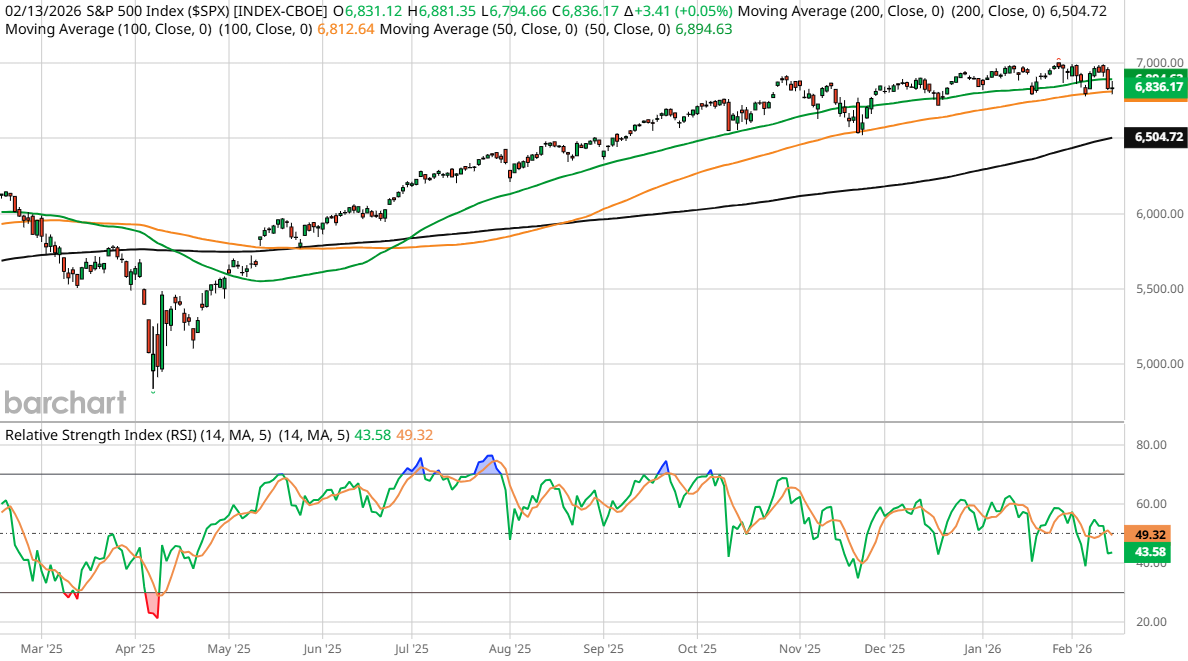

Markets have pulled back hard. The tone has shifted. Volatility is expanding, bearish commentators are resurfacing, and the narrative is turning cautious. Down days are heavier than up days. Correlations are rising. Cash is suddenly fashionable again. What should we make of it?

What is misunderstood is the mechanism underneath it. Markets do not bottom because investors feel fear. They bottom out when forced sales are done. Fear is emotional. Forced selling is structural. Price responds to structure.

Right now, the tradeable setup is not about calling a macro inflection point. It is about identifying where liquidity-driven selling has pushed price away from business reality.

We are in a phase of mechanical de-risking. Funds that started the year fully invested are managing drawdowns. Risk committees are tightening exposure. Margin desks are less patient. Passive flows amplify redemptions. When volatility rises, quant strategies reduce gross exposure. None of this requires earnings to collapse. It only requires positioning to unwind. That is why markets can fall sharply even when aggregate forward estimates have barely moved. In this environment, the correct question is not, “Is this the bottom?” The correct question is “Who is being forced to sell, and when do they stop?”

There are identifiable windows where supply exhausts.

The next four to six weeks are heavy with earnings. Earnings matter not because they will be perfect, but because they create liquidity events. Companies reiterate guidance. They update the backlog. They address refinancing plans. They reset the narrative. Weak holders use the event to exit. Stronger capital steps in once uncertainty clears.

Beyond earnings, look at balance sheet calendars. Debt maturities within the next twelve months separate businesses under structural pressure from those experiencing equity volatility. Companies with staggered maturities, covenant headroom, and free cash flow coverage are not distressed simply because their stock is down fifteen percent.

Refinancing windows over the next two quarters is a catalyst. If capital markets remain open and companies term out debt at acceptable spreads, equity risk compresses quickly. If they cannot, the thesis changes. In special situations, the catalyst window is even clearer. Spinoffs have defined separation dates. Breakups require board votes and regulatory filings. Lockup expirations release supply on known timelines. These events create forced selling by mandate. Index funds sell because of size constraints. Income funds sell because dividends reset. Generalists sell because they do not understand the standalone story. It isn’t fear; it’s structural selling.

