Senior executives are looking for new ways to innovate amid concerns over rising interest rates, geopolitical tensions and the rise of artificial intelligence

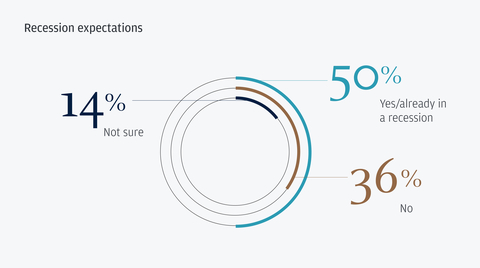

More than three-fourths of German business leaders expect increases in revenue (78%) and profits (75%) in the year ahead, up 9% and 16% respectively from 2023. At the same time, local leaders are acutely aware of the tense macroeconomic situation, with half (50%) expecting a recession in 2024, according to J.P. Morgan’s fourth annual Germany Business Leaders Outlook survey.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240117964388/en/

Recession expectations for German midsize business leaders (Graphic: Business Wire)

“It’s crucial to recognize the dual nature of the sentiments expressed by German business leaders—a balance between optimism and caution—especially with the economic uncertainties continuing into 2024,” said Bernhard Brinker, Head of Commercial Banking, DACH Region, J.P. Morgan. “This ambiguity is emblematic of the complex landscape they navigate, weighing positive indicators against potential challenges.”

In a survey of more than 250 C-suite executives from German midsize companies, cautious optimism is central amid persisting economic uncertainties. The hope is evident, with more than half having an overall positive outlook on the global (58%) and national (59%) economies. Additionally, 67% expect their capital expenditures to increase significantly this year, up 11% from 2023, and 70% expect their credit needs to also increase in the year ahead, up 6% from 2023.

“While the German business community continues to be simultaneously confronted with many different challenges, they have staunch confidence in their own strengths coupled with the resilience and innovative power of their industries,” said Stefan Povaly, Head of Germany, Senior Country Officer, J.P. Morgan.

Staying Resilient Through Economic Headwinds

While expecting to grow in the year ahead, German business leaders remain cautious given the rising costs to do business.

- Local executives cited rising interest rates (29%) as the top significant challenge they’re facing in the year ahead, closely followed by uncertain overall economic conditions (28%), the adoption of artificial intelligence (AI) (28%), navigating the labor environment (27%), as well as global unrest and geopolitical concerns (27%).

- Persistently high inflation rates remain a pressing concern for German business leaders, with nearly three-quarters (73%) reporting experiencing rising costs due to inflation, up 10% from 2023.

Remaining Competitive Through Innovation, Expansion and Talent

Despite continued economic obstacles, German business leaders are looking for ways to generate growth and stay competitive.

When surveyed about their business plans over the next 12 months, business leaders plan to expand their businesses by:

- Introducing new products and services (50%, up 13% from 2023)

- Introducing new distribution channels (50%), up 9% from 2023

- Expanding into new international (39%) and domestic (41%) geographical markets, down 4% from 2023

While the labor shortage continues in Germany, business leaders’ staffing expectations remain similar to 2023, with 43% planning to add headcount in the year ahead.

Integrating AI Tools Into Business Processes

2023 was the year in which AI—specifically generative AI—made its breakthrough. German business leaders realize the importance of embracing this technology if they are to remain successful in the long term, with 82% considering using or already using AI tools.

- Of those currently using or considering adopting AI, the most frequently mentioned business use include product development (56%), human resources and training (47%), business operations (45%), financial management (44%) and costing (46%).

- German business leaders’ plans for AI are in line with their U.K. (79%) and French (80%) counterparts.

For more information on the 2024 Germany Business Leaders Outlook survey, visit jpmorgan.com/business-leaders-outlook-DEU.

Survey Methodology

J.P. Morgan’s Germany Business Leaders Outlook survey was conducted online from November 16 – December 13, 2023. In total, 251 business leaders (CEOs, CFOs, heads of finance and owners) from German midsize companies (annual revenues generally ranging from €20 million to €2 billion) across various industries participated in the survey. Results are within statistical parameters for validity, and the error rate is +/- 6.0% with a 95% confidence level.

About JPMorgan Chase

JPMorgan Chase & Co. (NYSE: JPM) is a leading financial services firm based in the United States of America (“U.S.”), with operations worldwide. JPMorgan Chase had $3.9 trillion in assets and $328 billion in stockholders’ equity as of December 31, 2023. The Firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing and asset management. Under the J.P. Morgan and Chase brands, the Firm serves millions of customers in the U.S., and many of the world’s most prominent corporate, institutional and government clients globally. Information about JPMorgan Chase & Co. is available at www.jpmorganchase.com.

JPMorgan Chase in Germany

JPMorgan Chase’s roots date back a century and the firm is the largest international bank in Germany, with its EU headquarters in Frankfurt serving as the anchor of the region as it grows its business and employee base of more than 700 people across the country. JPMorgan Chase is committed to operating a healthy and vibrant company that plays a leading role in advancing a sustainable and inclusive economy, and works every day to apply its unique expertise, insights, and resources to help address economic and societal challenges facing its clients, employees, and communities.

© 2024 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A. Member FDIC. JPMorgan Chase Bank, N.A. is organized under the laws of USA with limited liability. Visit jpmorgan.com/cb-disclaimer for full disclosures and disclaimers related to this content.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240117964388/en/

Contacts

J.P. Morgan Germany, Kate Haywood, kate.l.haywood@jpmorgan.com

J.P. Morgan Commercial Banking, Bentley Weisel, bentley.r.weisel@chase.com