Block, Inc. (XYZ) is a financial technology company that builds ecosystems focused on commerce and financial products and services. Valued at a market cap of $40.1 billion, the company is ready to announce its fiscal Q4 earnings for 2025 in the near future.

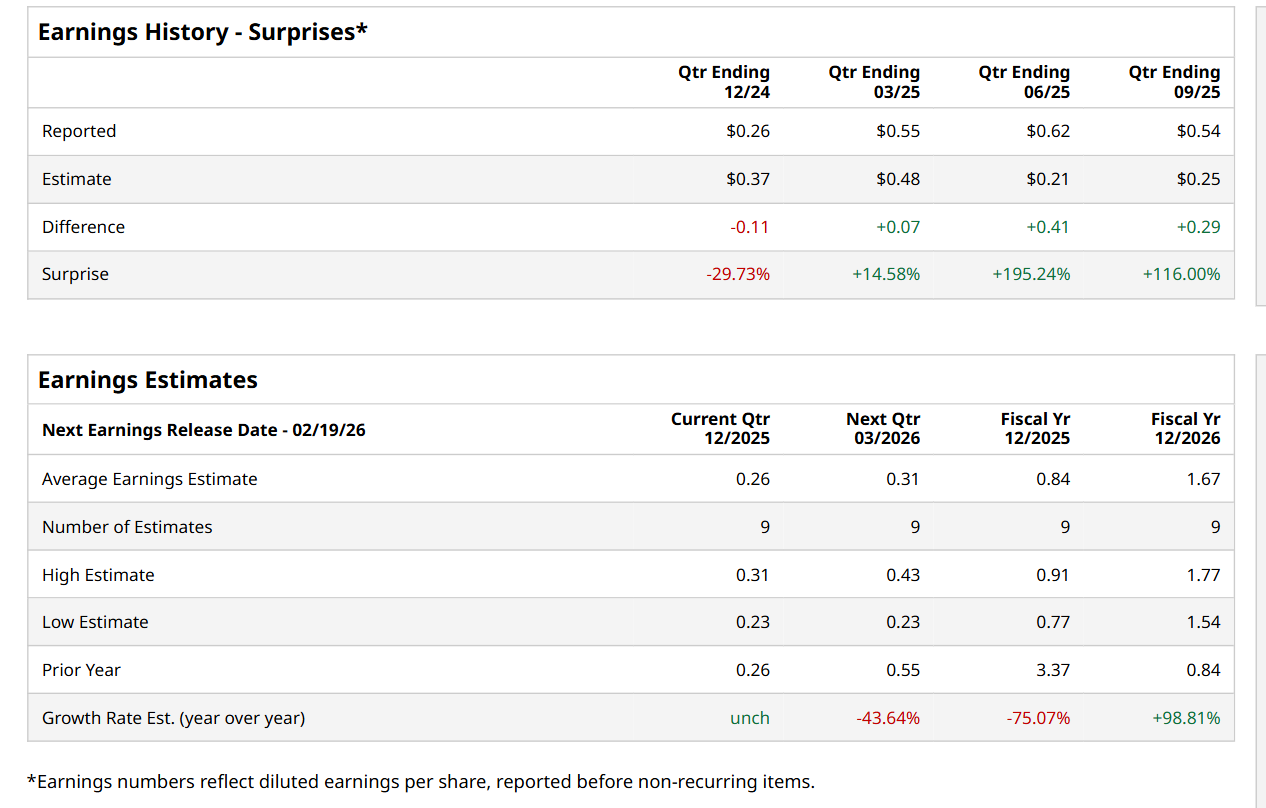

Before this event, analysts expect this fintech company to report a profit of $0.26 per share, in line with the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in two of the last four quarters, while missing on two other occasions. Its earnings of $0.54 per share in the previous quarter fell short of the forecasted figure by 14.3%.

For the current fiscal year, ending in December, analysts expect XYZ to report a profit of $0.84 per share, down 75.1% from $3.37 per share in fiscal 2024. Nonetheless, its EPS is expected to rebound and grow by 98.8% year-over-year to $1.67 in fiscal 2026.

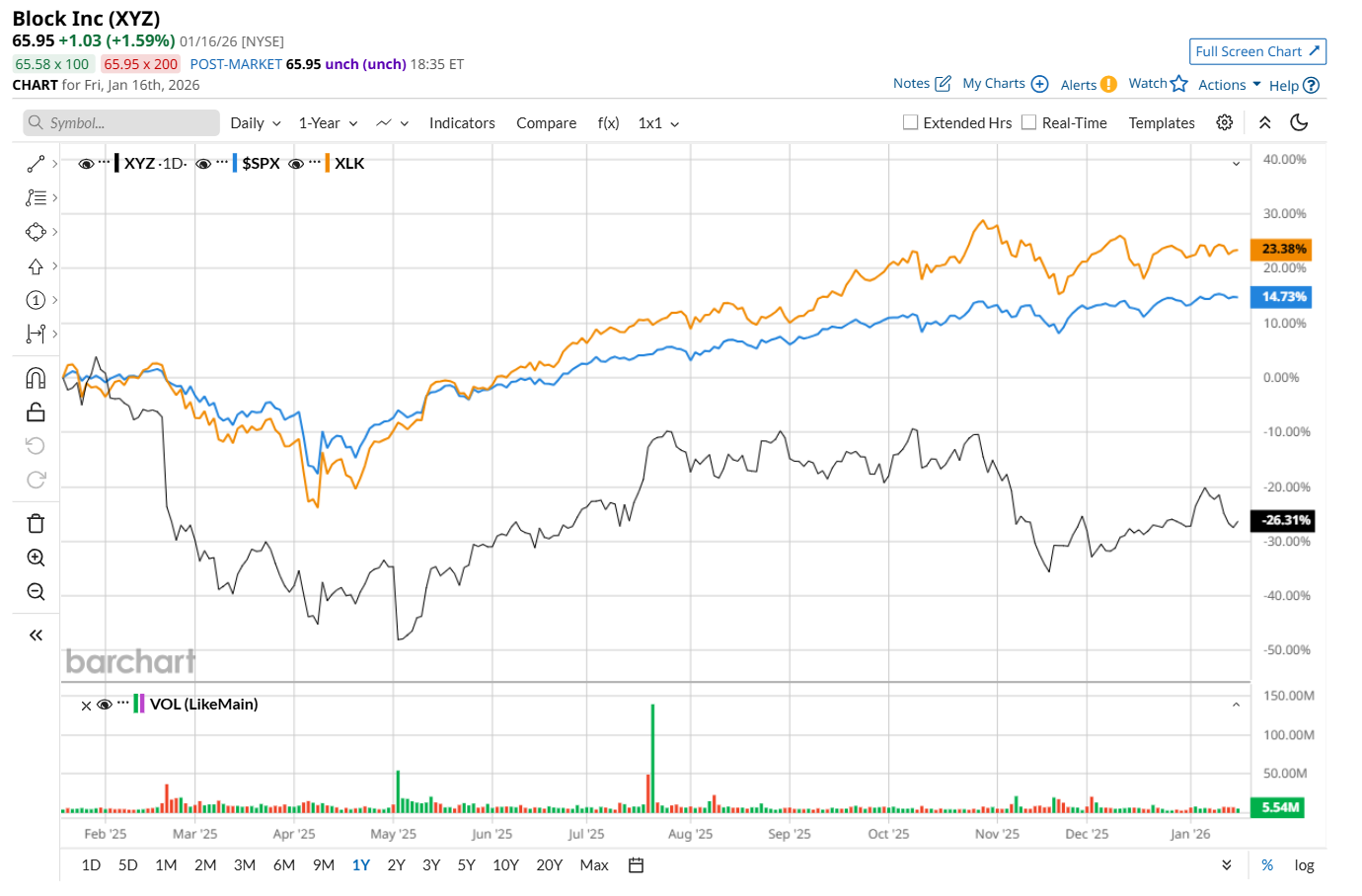

XYZ has declined 23.7% over the past 52 weeks, considerably underperforming both the S&P 500 Index's ($SPX) 16.9% return and the State Street Technology Select Sector SPDR ETF’s (XLK) 26.4% uptick over the same time period.

On Nov. 6, Block reported weaker-than-expected Q3 results, prompting its shares to drop 7.7% in the following trading session. The company’s overall revenue increased 2.3% year-over-year to $6.1 billion, but missed analyst expectations by 3.6%. Moreover, its adjusted EPS also grew 1.9% from the prior-year quarter to $0.54, but came in 14.3% below consensus estimates.

Wall Street analysts are moderately optimistic about XYZ’s stock, with a "Moderate Buy" rating overall. Among 42 analysts covering the stock, 25 recommend "Strong Buy," four advise "Moderate Buy,” 11 indicate "Hold,” and two suggest "Strong Sell” ratings. The mean price target for XYZ is $83.27, indicating a 26.3% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- After Rigetti Announced a Quantum Computing Delay, How Should You Play RGTI Stock in January 2026?

- Wells Fargo Says You Should Buy the Dip in Broadcom Stock

- Taiwan Semi Crushed Q4 Earnings. That Makes This 1 AI Chip Stock a Top Buy.

- As Trump Hits AMD MI325X Chips with a 25% Tariff, How Should You Play AMD Stock?