The base metals sector posted a 10.47% Q4 gain. The composite of copper, aluminum, nickel, lead, zinc, and tin forwards traded on the London Metals Exchange posted across-the-board gains in Q4 and 2025, moving 19.12% higher in 2025.

In my Q3 Barchart report on base metals, I concluded with the following:

Base metals have remained in bullish trends since the 2020 pandemic-inspired lows. Elevated inflation increases production prices, which underpins prices as the sector heads into Q4 and 2026.

U.S. trade tariffs and the Chinese economy are the most critical factors for the path of least resistance of copper, aluminum, nickel, lead, zinc, and tin prices. Watch the LME inventory levels for fundamental clues.

I remain bullish on base metals, but would only enter or add to long risk positions on price corrections in the current environment. Volatility over the past months in the COMEX copper futures could be a model for the entire sector in Q4 and 2026.

Base metals moved into 2026 in bullish trends.

Copper posts an impressive gain, with the forwards outperforming the futures in Q4

Copper on the London Metals Exchange outperformed copper on the CME’s COMEX division in Q4 with 20.98% and 17% respective gains.

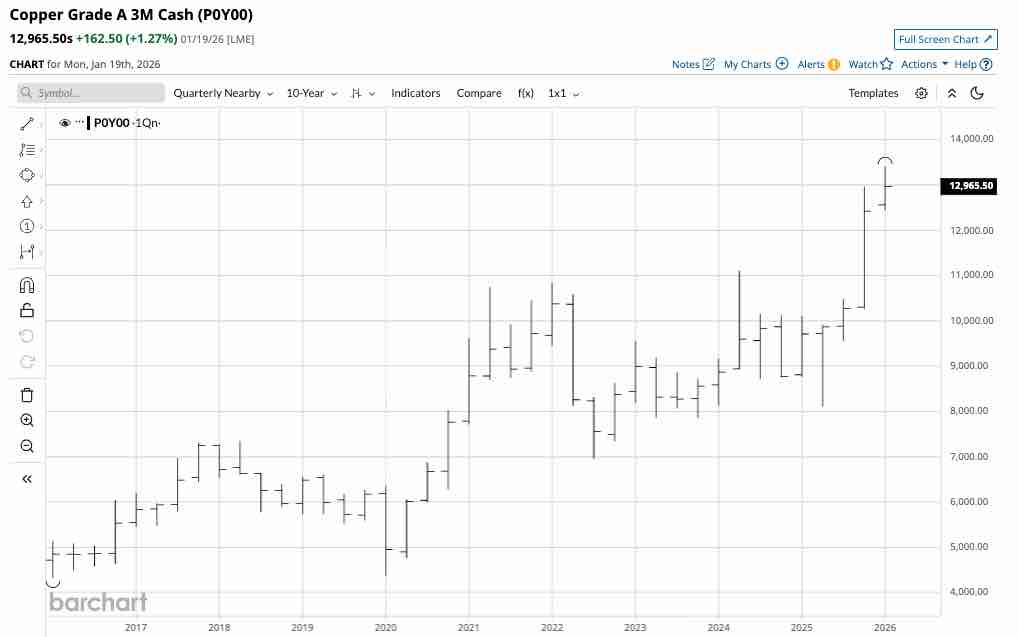

The quarterly chart highlights LME three-month copper’s 41.69% 2025 gain, with the red metal settling at $12,423 per metric ton on December 31, 2025.

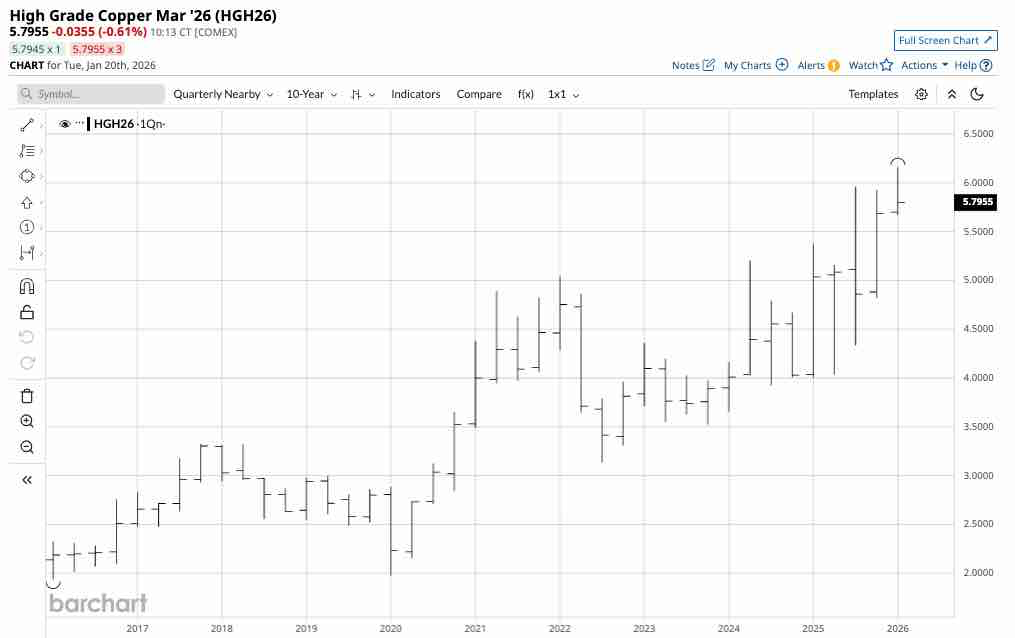

The quarterly chart highlights that the continuous COMEX copper future posted a 41.12% 2025 gain, with the futures settling at $5.6820 per pound on December 31, 2025.

LME and COMEX copper were the best-performing base metals in Q4 and 2025, with the futures and forwards rising to new record highs during the year.

As of January 20, 2026, LME and COMEX copper prices were higher than the 2025 closing levels and have reached new record highs in early 2026.

LME Stocks in 2025

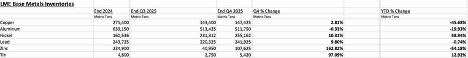

The London Metals Exchange (LME) is the world’s leading base or nonferrous metals trading platform with three-month contracts and daily settlements in copper, aluminum, nickel, lead, zinc, and tin. The LME has a network of warehouses and publishes inventories for the six metals. Tracking stockpiles can provide clues about price trends as they reflect supply and demand changes.

The chart shows substantial percentage decreases in copper, aluminum, and zinc stocks at the LME in 2025. While nickel and tin inventories rose, the potential for tariffs likely caused the metals to move out of LME warehouses.

COMEX copper warehouse stocks moved 173,974 tons higher in Q4 2025, to 498,061 metric tons. The combined LME and COMEX stock changes resulted in an overall 177,999-ton increase in inventories in Q4 2025. COMEX inventories were over 3.37 times higher than LME stocks as of the end of December 2025.

Double-digit percentage gains in aluminum and tin forwards

Three-month LME high-grade aluminum prices moved higher by 11.75% in Q4 2025, settling at $2,995.50 per metric ton. The aluminum forwards gained 17.40% in 2025.

Three-month LME tin prices moved 14.65% higher in Q4 2025, settling at $40,596 per metric ton. The aluminum forwards gained 39.59% in 2025.

High-grade aluminum and tin three-month forwards were higher than the 2025 closing price on January 20, 2026.

Gains in nickel, lead, and zinc forwards

Three-month LME nickel prices moved higher by 9.26% in Q4 2025, settling at $16,646.00 per metric ton. The nickel forwards gained 8.60% in 2025.

Three-month LME lead prices edged 0.88% higher in Q4 2025, settling at $2,006.00 per metric ton. The lead forwards gained 2.77% in 2025.

LME high-grade zinc prices moved higher by 5.32% in Q4 2025, settling at $3,117.50 per metric ton. Zinc’s price gained 4.67% in 2025.

The LME nickel, lead, and zinc prices were higher than the 2025 closing levels on January 20, 2026.

The prospects for Q1 and 2026- Trade and China remain critical

Base metals enter 2026 in bullish trends, which have been in place since the 2020 pandemic-inspired lows. Elevated inflation above the Fed’s 2% target, a falling U.S. dollar and other fiat currency values, and the prospects for lower interest rates underpin prices as the sector heads into Q1 2026.

U.S. trade policy and China’s economy are the most critical factors for the path of least resistance of copper, aluminum, nickel, lead, zinc, and tin prices. Watch the LME inventory levels for fundamental clues.

I remain bullish on base metals, but would only enter or add to long risk positions on price corrections. Expect price volatility, and you will not be disappointed.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart