AI may be the one that takes center stage, but memory chips are the ones that are actually dominating. Chip demand is drastically increasing, with computing and data-storage chips alone having a growth forecast of about 41.4% year-on-year (YoY) and making more than $500 billion as AI data centers add to their capacity.

Among them, NAND flash is the most prominent; the market is estimated to hit approximately $72.60 billion by 2030, thanks to the rapid adoption of SSD in servers, PCs, gaming, and other AI workloads.

Research now suggests that NAND contract prices are going to rise once more in early 2026, in a scenario where the growth of AI data and the long-term purchasing of hyperscalers come together, contrary to the limited supply. Thus, the top financial houses, such as BNP Paribas, have already begun designating this a “historic” memory cycle that theoretically might continue until 2026 and cause the promoters of the DRAM and NAND companies to upgrade their expectations and targets.

With DRAM and NAND prices already outrunning expectations and AI infrastructure spending keeping up with the momentum, what are the favorite memory chip stocks to grasp this scenario and blossom into sustainable growers? Let's find out.

Memory Chip Stocks to Buy: Seagate Technology (STX)

Seagate Technology (STX), based in Fremont, California, is focused on designing and manufacturing mass‑capacity data‑storage hardware for global customers. This is a company that has a forward annual dividend of $2.96 per share in the future, and its yield is estimated to be roughly 0.91%.

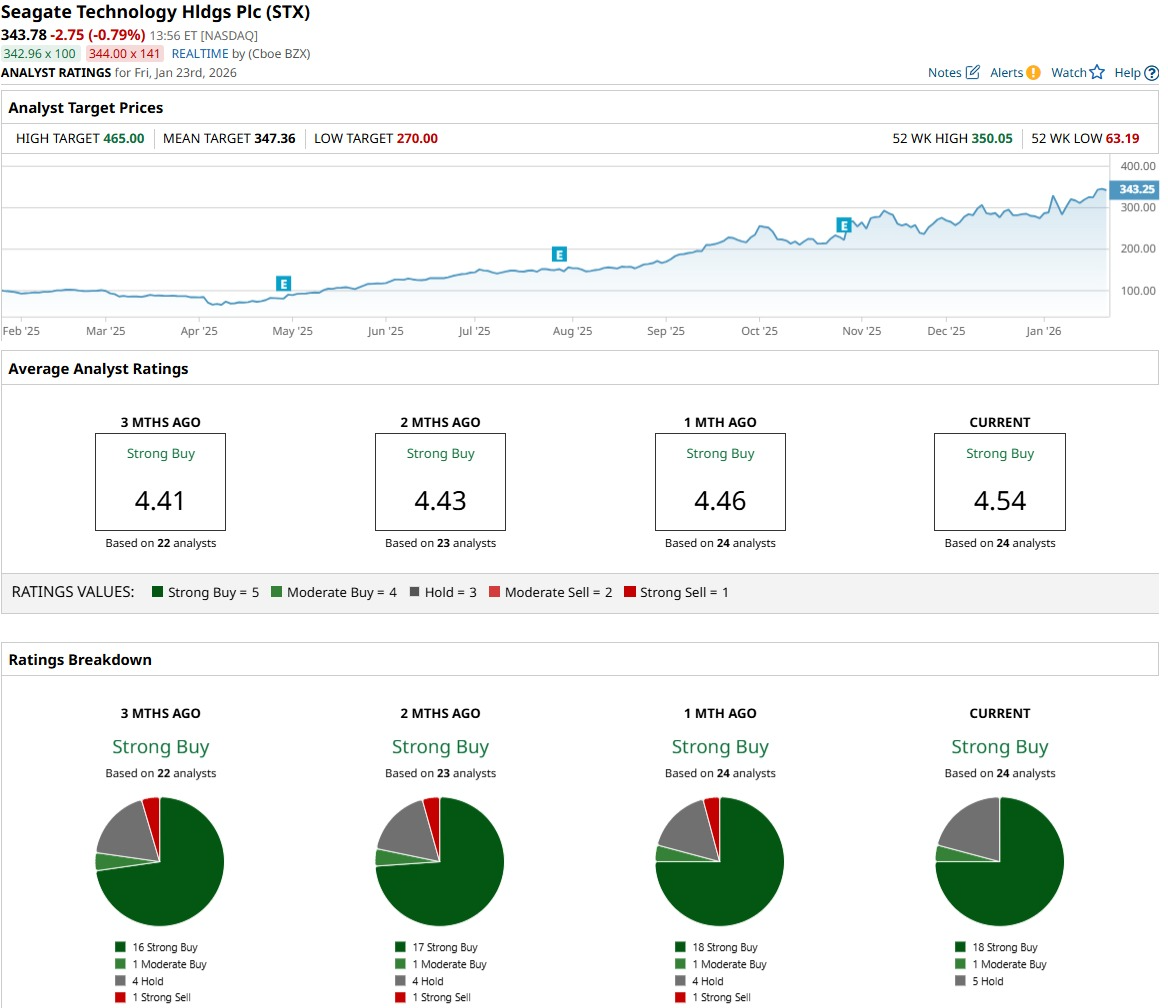

On Jan. 23, STX stock was $343.64 with an increase of approximately 24% so far for this year and 214% for the past 52 weeks.

This valuation signifies a market cap that is approximately $74 billion in size, along with a price-to-sales premium multiple of around 8.1x, which is noticeably above the estimated median of the sector, which is as low as 3.7x.

The company recently shipped 32TB SkyHawk AI, Exos, and IronWolf Pro hard drives globally through channel and retail partners, with prices that were recommended ranging from about $699.99 to $849.99 per unit, providing direct support to hyperscale workloads.

In addition to that, STX has also been fulfilling the expectations on the revenue side. Its fiscal update for the quarter, which ended in September 2025, disclosed that the company's earnings per share were around $2.51, while the consensus was $2.11, which is an 18.96% positive surprise.

The same report disclosed typical sales of about $2.63 billion, which is a 7.6% increase YoY, and net income of around $549 million, with growth of about 12.5%. The forward picture of STX is strikingly the same, with the following earnings report coming out on Jan. 27, after the close, with current-quarter EPS estimated at $2.59 as compared to $1.82 a year ago (+42.3%). For fiscal 2026, EPS is predicted to be $10.46, which is an increase from $7.26 last year (+44.1%).

That trajectory has helped shape a very constructive outlook, as the current analyst consensus rates the shares a “Strong Buy,” with an average price target close to $347.36 that sits only about 0.2% above spot price.

Memory Chip Stocks to Buy: SanDisk (SNDK)

SanDisk (SNDK), a roughly $73.78 billion equity based in Milpitas, California, designs NAND flash storage spanning enterprise SSDs, removable cards, and embedded solutions.

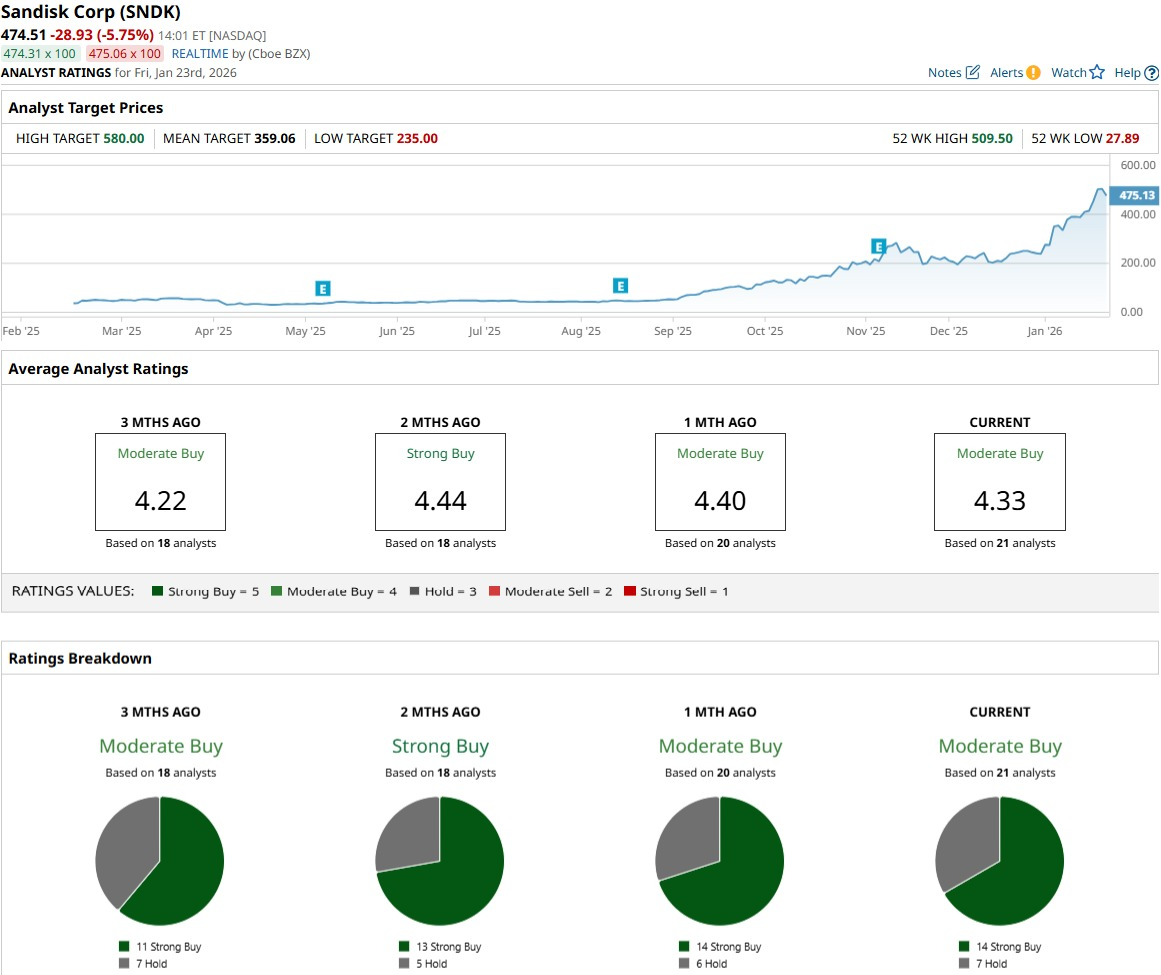

The stock trades at $474.55 as of Jan. 23, up 99.68% year‑to‑date (YTD).

Its premium valuation translates into a forward P/E of 39.04x versus a sector median of 25.28x.

This enthusiasm is closely linked to SanDisk’s push to explore the potential to effectively double pricing on select enterprise‑grade 3D NAND products.

SNDK’s recent earnings help explain the premium multiple. It was September 2025 when SanDisk delivered an EPS print of $0.90 against a $0.58 estimate, delivering a 55.17% upside surprise. This quarter produced $2.308 billion in sales, up 21.41% YoY, while net income surged to $112 million, an eye‑catching 586.96% jump as higher utilization and better pricing dropped through to the bottom line.

SNDK’s next earnings release is scheduled for Jan. 29, and its next quarter (March 2026) carries an average EPS estimate of $3.34 versus a prior year loss of $0.60, implying a 656.67% YoY swing. The full fiscal year ending June 2026 is projected at $11.60 EPS compared with $1.78 previously, a 551.69% growth rate.

This outlook is reflected in sentiment. The consensus from 21 covering analysts is a “Moderate Buy,” but the average target of $359.06 stands well below the current price, implying roughly 28.7% downside.

Memory Chip Stocks to Buy: Western Digital (WDC)

Western Digital (WDC), headquartered in San Jose, California, develops hard drives, SSDs, and platform solutions for cloud, enterprise, and consumer storage needs. This $83.18 billion equity pairs with a forward annual dividend of $0.50 per share, yielding about 0.22%.

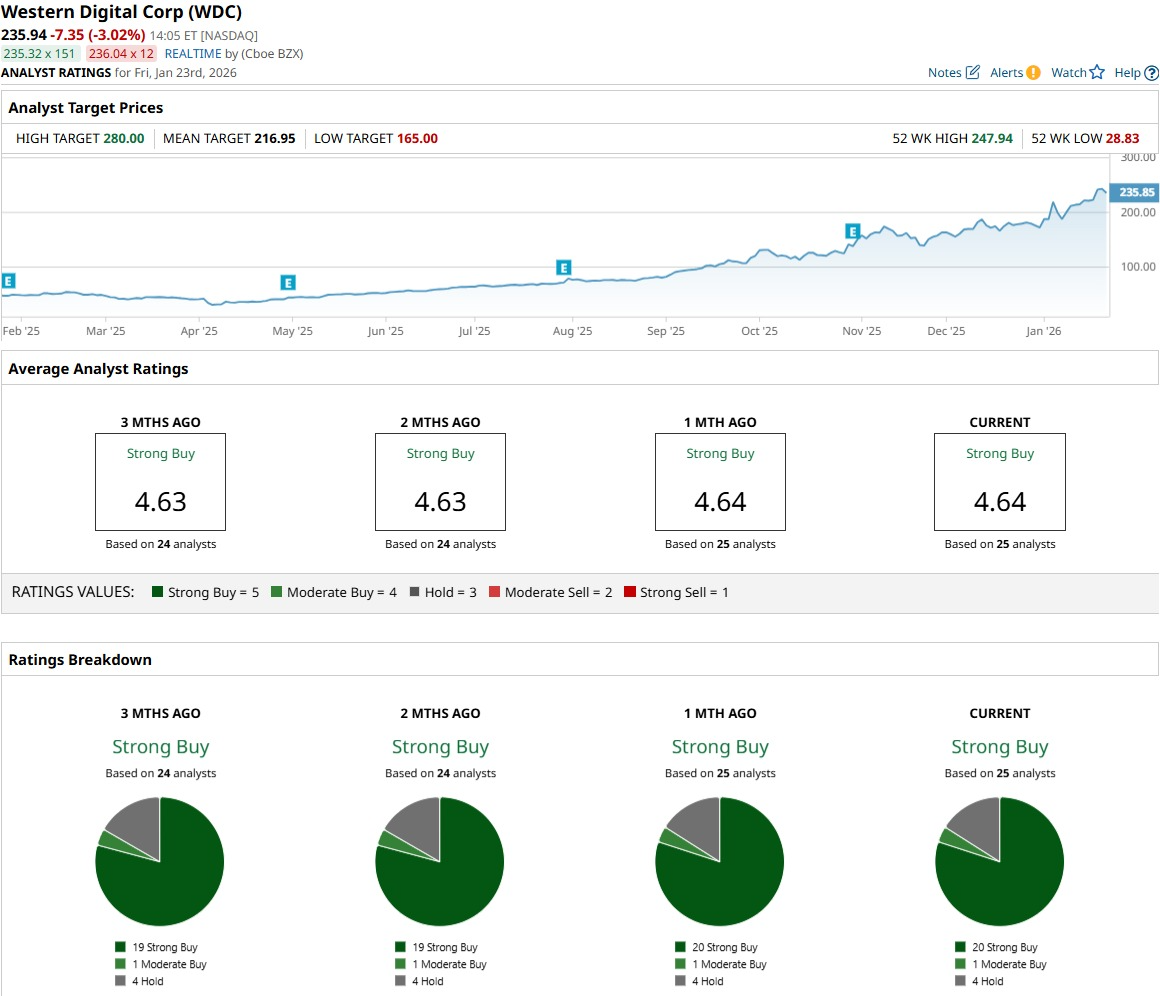

WDC sits at $236.18 as of Jan. 23, with a 36.63% YTD gain and a 356.94% advance over the past 52 weeks.

This pricing leaves Western Digital on a 36.85x price‑to‑cash‑flow multiple versus a 19.41x sector median. The company positioned itself at Supercomputing 2025, where it billed itself as a trusted AI storage leader and showcased next‑generation platforms, UltraSMR‑based high‑capacity systems, and OpenFlex disaggregated NVMe‑oF solutions to tackle bottlenecks in AI and HPC workloads.

This narrative is backed by rapidly improving fundamentals. The September 2025 quarter delivered adjusted EPS of $1.64 against a $1.47 estimate, an 11.56% beat that confirmed operating leverage. It produced $2.818 billion in sales for the period, up 344.19% YoY, while net income climbed to $1.182 billion, a 319.15% jump.

This forward picture is still constructive, with the next earnings release slated for Jan. 29 and current‑quarter EPS expected at $1.80 versus $1.55 a year earlier, implying roughly 16.13% growth. That full‑year fiscal 2026 EPS forecast of $7.13 compares with $4.53 previously, pointing to an estimated 57.40% expansion.

The consensus from 25 analysts sits at “Strong Buy,” even though the $216.95 average price target actually implies about 10.8% downside.

Memory Chip Stocks to Buy: Micron Technology (MU)

Micron Technology (MU), a $447.5 billion Boise‑based equity, manufactures DRAM, NAND, and high‑bandwidth memory for data centers, PCs, mobile, and automotive. This company has a modest forward dividend of $0.46 per share, implying about a 0.13% yield.

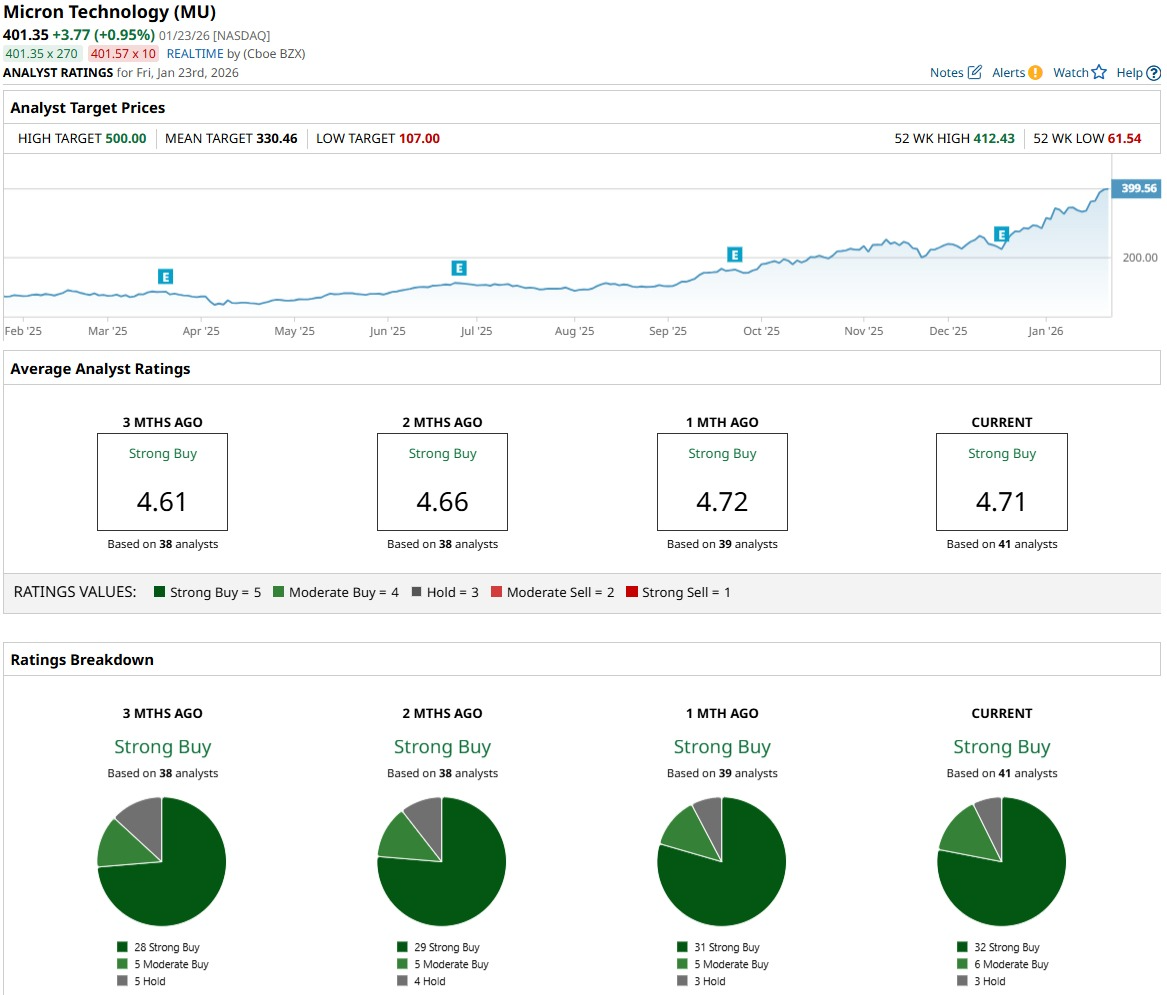

MU trades at $399.85 as of Jan. 23, a +39.92% YTD and +280.91% over 52 weeks.

Its premium pricing translates into an 11.72x price‑to‑sales multiple versus a 3.64x sector median. This January saw Micron’s $1.8 billion agreement to acquire a 300mm fab site in Taiwan from Powerchip, giving it a 300,000‑square‑foot cleanroom addressing DRAM supply tightness by the second half of 2027.

It was Dec. 16, 2025, when Micron reported fiscal Q1‑26 EPS of $4.61 versus a $3.67 estimate, a 25.61% beat that showed the leverage it has to DRAM and NAND pricing. The same quarter delivered $13.643 billion in revenue, up 20.57% YoY, while net income jumped to $5.24 billion, a 63.70% increase.

This guidance now points to another step change. In the second quarter of fiscal 2026, consensus sees an EPS of $8.18 versus $1.41 a year earlier, implying a 480.14% growth, while full‑year fiscal 2026 EPS is projected at $32.19 compared with $7.68 previously, a 319.14% expansion.

MU’s consensus from 41 analysts sits at “Strong Buy,” even as the $330.46 average target actually sits about 16.9% below the current quote.

Conclusion

Memory prices are already in the stratosphere, and these four names have clearly rerated to reflect that. Based on the earnings momentum, AI capex pipeline, and still‑tight DRAM/NAND conditions, the path of least resistance over the next few quarters likely stays skewed to the upside, though with sharper swings as expectations rise. Pullbacks rather than breakouts, therefore, look like the smarter moments to add exposure to this memory supercycle.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart