With a market cap of around $22 billion, Fox Corporation (FOX) is a U.S.-based news, sports, and entertainment company operating across cable networks, broadcast television, digital platforms, consumer finance, and studio production services. It produces and distributes content through brands such as FOX, Tubi, and its FOX Studio Lot while also serving third-party partners.

Shares of the New York-based company have underperformed the broader market over the past 52 weeks. FOX stock has decreased 2.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 12.1%. Moreover, shares of the company are down 20.6% on a YTD basis, compared to SPX’s marginal rise.

Looking closer, shares of the TV broadcasting company have lagged behind the State Street Communication Services Select Sector SPDR ETF’s (XLC) 9.1% gain over the past 52 weeks.

Despite reporting better-than-expected Q2 2026 adjusted EPS of $0.82 and revenue of $5.18 billion, shares of Fox Corporation fell 3.8% on Feb. 4. Adjusted EBITDA declined to $692 million, net income dropped to $229 million ($0.52 per share), and free cash flow swung to a $791 million deficit due to seasonal sports rights payments.

For the fiscal year ending in June 2026, analysts expect FOX's adjusted EPS to decline 2.5% year-over-year to $4.66. However, the company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

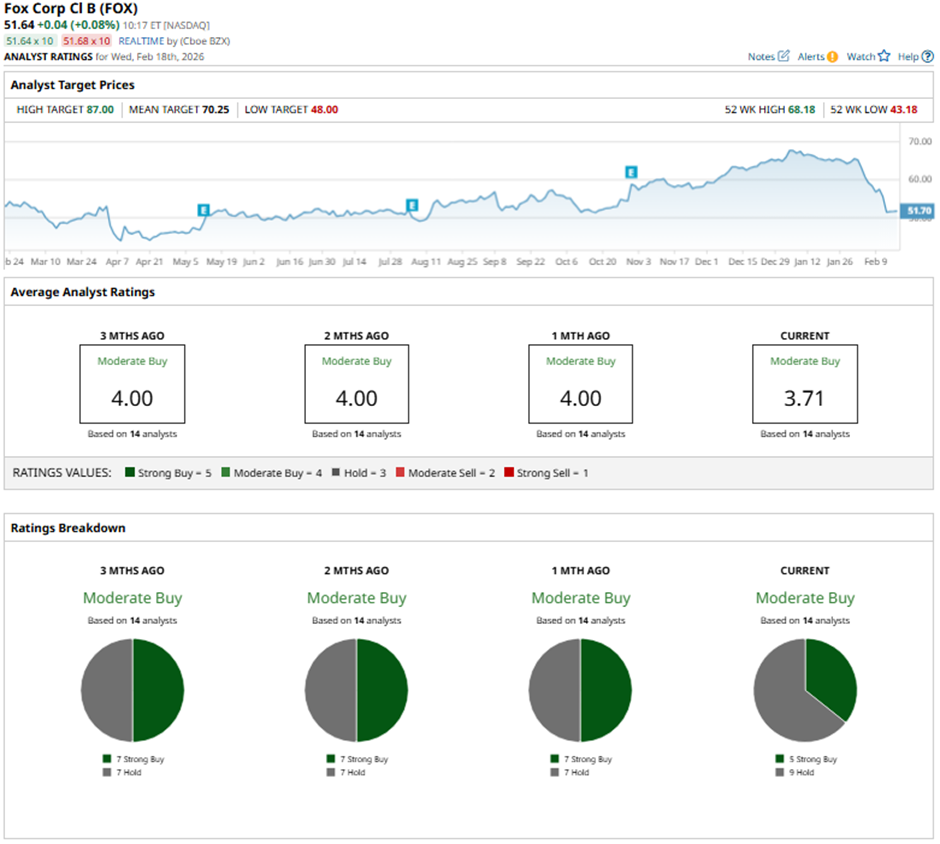

Among the 14 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on five “Strong Buy” ratings and nine “Holds.”

On Feb. 5, JPMorgan raised its price target on Fox Corporation to $69 while maintaining a “Neutral” rating.

The mean price target of $70.25 represents a premium of 36% to FOX's current levels. The Street-high price target of $87 implies a potential upside of 68.5% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Ford Recalibrates EV Strategy While Tesla Pivots To AI: Would the Bet Pay Off?

- Tesla Falters in China Again: How to Play TSLA Stock as Xiaomi Outsells

- It’s ‘Time to Shine’ for Applied Materials Stock, According to Analysts. Should You Buy AMAT Here?

- Up 40% in the Past Year, This Leading Stock Means Business