KLA Corporation (KLAC), formerly KLA-Tencor Corporation, is a leading provider of process control and yield management solutions for the semiconductor and electronics industries. Founded to enhance manufacturing precision through advanced inspection and metrology technologies, it is headquartered in Milpitas, California. The company has a market capitalization of $191.91 billion.

Over the past year, KLAC’s stock has been soaring due to robust fundamentals, strong investments in AI infrastructure, and momentum in advanced packaging technologies. Over the past 52 weeks, the stock has gained 95.8%, while it is up 21% year-to-date (YTD). It reached a 52-week high of $1,693.35 on Jan. 29, but is down 13.2% from that level.

On the other hand, the broader S&P 500 Index ($SPX) has gained 11.9% over the past 52 weeks but is down marginally YTD, indicating that the stock has outperformed the broader market. Next, we compare the stock with its own sector. The State Street Technology Select Sector SPDR ETF (XLK) has increased 16.3% over the past 52 weeks but declined 3.1% YTD. Therefore, the stock has outperformed its sector over these periods.

On Jan. 29, KLA Corp reported its second-quarter results for fiscal 2026 (quarter ended Dec. 31). The company’s total revenue increased 7.2% year-over-year (YOY) to $3.30 billion. The market leader in process control reported a non-GAAP EPS of $8.85 on a diluted basis, up 7.9% from the prior-year period.

While KLAC’s results topped analysts’ expectations, the stock dropped 15.2% intraday on Jan. 30, as the company reported experiencing longer-than-usual equipment delivery lead times due to component shortages.

For the current quarter, Street analysts expect KLAC’s profit to increase 8.4% YOY to $9.12 per diluted share, while for the current fiscal year, it is expected to increase 9.9% to $36.58 per diluted share, followed by a 25.2% growth to $45.81 per diluted share in fiscal 2027. The company also has a solid history of surpassing consensus estimates, topping them in all of the trailing four quarters.

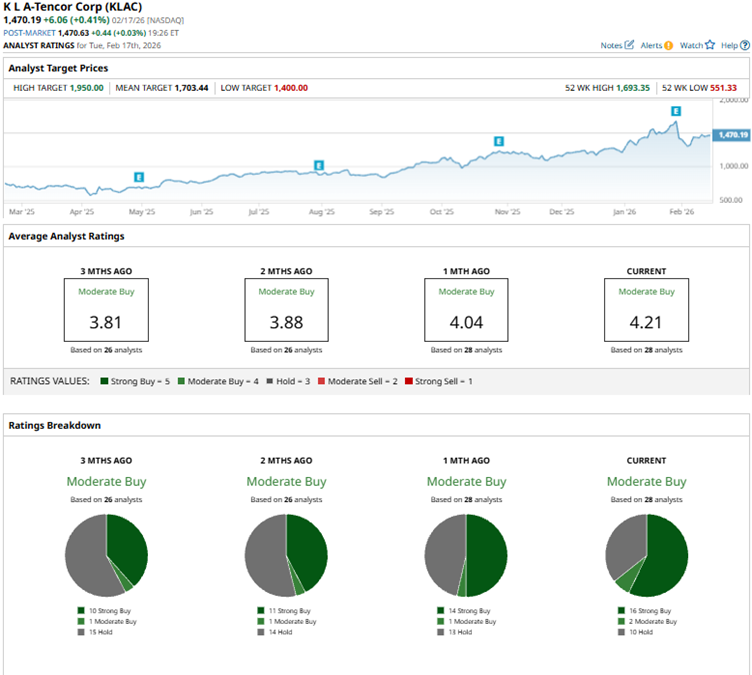

Among the 28 Wall Street analysts covering KLAC’s stock, the consensus is a “Moderate Buy.” That’s based on 16 “Strong Buy” ratings, two “Moderate Buys,” and 10 “Holds.” The ratings configuration has become more bullish than a month ago, with the number of “Strong Buy” ratings increasing from 14 to 16.

Recently, analysts at Citi reiterated a “Buy” rating on the stock and raised the price target from $1,450 to $1,800. Analysts are likely bullish about the Phase 2 upcycle in wafer fab equipment and its potential upside, as investors’ focus remains consistent through 2027. Citi analysts note alignment between the company’s commentary on wafer fabrication equipment and that of peer Lam Research, which raises confidence in the durability of industry expenditures.

KLA Corp’s mean price target of $1,703.44 indicates a 15.9% upside over current market prices. Moreover, the Street-high price target of $1,950 implies a potential upside of 32.6%.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- SoftBank Just Sold $3.6 Billion Worth of Nvidia Stock. Should You Ditch NVDA Too?

- Is It Too Late to Chase Masimo Stock on Major Danaher News?

- Warren Buffett Regrets Relearning This Lesson About Investing: It’s Important to Find Businesses ‘Where Tailwinds Prevail Rather Than Headwinds’

- Goldman Sachs Is Pounding the Table on This 1 Rare Earths Stock: New Price Target Implies 50% Upside