Hotel franchising company Wyndham (NYSE: WH) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 1.5% year on year to $396 million. Its non-GAAP profit of $1.39 per share wasin line with analysts’ consensus estimates.

Is now the time to buy Wyndham? Find out by accessing our full research report, it’s free.

Wyndham (WH) Q3 CY2024 Highlights:

- Revenue: $396 million vs analyst estimates of $408.3 million (3% miss)

- Adjusted EPS: $1.39 vs analyst expectations of $1.38 (in line)

- EBITDA: $208 million vs analyst estimates of $207 million (small beat)

- Management slightly raised its full-year Adjusted EPS guidance to $4.28 at the midpoint

- Gross Margin (GAAP): 62.4%, up from 59.7% in the same quarter last year

- Operating Margin: 43.2%, up from 40.5% in the same quarter last year

- EBITDA Margin: 52.5%, up from 49.8% in the same quarter last year

- Free Cash Flow Margin: 24%, up from 16.7% in the same quarter last year

- RevPAR: $49.33 at quarter end, in line with the same quarter last year

- Market Capitalization: $6.59 billion

"Our teams around the world once again delivered exceptional results, executing our long-term growth strategy and achieving 7% growth in comparable adjusted EBITDA fueled by continued system expansion, higher royalty rates and growth in our ancillary revenues," said Geoff Ballotti, president and chief executive officer.

Company Overview

Established in 1981, Wyndham (NYSE: WH) is a global hotel franchising company with over 9,000 hotels across nearly 95 countries on six continents.

Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Sales Growth

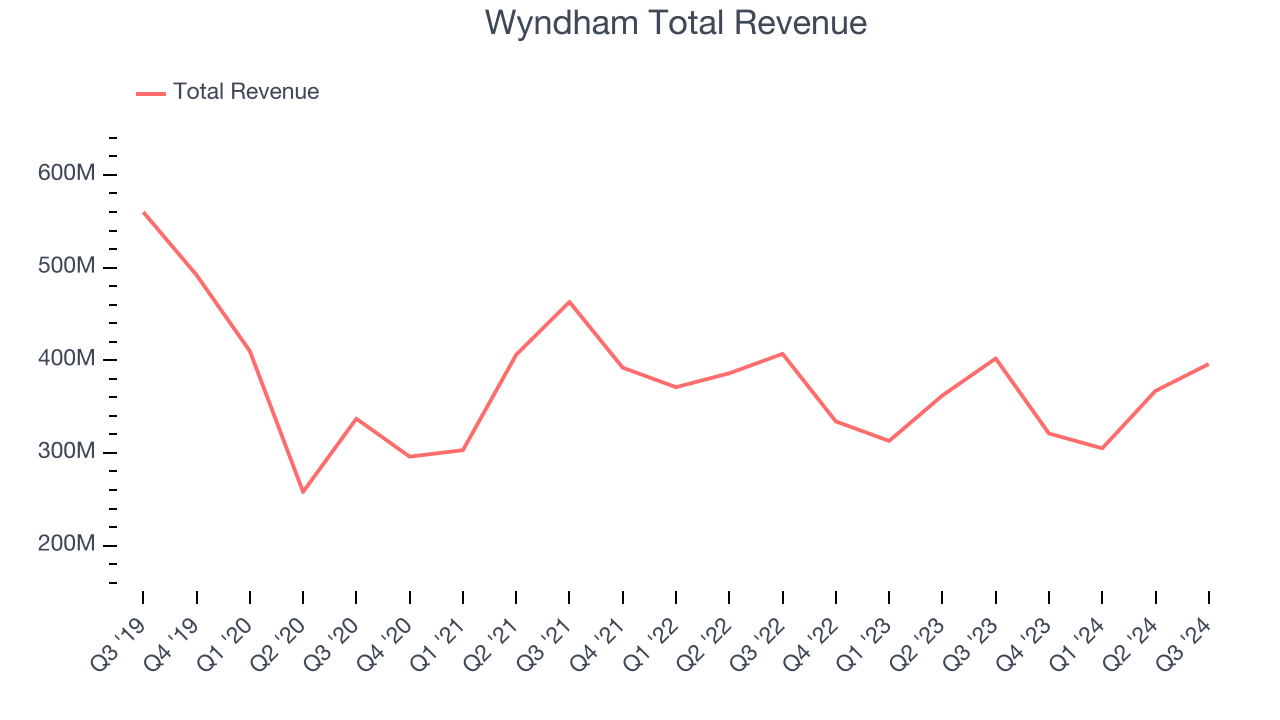

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Wyndham’s demand was weak over the last five years as its sales fell by 7.8% annually, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or emerging trend. Wyndham’s annualized revenue declines of 5.5% over the last two years suggest its demand continued shrinking.

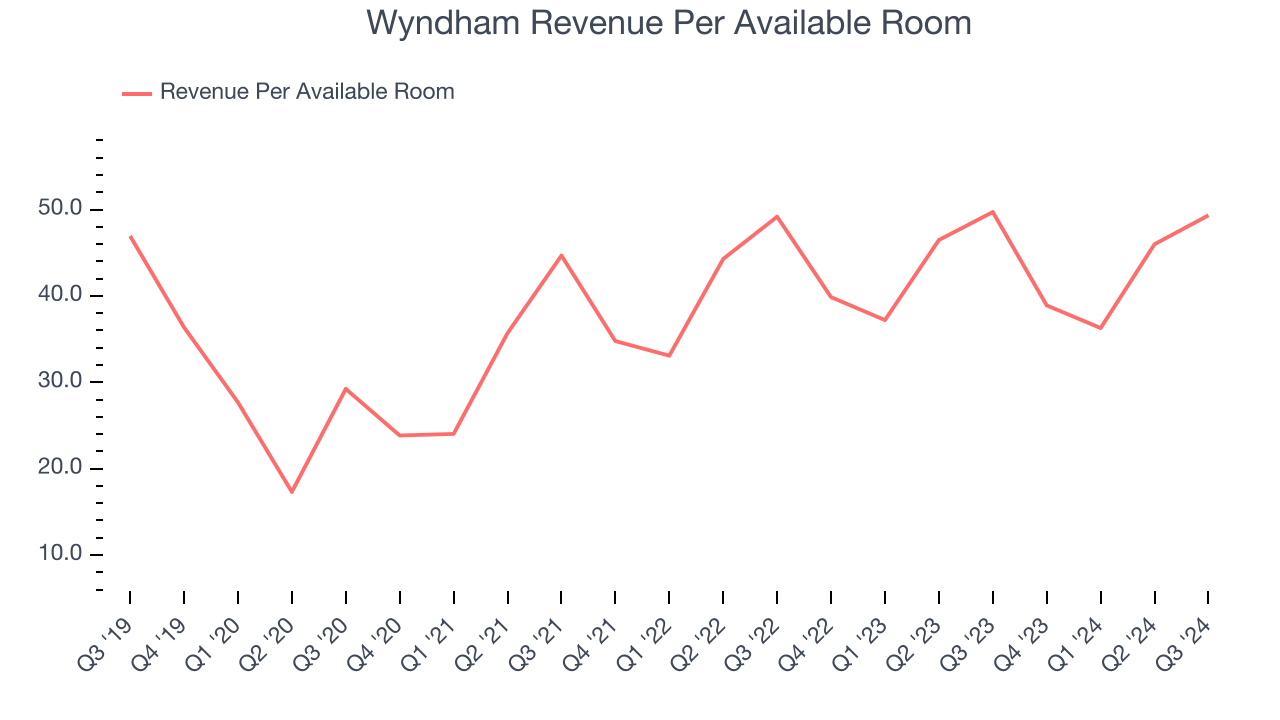

We can better understand the company’s revenue dynamics by analyzing its revenue per available room, which clocked in at $49.33 this quarter and is a key metric accounting for daily rates and occupancy levels. Over the last two years, Wyndham’s revenue per room averaged 3.3% year-on-year growth. Because this number is better than its revenue growth, we can see its room bookings outperformed its sales from other areas like restaurants, bars, and amenities.

This quarter, Wyndham missed Wall Street’s estimates and reported a rather uninspiring 1.5% year-on-year revenue decline, generating $396 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 6.2% over the next 12 months, an acceleration versus the last two years. While this projection shows the market thinks its newer products and services will spur better performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

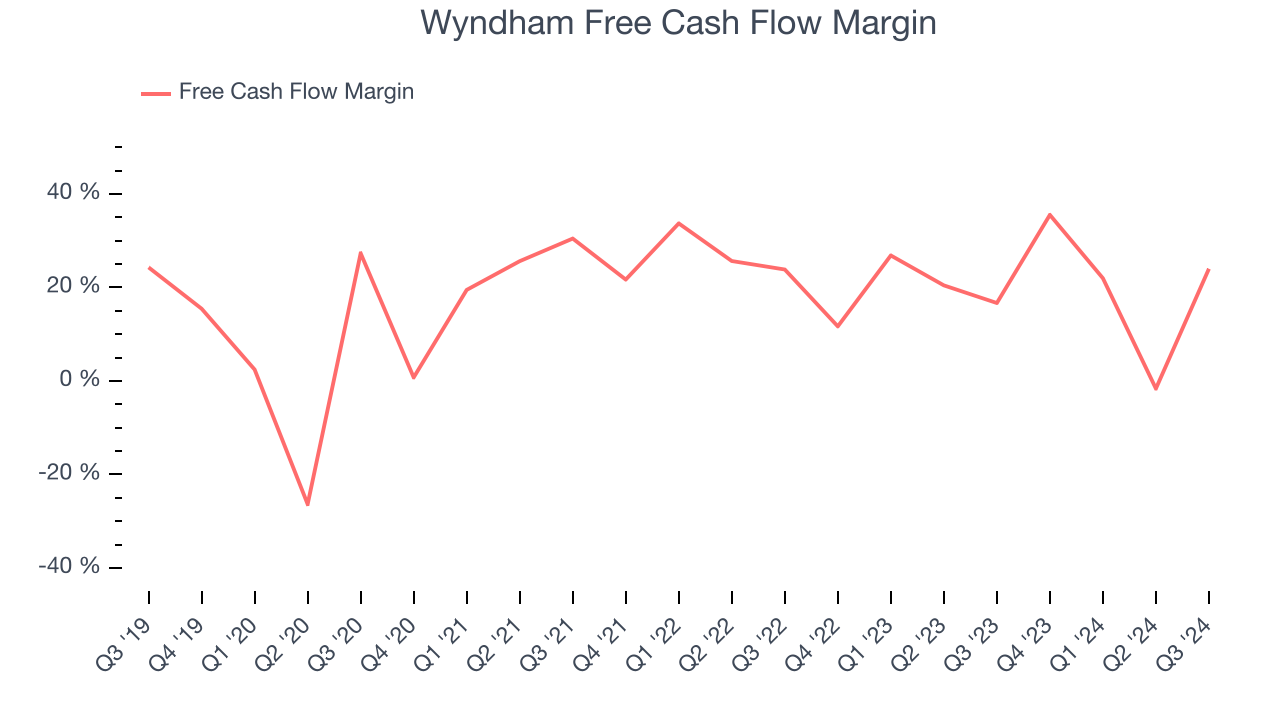

Wyndham has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 19.1% over the last two years, quite impressive for a consumer discretionary business.

Wyndham’s free cash flow clocked in at $95 million in Q3, equivalent to a 24% margin. This result was good as its margin was 7.3 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends trump fluctuations.

Key Takeaways from Wyndham’s Q3 Results

Revenue missed, although adjusted EPS came in line with expectations. While the company maintained its full year EBITDA guidance, it very slightly raised EPS guidance. Overall, this was a mixed quarter. The stock remained flat at $81.77 immediately after reporting.

Is Wyndham an attractive investment opportunity at the current price?When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.