I have seen this phenomenon repeatedly. In 2008, in 2011, and in 2020, prices stopped falling before sentiment improved. Liquidity stabilized first. Headlines followed. When a business's incentive structure improves and temporary supply sets the price, structural alpha emerges. Consider a spinoff. Pre-separation, the business is buried inside a conglomerate with capital allocated inefficiently. Post-separation, management compensation is tied to standalone return metrics. Capital discipline improves. Costs are addressed. Asset sales become rational rather than political.

A more recent example was (SNDK) in April 2024 after its separation from (WDC) The stock fell sharply in the weeks following the breakup. There was no collapse in demand. There was no balance sheet crisis. What there was, however, was mechanical selling. Index funds were adjusting. Generalist holders who owned (WDC) for exposure to diversified storage were not natural owners of a standalone memory business. Mandated capital rotated out. The selling was structural. SanDisk went on to become one of the best-performing stocks in the S&P over the following year

By mid-April, volume began to contract even as headlines remained cautious. Price stopped making lower lows before the broader semiconductor narrative improved. The forced sellers were done. The business had not changed. Liquidity had. That is how bottoms form. Yet in the weeks surrounding separation, prices often fall. The business did not deteriorate; rather, holders who owned the parent company for diversification sold the smaller, more volatile entity. Funds with minimum market cap mandates must exit. The selling process does not take into account the intrinsic value of the business. That is the bottoming process.

The same dynamic occurs in dividend cuts. Income mandates sell automatically. Algorithms flag the cut. Price gaps lower. But if the dividend cut repairs the balance sheet and extends the maturity runway, long-term equity value may improve while the price falls.

To connect fundamentals to price action, watch volume and relative strength. Heavy volume on declines is normal during forced selling. What matters is what happening next. If subsequent tests of the lows occur on lighter volume, supply is thinning. If a stock stops underperforming its sector during index weakness, that is information. Relative strength often turns before absolute price does. Short interest also matters. Rising short interest during broad market stress does not always signal conviction. It can reflect hedging activity. If shorts increase while the price stabilizes, the setup changes. Potential energy builds.

Options positioning is another indicator. When put skew expands aggressively, insurance demand is peaking. That is not a buy signal by itself. It is a sign that fear is being priced. The bottom occurs when incremental demand for protection fades because sellers are finished.

Define risk clearly. If earnings reveal genuine demand destruction rather than temporary margin compression, the thesis changes. If refinancing fails or spreads widen materially, leverage becomes the dominant variable. If separation timelines slip or boards retreat from announced strategic actions, structural alpha evaporates.

Macro liquidity remains a variable. An external shock can extend forced selling beyond rational valuation levels. That is why entries should be staged. You accumulate exhaustion, not free fall.

What invalidates the setup is a continued price decline with expanding volume after catalysts pass without new negative information. If earnings are stable, debt is refinanced, and separation proceeds on schedule, yet the price continues to deteriorate aggressively, then something else is wrong. The market is not a moral system. It does not reward courage or punish fear. It responds to flows. Right now, flows are negative. But flows are finite. For active traders, the framework is tactical. Identify balance sheet-sound businesses that have defined catalyst windows over the next sixty days. Monitor volume exhaustion. Watch relative strength versus peers. If the earnings confirm the durability of the cash flow and the price maintains its previous support on lighter volume, it indicates the end of forced sellers.

For income investors, focus on coverage ratios and maturity ladders. If free cash flow covers dividends and maturities stagger beyond near-term windows, equity volatility does not indicate insolvency. For catalyst-driven participants, anchor to dates. Earnings calls. Board meetings. Separation filings. Refinancing announcements. If those events pass without structural damage and the price stops making lower lows, supply has likely cleared. Markets do not announce bottoms. There is no bell that rings when the last fund has sold. Price simply stops responding to bad news. It absorbs it. That is the moment that matters.

Fear is loud. Forced selling is mechanical. Once the mechanical pressure ends, the price reverts toward business reality. We are approaching a heavy catalyst window. Earnings over the next month. Refinancing updates in the next quarter. Strategic actions in motion across multiple sectors. This is where liquidity resets. If earnings confirm durability and technical levels hold on reduced volume, selective accumulation in the balance sheet of strong special situations is rational. If refinancing closes and leverage concerns fade, equity repricing can be sharp. If separation proceeds and post-breakup incentives align management with shareholders, value often unlocks quietly while sentiment remains skeptical.

The opportunity is not in predicting the macro headline. It is in recognition when forced sellers have completed their work. Markets bottom when supply is exhausted, not when fear peaks.

When the selling stops, the price will tell you.

On the date of publication, Jim Osman did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Markets Don’t Bottom On Fear. They Bottom When Forced Sellers Are Done

- AI Disruption Fear, FOMS and Other Key Things to Watch this Week

- Warren Buffett Says Only Buy Stocks You’re Comfortable Holding For Ten Years, Otherwise Don’t Bother Even ‘Owning it for Ten Minutes’

- Is AMD Stock a Buy? Why Wall Street Sees 40% Upside From Here.