The artificial intelligence (AI)-driven infrastructure buildout is driving significant demand for memory and storage solutions, supporting companies like Western Digital (WDC).

Western Digital focuses on manufacturing high-capacity hard disk drives, a critical component for storing the vast datasets required by AI workloads. From cloud service providers to hyperscale data centers, customers are racing to secure more storage to keep pace with AI adoption. This surge in demand has tightened supply, lifted pricing, and translated into meaningful gains in both revenue and profitability for the company.

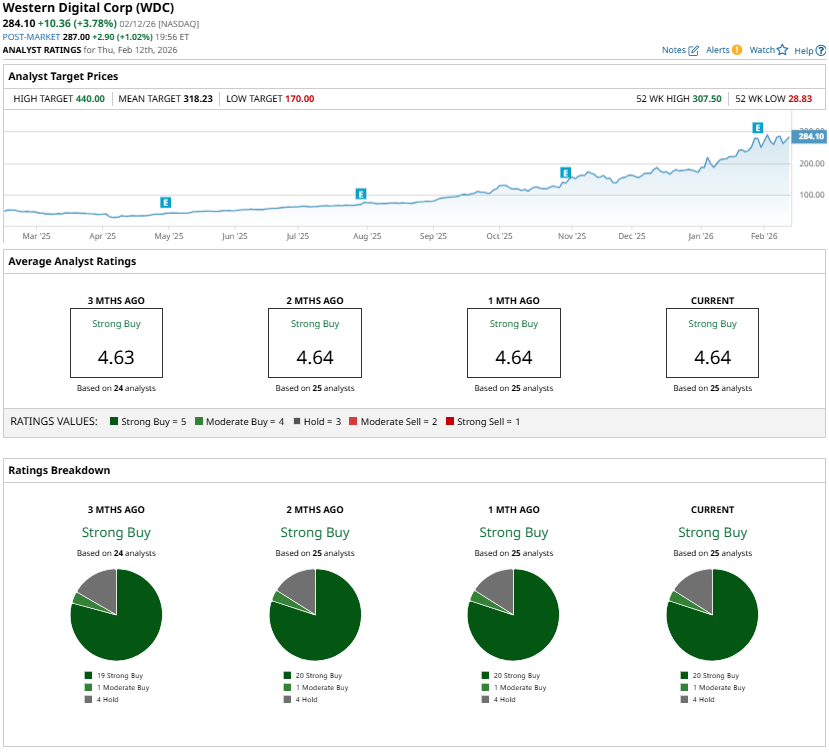

Thanks to tailwinds from strong demand, Western Digital stock has rallied by more than 453% over the past year. Despite the strong rally in WDC stock, its valuation still looks attractive. Moreover, at least one analyst has set a 12-month price target of $440 for Western Digital shares, the highest forecast currently on the Street. With the stock recently closing at $284.10, hitting that target would imply an additional 55% upside in 12 months.

Here’s What Could Support WDC Stock’s Rally

As AI workloads scale and cloud infrastructure continues to expand, demand for higher-density storage is accelerating. This trend will continue to drive Western Digital’s financials and share price.

The company is benefitting from solid demand for its high-capacity nearline drives. For instance, in the last reported quarter, its revenue rose 25% year-over-year (YoY) to $3 billion, driven by strong demand for nearline storage products. Its adjusted earnings per share (EPS) climbed 78% YoY to $2.13. Shipment volumes also moved higher, including more than 3.5 million units of the company’s latest-generation ePMR drives, which offer higher storage capacity.

Cloud customers continue to dominate the revenue mix, accounting for 89% of total sales, or $2.7 billion, representing a 28% YoY increase. This growth reflects sustained demand for higher-capacity drives from hyperscale customers. The client segment contributed $176 million, up 26% YoY, while consumer revenue totaled $168 million and declined slightly from the prior year.

Visibility into future demand further strengthens the investment case. Western Digital has firm purchase commitments with its top seven customers extending through calendar year 2026. In addition, the company has secured longer-term commercial agreements with three of its largest five customers, including contracts that run through 2027 and 2028. These agreements provide revenue stability and support continued capacity planning.

Margin expansion is another catalyst supporting the stock’s rally. During the second quarter, adjusted gross margin expanded by 770 basis points YoY and 220 basis points sequentially. This improvement reflects a favorable mix shift toward higher-capacity drives, along with disciplined cost management across manufacturing operations and the broader supply chain.

Looking ahead, management remains optimistic. For Q3, the company expects revenue of approximately $3.2 billion, representing around 40% YoY growth. Gross margin is projected to be between 47% and 48%, a substantial improvement from 40.1% in the prior-year period. EPS is forecasted at $2.30, compared with $1.36 a year earlier.

A supportive pricing environment and ongoing customer migration toward higher-capacity drives should continue to benefit profitability. At the same time, its focus on reducing manufacturing and supply-chain costs adds further leverage to earnings growth.

Overall, accelerating revenue, expanding margins, and improving earnings visibility position Western Digital well for continued upside. These factors are likely to remain key drivers supporting the stock’s rally through 2026.

Western Digital’s Valuation Indicates Further Upside Potential

Despite the significant rally, Western Digital’s valuation still looks compelling. WDC stock trades at 30.5 times forward EPS, which is low given its strong growth potential. Analysts expect its EPS to grow by 87.2% in fiscal 2026 and jump 79.1% in 2027. Its low valuation and strong growth prospects indicate further upside potential in WDC stock.

Conclusion on WDC Stock

AI-driven demand for high-capacity storage, long-term customer commitments, and accelerating margin expansion provides Western Digital with strong earnings visibility. The rapid EPS growth and a reasonable forward multiple support the view that the stock has further upside potential and could hit $440.

At the same time, analysts maintain a “Strong Buy” consensus rating on Western Digital shares.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart