Over the past six months, DNOW’s stock price fell to $12.58. Shareholders have lost 16.8% of their capital, which is disappointing considering the S&P 500 has climbed by 11.3%. This might have investors contemplating their next move.

Is now the time to buy DNOW, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Is DNOW Not Exciting?

Even though the stock has become cheaper, we're cautious about DNOW. Here are three reasons we avoid DNOW and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

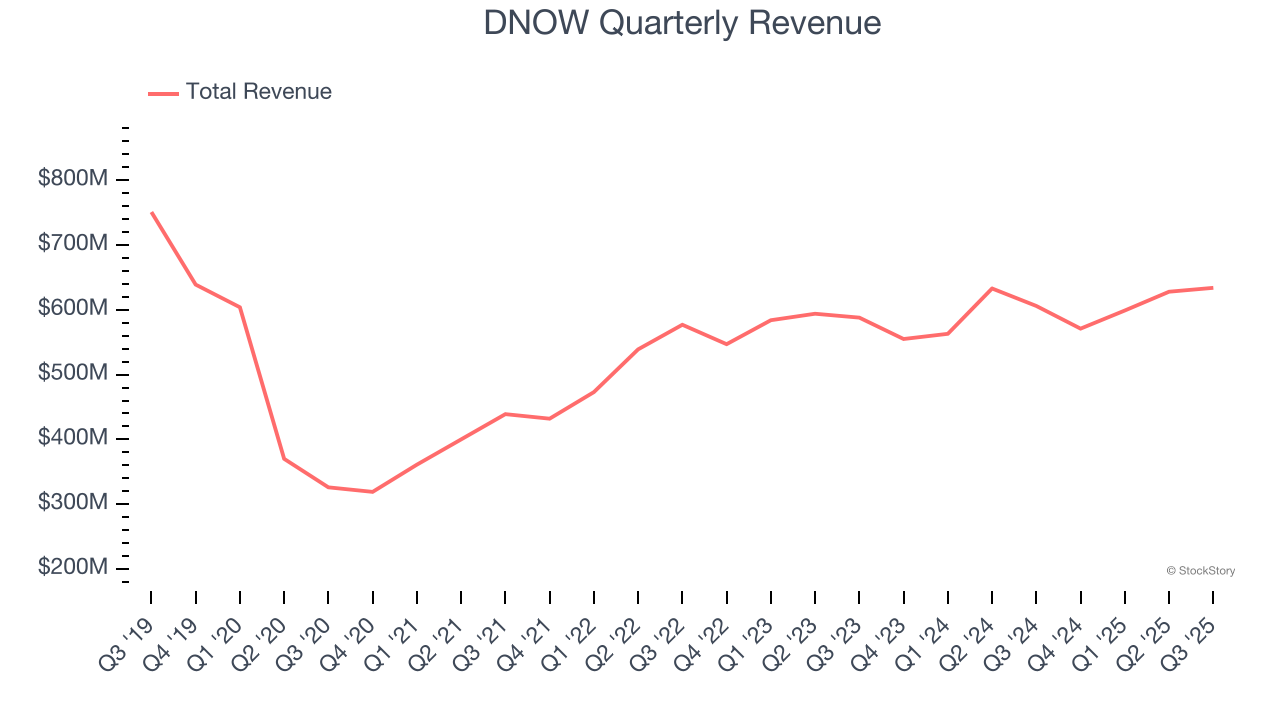

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, DNOW’s 4.6% annualized revenue growth over the last five years was tepid. This was below our standard for the industrials sector.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect DNOW’s revenue to rise by 3.7%, close to its 4.6% annualized growth for the past five years. This projection is underwhelming and implies its newer products and services will not lead to better top-line performance yet.

3. EPS Growth Has Stalled Over the Last Two Years

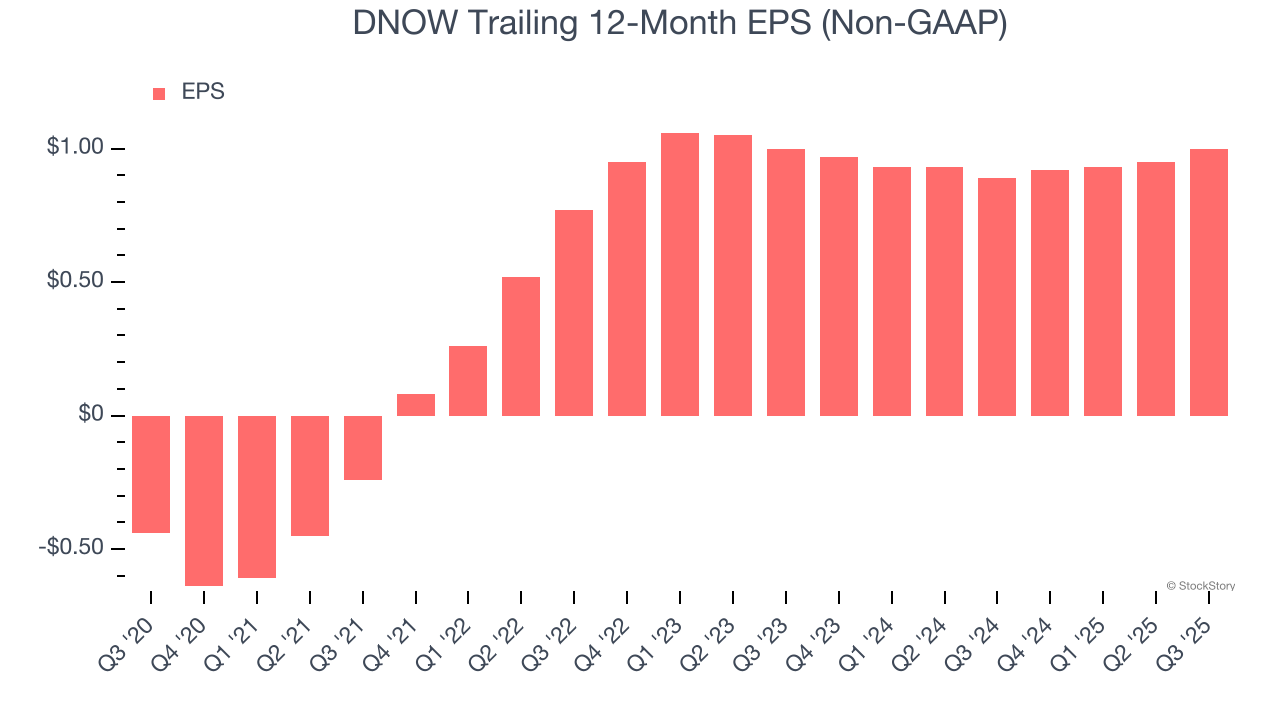

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

DNOW’s flat EPS over the last two years was worse than its 2.5% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

DNOW isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 29.4× forward EV-to-EBITDA (or $12.58 per share). This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now. Let us point you toward one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of DNOW

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.