For more than 85 years, Tennessee-based Tractor Supply Company (TSCO) has focused on serving rural and suburban customers, including recreational farmers, ranchers, homeowners, gardeners, and pet owners. As the largest rural lifestyle retailer in the U.S. and a Fortune 500 company, it employs more than 52,000 people. The company offers a wide range of products both in-store and online, catering to customers who prioritize hands-on, land-focused lifestyles.

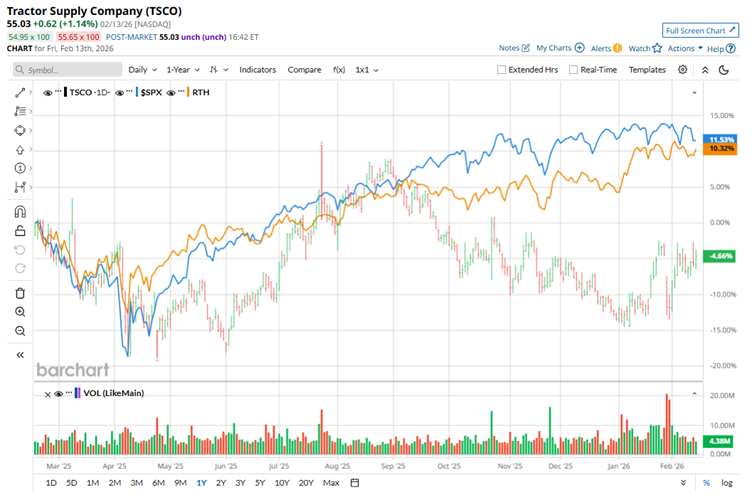

Its business model centers on accessible pricing, broad product availability, and a multichannel shopping experience designed to meet the needs of its diverse customer base. With a market capitalization of roughly $29.1 billion, Tractor Supply hasn’t kept pace with the broader market over the past year. The stock has slipped about 3.4%, notably trailing the S&P 500 Index ($SPX), which climbed 11.8% over the same period.

That said, the tone has shifted in 2026. TSCO shares have rebounded, gaining 10% year to date and outperforming the SPX, which has posted a slight decline. Still, when stacked against its retail peers, the picture is mixed. Tractor Supply has trailed the VanEck Retail ETF (RTH), which has delivered a 9.1% return in 2025.

Tractor Supply’s muted stock performance over the past year largely reflects its growth slowdown. Over the past three years, the company has delivered average annual revenue growth of just 3%, trailing many peers in the broader consumer retail space. Same-store sales trends have also been underwhelming. Modest comparable sales gains over the past two years suggest the company has struggled to drive stronger traffic into its brick-and-mortar stores.

In the fourth quarter of 2025, which was released last month, net sales rose 3.3% year over year to $3.90 billion, up from $3.77 billion. However, comparable store sales edged up only 0.3%, slowing from a 0.6% increase in the same quarter a year earlier. Management acknowledged the softer momentum, noting that fourth-quarter results fell short of expectations amid a shift in consumer spending patterns. While demand for essential categories remained steady, discretionary purchases showed signs of moderation, a dynamic that weighed on overall performance.

Looking forward to the fiscal year ending in December 2026, analysts expect TSCO’s EPS to rise 5.8% year-over-year to $2.18. The company's earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters, while missing on two other occasions.

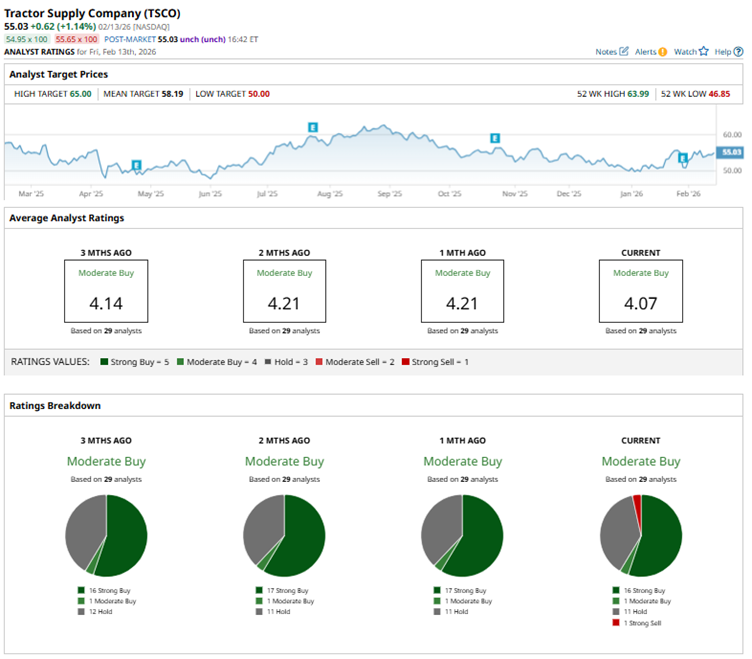

Wall Street is still leaning bullish on Tractor Supply, but the enthusiasm isn’t unanimous. The stock holds a consensus “Moderate Buy” rating from 29 analysts, with 16 “Strong Buys” and one additional “Moderate Buy” anchoring the optimistic camp. Meanwhile, 11 analysts sit on the sidelines with “Hold” ratings, and one has turned outright cautious with a “Strong Sell.”

Importantly, the tone has shifted slightly over the past month. The addition of a “Strong Sell” rating suggests that while most analysts remain constructive, a bit of skepticism has started to creep into the narrative.

Earlier this month, Guggenheim reiterated its “Buy” rating and $65 price target on Tractor Supply, after meetings with the company’s leadership team. Management highlighted potential comparable-sales tailwinds, category initiatives to boost market share, and incremental margin support from retail media growth and cost controls, reinforcing Guggenheim’s constructive stance.

The mean price target of $58.19 represents a premium of 5.7% to TSCO’s current levels, while Guggenheim’s Street-high price target of $65 implies a potential upside of 18.1% from the current price levels.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart