Vulcan Materials Company (VMC), headquartered in Birmingham, Alabama, produces and supplies construction aggregates. Valued at $43.7 billion by market cap, the company’s principal product lines are aggregates, asphalt mix, concrete, and cement.

Shares of the largest producer of construction aggregates have underperformed the broader market over the past year. VMC has gained 11.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 11.9%. In 2026, however, VMC stock is up 6%, surpassing the SPX’s marginal drop on a YTD basis.

Narrowing the focus, VMC has also trailed the Invesco Building & Construction ETF (PKB). The exchange-traded fund has gained about 41.7% over the past year and has posted 16.7% gains on a YTD basis.

On Feb. 10, Vulcan Materials shares dropped 5.5% after the company reported disappointing Q4 2025 results and issued weak 2026 guidance. Revenue of $1.91 billion missed expectations, while adjusted EPS of $1.70 fell well short of the $2.11 consensus. Adjusted EBITDA also lagged forecasts at $518 million versus $603.8 million expected. Looking ahead, the company’s 2026 EBITDA outlook came in below estimates of $2.65 billion, reinforcing investor concerns about near-term growth and profitability.

For the current fiscal year, ending in December, analysts expect VMC’s EPS to grow 13% to $9.04 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters while missing the forecast on two other occasions.

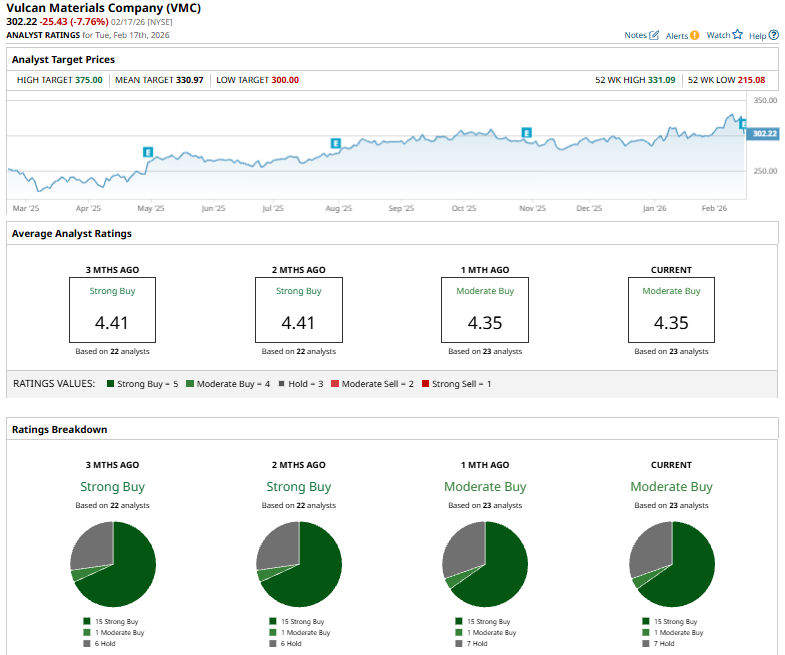

Among the 23 analysts covering VMC stock, the consensus is a “Moderate Buy.” That’s based on 15 “Strong Buy” ratings, one “Moderate Buy,” and seven “Holds.”

The overall rating is bullish than two months ago when the stock had a “Strong Buy.”

On Jan. 29, Wells Fargo analyst Timna Tanners raised Vulcan Materials’ price target to $317 from $310 while maintaining an “Equal-Weight” rating. The firm remains selective on building-materials stocks and favors earlier-cycle exposures, anticipating a gradual recovery in housing and remodeling demand.

The mean price target of $330.97 represents a 9.5% premium to VMC’s current price levels. The Street-high price target of $375 suggests an upside potential of 24.1%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Goldman Sachs Is Pounding the Table on This 1 Rare Earths Stock: New Price Target Implies 50% Upside

- 3 Option Ideas to Consider this Wednesday for Income and Growth

- Stock Index Futures Climb as AI Jitters Ease, FOMC Minutes and U.S. Economic Data in Focus

- Earn While You Sleep: 3 High-Yield Dividend Stocks to Buy and Hold Forever