With a $12.2 billion market cap, The Trade Desk, Inc. (TTD) is a leading independent demand-side platform (DSP) that enables advertisers and agencies to buy and manage digital advertising campaigns programmatically across channels such as connected TV (CTV), display, video, audio, mobile, and social. Founded in 2009 and headquartered in Ventura, California, the company provides data-driven ad-buying software used by major global brands and advertising agencies.

Shares of TTD have considerably underperformed the broader market over the past year. TTD has declined 68.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 11.9%. In 2026, TTD’s stock plummeted 33.5%, compared to the SPX’s marginal dip on a YTD basis.

Narrowing the focus, TTD has also lagged behind the Invesco AI and Next Gen Software ETF (IGPT). The exchange-traded fund has gained 28.4% over the past year and 4.5% this year.

The Trade Desk shares fell about 4% on Feb. 5, amid a broader selloff in software and ad-tech stocks after new AI agent releases from Anthropic and OpenAI intensified fears that autonomous AI platforms could displace traditional software applications and seat-based revenue models.

Additionally, the stock plunged over 10% in the last week of January after the sudden resignation of CFO Alex Kayyal, less than six months into the role, with longtime executive Tahnil Davis named interim CFO. The unexpected leadership change raised governance and execution concerns despite the company reaffirming Q4 guidance.

For FY2025 that ended in December, analysts expect TTD’s EPS to grow 26.9% to $0.99 on a diluted basis. The company’s earnings surprise history is disappointing. It missed the consensus estimate in three of the last four quarters while beating the forecast on another occasion.

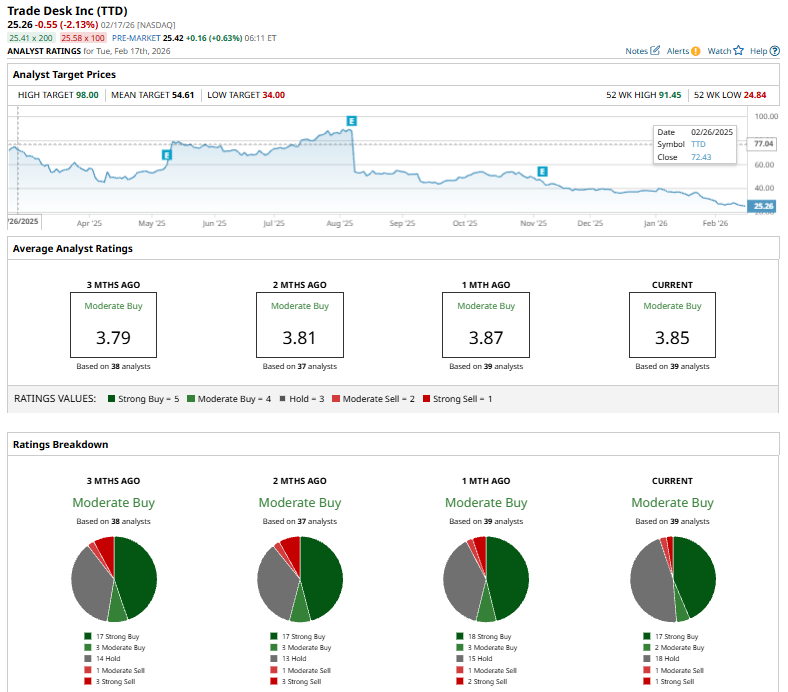

Among the 39 analysts covering TTD stock, the consensus is a “Moderate Buy.” That’s based on 17 “Strong Buy” ratings, two “Moderate Buys,” 18 “Holds,” one “Moderate Sell,” and one “Strong Sell.”

The configuration is bearish compared with a month ago, when the stock had 18 “Strong Buy” recommendations.

On Feb. 3, KeyBanc analyst Justin Patterson cut Trade Desk’s price target to $40 from $88 to reflect a more conservative growth outlook and lower valuation multiples, while maintaining an “Overweight” rating. The firm expects continued volatility in SMID-cap ad-tech earnings, citing tighter competition for ad budgets and evolving positioning around agentic AI as key overhangs.

The mean price target of $54.61 represents a 115% premium to TTD’s current price levels. The Street-high price target of $98 suggests an ambitious upside potential of 288%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Goldman Sachs Is Pounding the Table on This 1 Rare Earths Stock: New Price Target Implies 50% Upside

- 3 Option Ideas to Consider this Wednesday for Income and Growth

- Stock Index Futures Climb as AI Jitters Ease, FOMC Minutes and U.S. Economic Data in Focus

- Earn While You Sleep: 3 High-Yield Dividend Stocks to Buy and Hold Forever