Alphabet (GOOGL) has been on an absolute tear in 2026, already up 6.4% year-to-date with its market cap surging towards $4 trillion.

The options flow from Monday suggests institutional traders are betting this AI-driven rally has further room to run.

Let's break down the unusual options flow and what it might signal about the stock's potential direction.

Options Volume and Flow Analysis

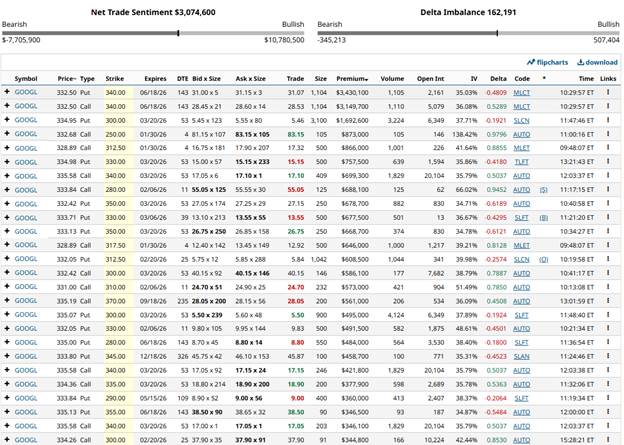

This options flow data from Google on Monday, January 26th represents exceptionally bullish institutional positioning, with over $3 million in net bullish sentiment and a positive delta imbalance exceeding 162,000.

The concentration of large call trades across multiple strike prices and expirations suggests major players are positioning for significant upside through the first half of 2026.

Net Trade Sentiment: +$3,074,600 (strongly bullish)

Delta Imbalance: +162,191 (heavily bullish)

The flow reveals aggressive call buying concentrated at key strikes:

A massive $3.43 million call purchase at the $340 strike expiring June 18, 2026 stands out as the single largest trade, suggesting conviction that Google will push well above current levels by mid-year. This represents premium paid on 1,104 contracts with a delta of 0.48, indicating these are out-of-the-money calls targeting significant upside.

Multiple seven-figure call trades appear across various strikes including $280, $300, $312.50, and $330, demonstrating broad-based bullish conviction rather than concentrated speculation. The diversity of strikes and expirations suggests institutional players are positioning across multiple time horizons.

Notably, heavy call volume concentrated in March 2026 expiration likely targets the company's Q4 2025 earnings report (scheduled for early February) and subsequent AI product announcements, while the June positioning suggests longer-term bullish thesis extending through the first half of 2026.

While there is some put activity visible in the flow, particularly at the $300 and $340 strikes, the net sentiment remains overwhelmingly bullish with call volume and premium substantially outweighing protective put buying.

Technical Picture

Google's stock continues to show remarkable technical strength, trading at $333.26, up 1.63% on the day with a year-to-date gain of 6.4%. The stock is comfortably above both its 21-day and 50-day moving averages, demonstrating sustained institutional accumulation.

The stock has established a pattern of higher lows throughout 2025 and early 2026, with strong support developing around the $300-310 zone. The recent breakout to new all-time highs above $330 has occurred on healthy volume.

This technical strength aligns perfectly with the bullish options positioning we observed, where traders are betting on continued upward momentum through mid-2026.

The combination of price action, moving average alignment, and volume profile suggests the stock is in a strong uptrend with room for further gains.

Recent Catalysts Driving Momentum

Several significant developments are fueling the recent surge in Google's stock price and institutional interest.

The launch of Gemini 3 in December 2025 positioned Google as a serious competitive force in AI, surpassing ChatGPT in performance benchmarks and easing concerns that the company was falling behind in the AI race.

This breakthrough has renewed confidence in Google's AI strategy and long-term positioning.

Google recently scored a major deal with Apple (AAPL), where its Gemini models and cloud technology will power the next generation of Apple's AI features. This partnership validates Google's AI capabilities and opens up significant new revenue streams.

The company's custom Ironwood AI chip has emerged as a potential competitor to Nvidia's offerings, with multi-billion dollar deals including granting Anthropic access to up to 1 million Tensor Processing Units (TPUs). Reports suggest Google may begin selling TPUs to Meta, creating an entirely new hardware revenue stream.

Warren Buffett's Berkshire Hathaway purchased $4.9 billion in Alphabet stock in late 2025, providing a significant confidence boost and attracting attention from institutional investors who closely follow Berkshire's moves.

On January 8, 2026, Cantor Fitzgerald upgraded Alphabet to "Overweight," calling it the "king of all AI trades" and citing the company's unique position across the entire AI stack from data centers and custom chips to large language models and consumer applications.

Other firms including Citi and Bank of Nova Scotia have raised price targets, with some analysts projecting the stock could reach $370-$380 in 2026.

Risk Considerations

Despite the bullish options flow and strong momentum, Google faces several near-term risks that traders should monitor carefully.

Valuation has become increasingly stretched following the 65% rally in 2025. At roughly 30 times forward earnings, the stock trades well above the Communication Services sector median of 18x, with a price-to-sales ratio of 10x greatly exceeding sector norms. The rich valuation means the stock has priced in substantial growth expectations, leaving limited margin for disappointment.

Antitrust concerns remain a persistent overhang. The company continues to face regulatory scrutiny in both the US and Europe regarding its search dominance, advertising practices, and app store policies. Any adverse rulings could impact the business model or force structural changes.

AI infrastructure spending is accelerating rapidly, with management committing to massive capital expenditures on TPU capacity and data centers. While necessary for maintaining competitive position, this aggressive investment cycle will pressure near-term margins and free cash flow generation.

Competition in AI is intensifying from multiple fronts. OpenAI, Microsoft, Amazon, and others are heavily investing in competing technologies. Google's search business, while currently strong, faces potential disruption from AI-powered alternatives that could change how users access information.

The advertising market, which still represents the majority of Google's revenue, remains sensitive to economic conditions. Any slowdown in ad spending could impact growth rates and disappoint the lofty expectations now built into the stock price.

Trading Implications

While the institutional flow provides potential trading opportunities, traders should consider risk-defined strategies that balance potential upside with downside protection given the elevated valuation levels.

A covered call strategy offers an attractive method to generate income while maintaining exposure to Google's upside potential. Selling calls against long stock positions can enhance returns in a sideways to moderately bullish market while providing some downside cushion through premium collection.

More directionally-focused traders could explore bull call spreads as a capital-efficient, risk-defined strategy. This approach limits maximum loss while still providing meaningful upside participation if the stock continues its advance.

Given the substantial out-of-the-money call buying visible in the flow, traders might also consider calendar spreads, selling near-term options while buying longer-dated calls to capitalize on the expected multi-month rally scenario that institutional players appear to be positioning for.

Conclusion

The significant options flow in Google suggests well-informed institutional traders are positioning for continued upside driven by AI momentum, cloud growth, and new hardware revenue streams.

The combination of strong technical positioning, positive fundamental catalysts, and substantial institutional buying creates a compelling setup for potential further gains. However, the elevated valuation following 2025's rally means expectations are high and any disappointment could trigger meaningful volatility.

As with any options trading strategy, careful analysis, disciplined risk management, and a comprehensive understanding of both technical and fundamental factors are crucial.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Options Flow Alert: Institutional Money Loading Up on Google Stock

- SoFi Technologies (SOFI) is Flashing an Intriguing Quant Setup Ahead of Q4 Earnings

- Costco Stock Has Moved Up Over the Last Month - What Are the Best Plays Now?

- A Storm Is Brewing: How To Manage Risk and Weather Financial Turbulence in 2026