CoreWeave (CRWV) shares pushed notably higher on Jan. 26, after Nvidia (NVDA) announced a $2 billion investment in the artificial intelligence (AI) infrastructure company.

CRWV believes this deal will help accelerate its buildout of “5 gigawatts of AI factories by 2030.” Still, it may not be enough for investors to load up on its stock at current levels.

At its intraday peak, CoreWeave stock was seen trading nearly 65% higher than its December low.

Jensen Huang’s Remarks Make CoreWeave Stock Less Attractive

Nvidia’s investment in the AI infrastructure firm appears positive on the surface, but chief executive Jensen Huang's latest remarks warrant caution in buying CRWV stock today.

Speaking with CNBC this morning, Huang said the chipmaker was investing a “small percentage” of what’s needed for a 5 GW buildout vital for the fast-growing AI industry.

According to experts’ estimates, that sort of data center capacity may require as much as $75 billion in investments.

This means Livingston, New Jersey-headquartered CoreWeave needs to raise billions more to deliver on its “5 GW” promise, some of which may come from debt or stock offerings, raising dilution risk for its existing shareholders.

CRWV Shares’ Technicals Aren't Particularly Encouraging

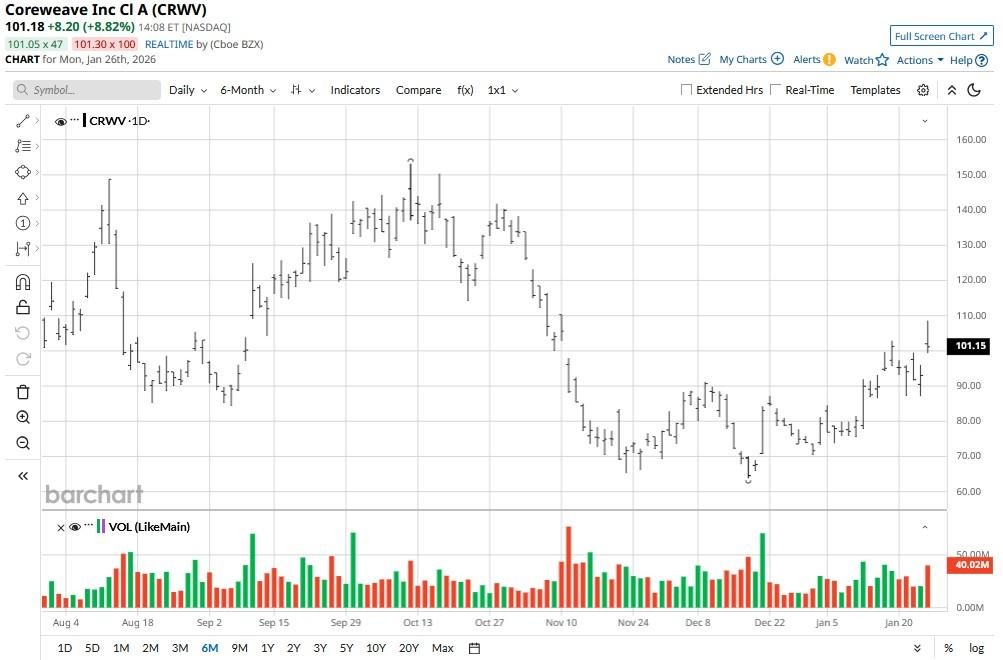

From a technical perspective, CoreWeave shares — following today’s surge — stand at an inflection point.

At the time of writing, they’re challenging their 200-day moving average (MA) at the $104 level, a decisive break above which could accelerate upward momentum in the near term.

On the flip side, however, CRWV’s failure to break out may reinforce that its broader downtrend remains intact.

Also worth mentioning is that CoreWeave is currently trading at a price-to-sales (P/S) ratio of more than 10, which appears somewhat stretched given that the company has yet to turn a profit.

Meanwhile, CRWV doesn’t pay a dividend to incentivize ownership either.

What’s the Consensus Rating on CoreWeave?

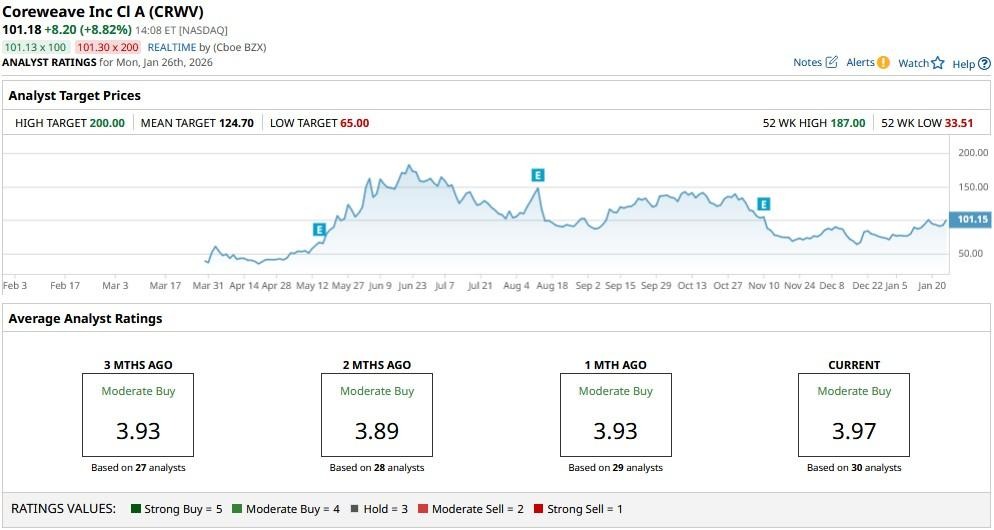

Despite aforementioned concerns, Wall Street analysts continue to believe that AI tailwinds alone will push CRWV shares higher in 2026.

According to Barchart, the consensus rating on CoreWeave remains at "Moderate Buy," with the mean target of about $125 indicating potential upside of more than 20% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- What's Next for Sandisk Stock After a 1,000% Rally?

- USAR Stock Is Solidly in Overbought Territory as Trump Invests in USA Rare Earth. Can You Still Chase the Rally Here?

- JPMorgan Says You Should Sell This 1 Flying Car Stock Short Now

- CoreWeave Stock Is Challenging Its 200-Day Moving Average on Nvidia Investment. Should You Load Up on CRWV Here?