Live Cattle prices are up, and EPS down

Earnings per share in Tyson Foods Inc. (NYSE: $TSN) have declined from $3.07 per diluted during the first quarter of 2022 to an astonishing $0.88 in the first quarter of 2023 (that's a 72% decline!). To understand if this will be the new norm for the food giant, we need to understand what is brewing - or mooing - trouble.

Live Cattle Futures, historically trading within the $95-$130 range, have seen two major breakouts in the past 10 years. One of these breakouts to $171.65 in 2014 did not affect Tyson's profitability, given their revenue sources were more diversified then. This time around, with live cattle trading at $164, Tyson's volume of beef products has exposed the firm to increased protein costs.

Most people associate chicken when they hear Tyson Foods, those savvy ones understand that beef products have been growing to match - and overtake - chicken as of 2018 in terms of net sales for the firm.

Is this mad cow disease, or just buying beef at the wrong time?

Tackling the future is no easy task. However, markets seem to have priced in and taken to heart USDA's guidance. Such guidance indicates that beef and chicken production will remain relatively flat in 2023 compared to 2022, cited in Tyson Foods' latest quarterly report.

Within this quarterly report, management has also pointed to expected beef segment operating margins of 2-4%, compared to the previous indication of 5-7% margins. This bearish change in expectations, along with USDA's statement, leads markets to believe that the firm will see no light at the end of the tunnel until live cattle prices normalize in prices. However, this is what markets are missing:

Restructuring plan cost savings, synergies and acquisitions

Despite all the negative noise that Tyson Foods may be drawing on from macroeconomic factors such as rising rates and live cattle prices, markets can quickly forget that these issues are industry-wide symptoms affecting other businesses outside of Tyson Foods; therefore, it would be useful to remember that the core business has not changed... or has it?

As of 2020, Tyson Foods has deployed a restructuring plan, "the plan," as cited in their annual reports. Such a plan consists of reducing overhead, acquiring value-adding businesses, consolidating executive locations into Arkansas headquarters and investing in innovative technology for optimized processes.

Reportedly, as of 2022, this plan has yielded $700 million dollars in cost savings, 48% of their five-year average free cash flow - and management has pointed to an expected $1 billion dollars in savings through synergies by the end of 2023. All of these savings yielding increases in bottom-line net income and free cash flow can mean a couple of things:

- The company will have more cash on hand to effect further acquisitions into ESG-focused protein production.

- Accelerated share buybacks.

- Increased dividend payouts, which currently yield 3.18% as of this writing.

And how could we forget all of these dynamics can serve to upgrade current price targets set by Street wide analysts?

Cases for Valuation

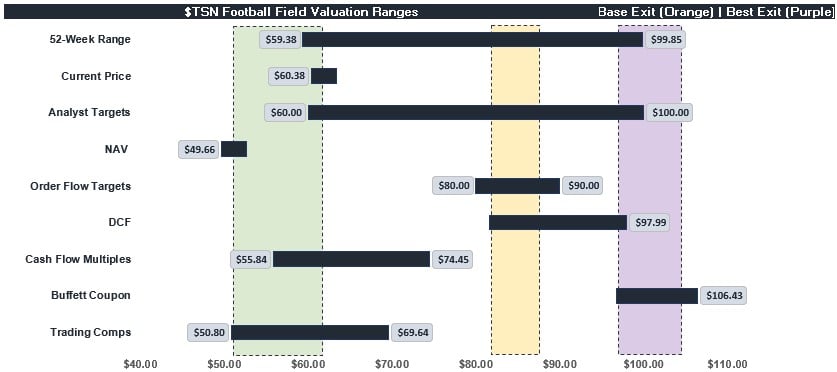

Analysts seem to be conflicted as to whether rising live cattle prices will prevail or will restructuring cost savings will win this battle. A case in point is that analysts are ranging this stock from $56-$95. This wide range can be explained by the current state of the live cattle market, downward pressure on protein manufacturing stocks and rising interest rates.

A clearer picture of where this stock is thought to be headed:

As a buying range, Tyson Foods deserves to be placed on a watchlist not only for its brand name recognition and industry-leading profitability but also for its trading near NAV and book value levels, as seen above.

Chickens have come home to roost a buying range

Speaking technicals, Tyson Foods has entered the Fibonacci "Golden Ratio" of a 78.6% to 61.8% regression level since its decline in March 2020 to $42.53. Apart from this, weekly RSIs and Money Flow Index indicators point to a possibly exhausted decline which was ignited in April 2022.

Lastly, volatility has seen a breakout above Average True Ranges (ATRs) of 2.5%. During the earnings announcement shedding light on catastrophic declines in margins, ATRs broke above 3% signaling that a short-term reversal might be in the queue for this stock.