Des Moines, Iowa-based Principal Financial Group, Inc. (PFG), is a leading global financial services provider that offers a wide range of financial products and services to individuals, corporations, and institutional clients. With a market cap of $20.1 billion, the company offers retirement solutions, life and health insurance, wellness programs, and investment and banking products.

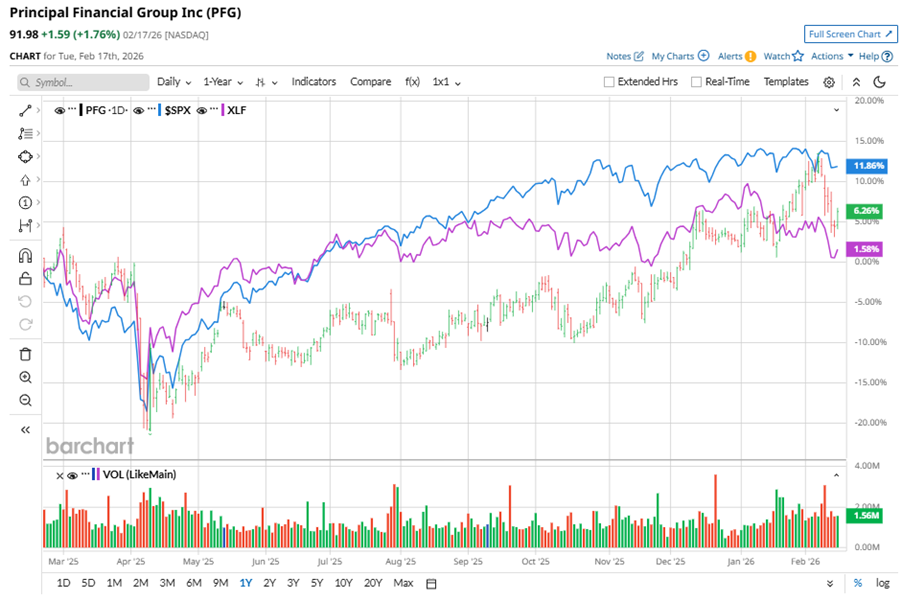

Shares of this global financial services company have underperformed the broader market over the past year. PFG has gained 7.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 11.9%. However, in 2026, PFG stock is up 4.3%, surpassing the SPX’s marginal fall on a YTD basis.

Narrowing the focus, PFG’s outperformance is apparent compared to the Financial Select Sector SPDR Fund (XLF). The exchange-traded fund has gained marginally over the past year. Moreover, the stock’s returns on a YTD basis outshines the ETF’s 4.7% losses over the same time frame.

On Feb. 9, PFG shares closed down by 1.5% after reporting its Q4 results. Its adjusted EPS of $2.19 did not meet Wall Street expectations of $2.23. The company’s full year adjusted EPS growth is expected to be 9% to 12%.

For the current fiscal year, ending in December, analysts expect PFG’s EPS to grow 13.4% to $9.38 on a diluted basis. The company’s earnings surprise history is disappointing. It missed the consensus estimate in three of the last four quarters while beating the forecast on another occasion.

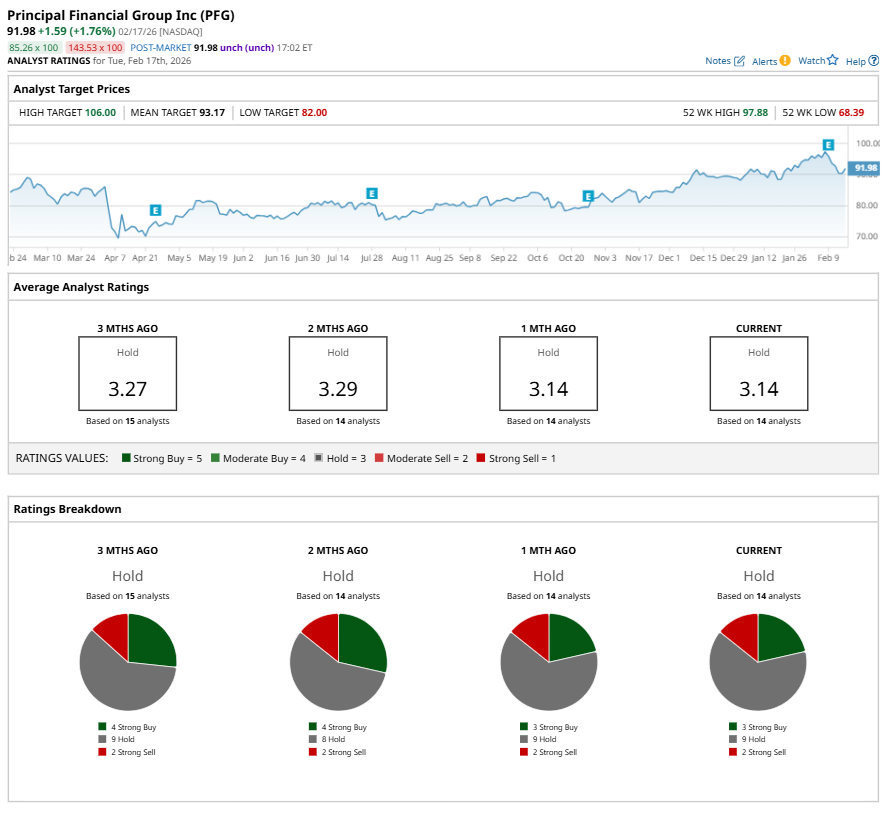

Among the 14 analysts covering PFG stock, the consensus is a “Hold.” That’s based on three “Strong Buy” ratings, nine “Holds,” and two “Strong Sells.”

This configuration is less bullish than two months ago, with four analysts suggesting a “Strong Buy.”

On Feb. 10, Piper Sandler Companies (PIPR) analyst John Barnidge maintained a “Buy” rating on PFG and set a price target of $100, implying a potential upside of 8.7% from current levels.

The mean price target of $93.17 represents a 1.3% premium to PFG’s current price levels. The Street-high price target of $106 suggests an upside potential of 15.2%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Goldman Sachs Is Pounding the Table on This 1 Rare Earths Stock: New Price Target Implies 50% Upside

- 3 Option Ideas to Consider this Wednesday for Income and Growth

- Stock Index Futures Climb as AI Jitters Ease, FOMC Minutes and U.S. Economic Data in Focus

- Earn While You Sleep: 3 High-Yield Dividend Stocks to Buy and Hold Forever