Santa Clara, California-based ServiceNow, Inc. (NOW) provides cloud-based solutions for digital workflows. Valued at a market cap of $112 billion, the company helps businesses integrate systems, reduce manual processes, and improve operational efficiency using AI-driven automation.

This software company has notably lagged behind the broader market over the past 52 weeks. Shares of NOW have declined 45.9% over this time frame, while the broader S&P 500 Index ($SPX) has soared 11.8%. Moreover, on a YTD basis, the stock is down 30.1%, compared to SPX’s marginal drop.

Narrowing the focus, NOW has also underperformed the State Street SPDR S&P Software & Services ETF (XSW), which decreased 23.2% over the past 52 weeks and 19.1% on a YTD basis.

On Feb. 9, shares of NOW surged 3.1% after analysts indicated that the recent “SaaSpocalypse” downturn had driven valuations into deeply undervalued levels, triggering opportunistic buying. The broader Software-as-a-Service (SaaS) sector had faced significant pressure in early 2026 amid concerns that autonomous AI agents could disrupt traditional seat-based subscription models. However, large institutional investors began shifting their money back into well-established companies with loyal customer bases and stable, recurring revenue streams. The rebound was supported by a Barclays PLC (BCS) report noting that enterprise migrations away from legacy systems typically take years rather than weeks, creating a durable competitive moat for leading providers, particularly in areas such as compliance and governance.

For fiscal 2026, ending in December, analysts expect NOW’s EPS to grow 26.5% year over year to $2.48. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

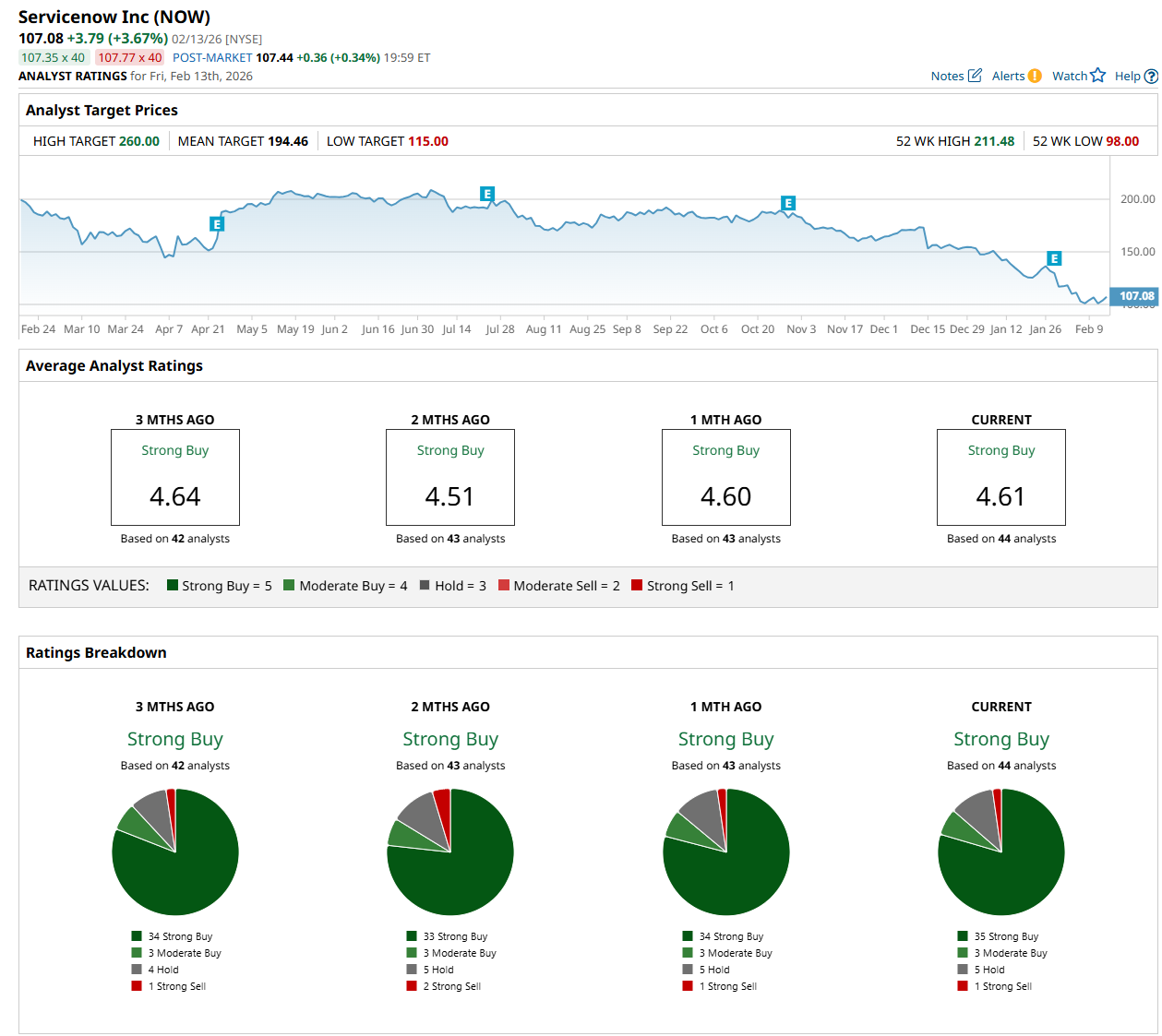

Among the 44 analysts covering the stock, the consensus rating is a "Strong Buy,” which is based on 35 “Strong Buy,” three “Moderate Buy,” five "Hold,” and one “Strong Sell” rating.

The configuration is more bullish than a month ago, with 34 analysts suggesting a “Strong Buy” rating.

On Feb. 9, Matthew Hedberg from RBC Capital maintained a "Buy" rating on NOW, with a price target of $150, indicating a 40.1% potential upside from the current levels.

The mean price target of $194.46 represents an 81.6% premium to its current price levels, while its Street-high price target of $260 suggests an ambitious 142.8% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart