When one of the world's most successful activist investors starts buying, smart money pays attention. With roughly $80 billion in assets under management, Elliott Management has built its reputation on spotting undervalued opportunities and pushing for change. Now, the firm is betting big on The London Stock Exchange Group (LSEGY), according to a Reuters report.

The AI Picks-and-Shovels Play

While everyone's chasing the next hot AI model, Elliott sees something different — the infrastructure powering it all. LSEG isn't building flashy chatbots. Instead, it owns financial data that AI models desperately need but can't replicate.

Think about it this way. During the California Gold Rush, some miners struck it rich. But the real winners were selling picks and shovels. Similarly, LSEGY stock can act as a pick-and-shovel play for the AI revolution in finance.

The company controls over 33 petabytes of specialized financial data. To put that in perspective, that's more than three times the size of the entire “common crawl,” the massive dataset used to train most large language models.

LSEG breaks down its Data & Feeds business, which generates over 20% of total revenue, into several protected categories. Real-time data accounts for 45% of Data & Feeds revenue. This information comes directly from 575 global exchanges through LSEG's own infrastructure. It delivers “millions of hard facts per second” — not probabilistic guesses. Another 25% comes from specialized, proprietary content. This includes exclusive deals, such as an agreement with Reuters, and contributed data, such as LSEG's deals database. Even data that starts as public information gets transformed. LSEG's league tables, for example, pull in up to 25,000 monthly contributions from nearly 2,000 financial and legal advisers. These human contributors correct public deal details and add information on deals that are not reported elsewhere.

The bottom line? Some 90% of LSEG's Data & Feeds revenue comes from sources that AI models cannot access through public channels, according to the company's third-quarter earnings call.

The Microsoft Partnership Advantage

LSEG isn't sitting still, either. The company partnered with Microsoft (MSFT) in 2022, with the tech giant taking a 4% stake worth $2 billion as part of a 10-year collaboration. This partnership has already delivered results. LSEG now distributes its data through Microsoft Azure, Teams, and even Copilot.

In recent weeks, the company made certain datasets available to all Copilot users — potentially opening up entirely new customer segments beyond traditional finance. CEO David Schwimmer explained during the earnings call that through Model Context Protocol (MCP) servers, LSEG can control and monitor data access.

Customers can't download everything, train their own models, and walk away. The company maintains control as it expands distribution.

Elliott Management's Game Plan

Elliott Management has been pushing LSEG to improve performance, encourage fresh share buybacks, and close margin gaps with competitors. The activist investor reportedly does not want a full sale or spinoff of the stock exchange business.

Some shareholders are cheering the intervention. Stephen Yiu, Chief Investment Officer of Blue Whale Growth Fund and an LSEG shareholder, told Reuters that the company needs a sharper strategic focus, especially as AI is disrupting its core business.

LSEG has already shown a willingness to act. Last year, the company sold 20% of its post-trade services business and announced a £1 billion share buyback program, according to Reuters.

Is LSEG Stock Undervalued?

With shares down 28% over the past year, LSEG now trades at a significant discount. It is priced at 16.7 times forward earnings, below the 10-year average.

The company posted 6.4% organic growth in Q3, raised its margin guidance, and accelerated a £1 billion buyback program. Management also announced another £1 billion buyback to be completed by February 2026, demonstrating strong cash generation despite market concerns.

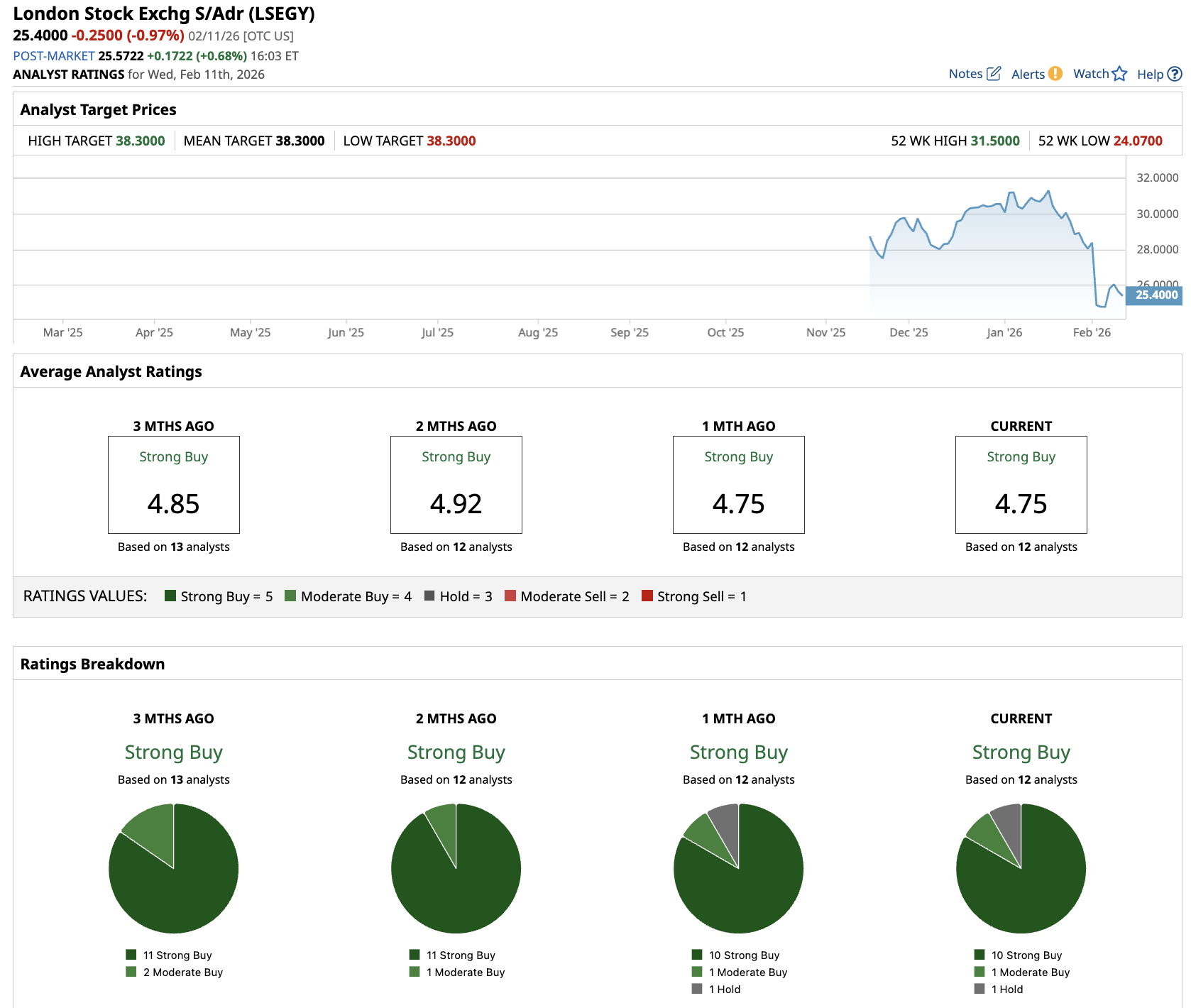

Out of the 12 analysts covering LSEGY stock, 10 recommend a “Strong Buy” rating, one recommends “Moderate Buy,” and one recommends a “Hold” rating. The average LSEG stock price target is $38.30, which implies about 45% potential upside from the current price of $26.42.

Elliott Management clearly sees what many investors are missing — a company with irreplaceable data infrastructure trading at beaten-down prices. That's the kind of setup that gets billionaire activists excited.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart