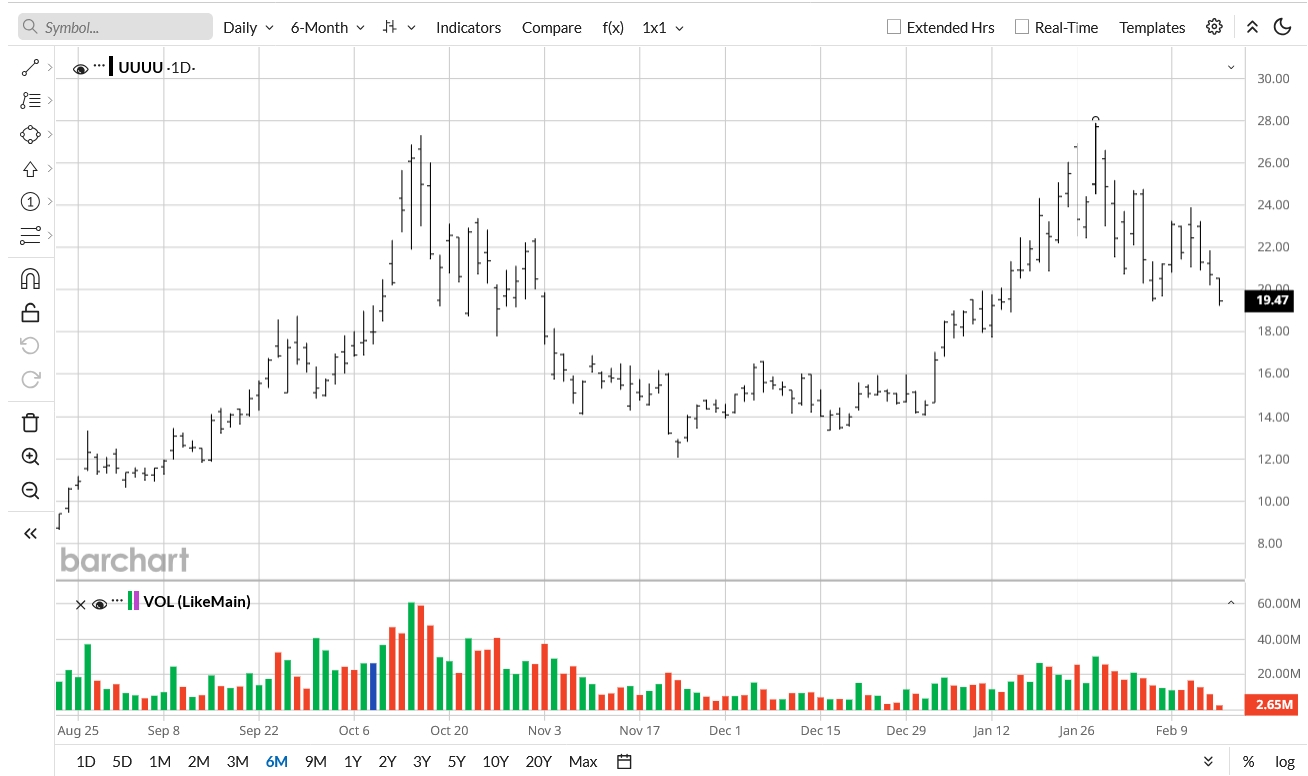

Wall Street may have calmed down on software stocks, but rare earths are still in fashion. Goldman Sachs analyst Brian K. Lee initiated coverage of Energy Fuels (UUUU) on Feb. 11 with a "Buy" rating. His price target is $30, which implies an approximately 50% upside potential here.

His thesis rests on a rare dual advantage. Energy Fuels owns and operates the White Mesa Mill in Utah. It's the only processing facility in the country that is capable of handling both conventional uranium and rare earth elements. In short, you get a singular domestic play on two of the most strategically important mineral categories simultaneously.

And UUUU stock has already skyrocketed over 300% in the past year.

Thus, it makes sense why Goldman is bullish.

Positive Catalysts are Stacking Up

Lee pointed out that Energy Fuels exceeded its 2025 production and sales guidance and mined over 1.6 million pounds of uranium. The company has three heavy mineral sands assets coming online over the next five years, which will supply monazite. Monazite is the key feedstock for rare earth production. Not only that, it is expanding into light and heavy rare earths like NdPr, Dy, and Tb, and bulls expect Energy Fuels to potentially supply ~45% of total U.S. rare earth demand and 100% of U.S. heavy REE (dysprosium, terbium) demand by 2030.

If this happens, this one company will have tremendous leverage over the entire U.S. supply chain. Companies could race to secure their own supply just in case unforeseen future events restrict Chinese imports again.

Geopolitics Won't Let UUUU Die

China controls roughly 90% of global rare earth processing, and last year, Beijing restricted exports to the U.S. Since that threat, Washington has invested billions into rare earth companies based in the U.S. to make sure the domestic supply is secure. If anything, these restrictions have revealed a vulnerability that the government is now desperately trying to remedy.

In early February 2026, Trump signed an executive order launching Project Vault, aimed at creating the first U.S. strategic mineral reserve, backed by $1.67 billion in private capital and a $10 billion loan facility from the U.S. Export-Import Bank.

Goldman explicitly cited increasing policy support for domestic supply and production of critical minerals as a favorable factor.

And it isn't alone in its optimism since others on Wall Street have price targets approaching $30 as well.

HC Wainwright has a “Buy” rating with a $26.75 target, and B. Riley Financial is at "Buy" with $27. Even Roth MKM, which previously had a "Sell" rating, was recently upgraded to “Neutral” and bumped its target to $15.50

The overall consensus rating is “Strong Buy.”

Not Just Stock Price: The Other Numbers Behind UUUU's Surge

Energy Fuels has had an extraordinary run, with Q4 2025 uranium sales expected at ~360,000 pounds. This is a 50% sequential increase that will generate $27 million in revenue at a weighted average price of $74.93 per pound.

The company also locked in two new long-term hybrid-priced uranium contracts covering 2027-2032, with a total delivery book of 2.41-4.41 million pounds over that period. Management expects the cost of goods sold to start declining in Q1 2026 as lower-cost Pinyon Plain ore enters the sales mix.

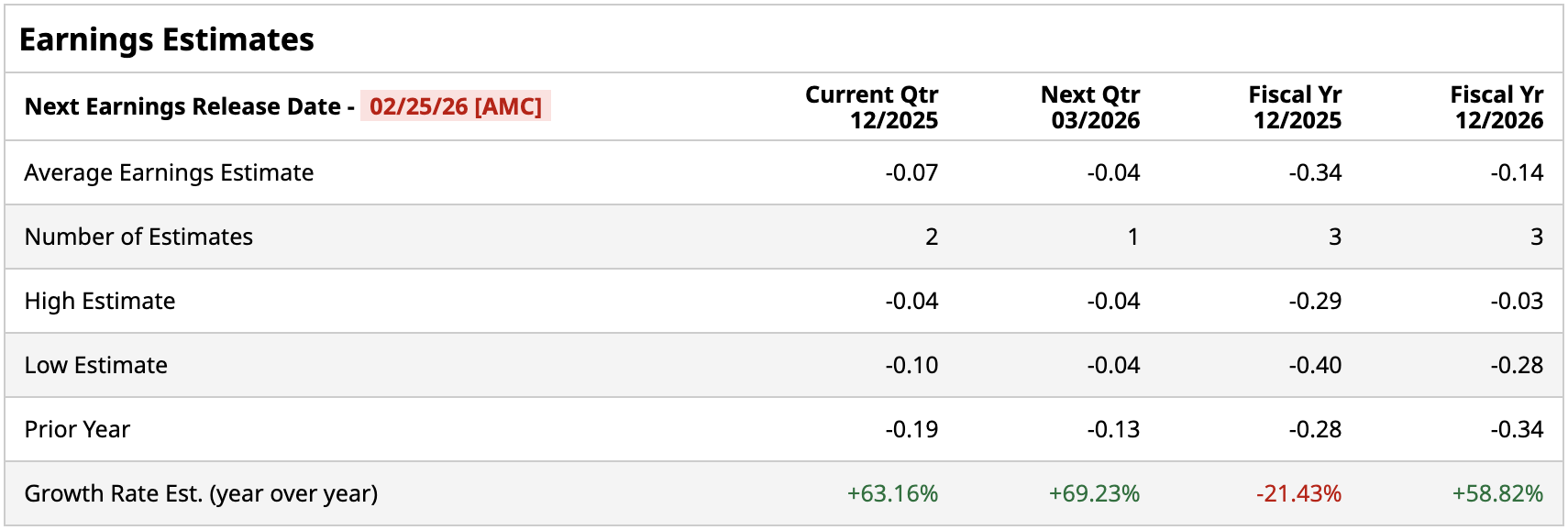

That said, the company is still posting losses. The consensus estimate pegs 2025 EPS at a loss of $0.34 per share, and 2026 is expected to come in at a loss of $0.14.

The path to profitability is real, but it hasn't arrived yet.

Where I See the Stock in One Year

The ex-China rare earth market faces persistent supply bottlenecks through 2026 and 2027, according to S&P Global, as alternative suppliers are still being constructed and commissioned. China's April 2025 restrictions on seven rare earth elements remain in place alongside a dual-use licensing system that continues to constrain exports to the U.S. and allied military end-users.

This year, Beijing imposed fresh export controls targeting dual-use items headed to Japan. This puts rare earths back in the spotlight, and Washington's response has been aggressive beyond just Project Vault. The Trump administration launched an initiative to form a "metallic alliance" with more than 50 nations.

With all of this in mind, I see UUUU stock heading higher. I still believe multibagger returns are possible as valuations don't matter much during the rapid scaling phase Energy Fuels is in. It is well-positioned to receive billions more in investments.

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart