Digital ad verification company Integral Ad Science (NASDAQ: IAS) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 15.6% year on year to $154.4 million. Its GAAP profit of $0.04 per share was 42.2% below analysts’ consensus estimates.

Is now the time to buy Integral Ad Science? Find out by accessing our full research report, it’s free for active Edge members.

Integral Ad Science (IAS) Q3 CY2025 Highlights:

- Revenue: $154.4 million vs analyst estimates of $149.3 million (15.6% year-on-year growth, 3.4% beat)

- EPS (GAAP): $0.04 vs analyst expectations of $0.07 (42.2% miss)

- Adjusted Operating Income: $30.2 million vs analyst estimates of $16.73 million (19.6% margin, 80.5% beat)

- Operating Margin: 4.9%, down from 15.1% in the same quarter last year

- Free Cash Flow Margin: 32.9%, down from 36.9% in the previous quarter

- Market Capitalization: $1.71 billion

"We exceeded our revenue and adjusted EBITDA outlook for the third quarter with strength across our businesses," said Lisa Utzschneider, CEO of IAS.

Company Overview

Processing over 280 billion digital ad interactions daily through its AI-powered technology, Integral Ad Science (NASDAQ: IAS) provides a cloud-based platform that measures and verifies digital advertising across devices, channels, and formats to ensure ads are viewable, fraud-free, and brand-safe.

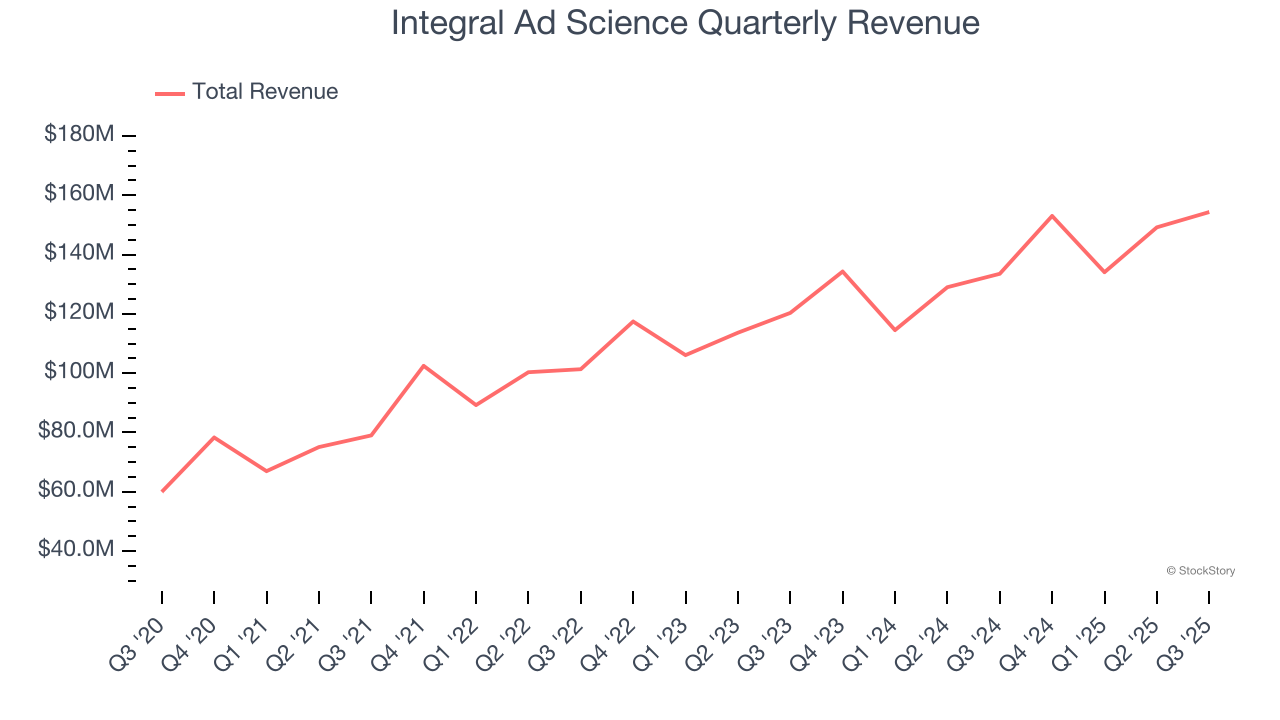

Revenue Growth

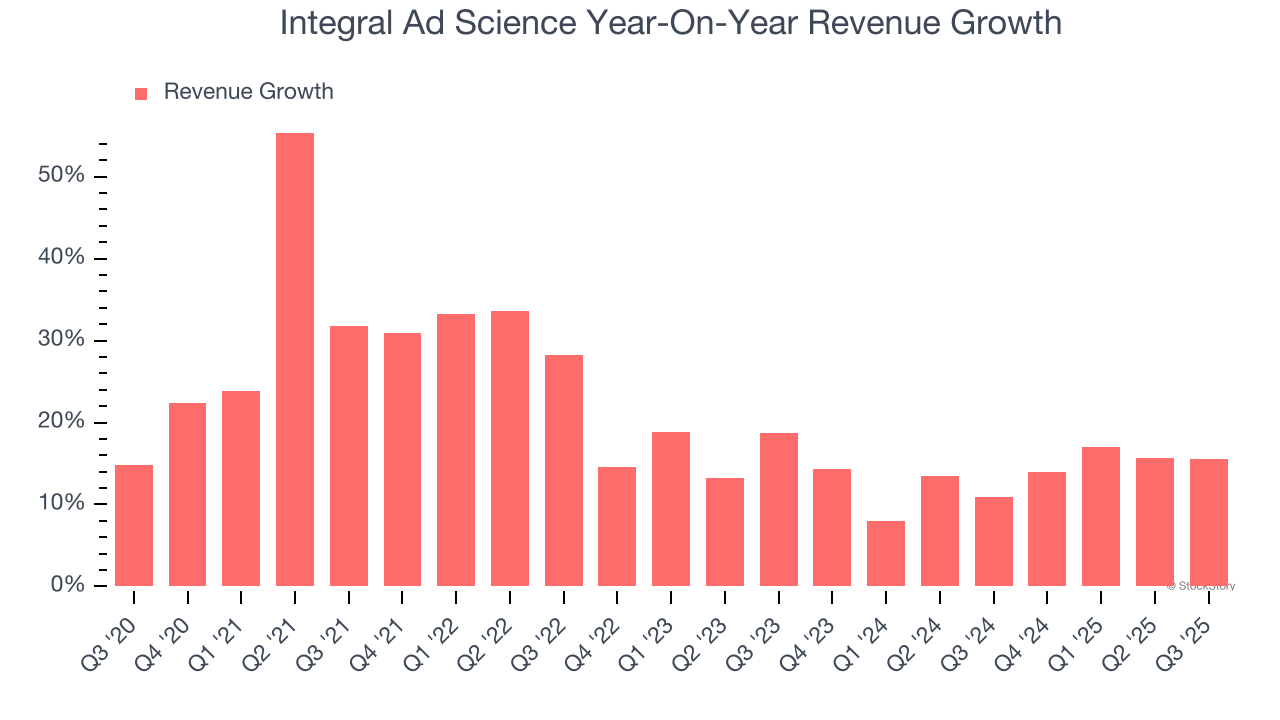

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Integral Ad Science grew its sales at a decent 21.2% compounded annual growth rate. Its growth was slightly above the average software company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Integral Ad Science’s recent performance shows its demand has slowed as its annualized revenue growth of 13.6% over the last two years was below its five-year trend.

This quarter, Integral Ad Science reported year-on-year revenue growth of 15.6%, and its $154.4 million of revenue exceeded Wall Street’s estimates by 3.4%.

Looking ahead, sell-side analysts expect revenue to grow 10% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Integral Ad Science is extremely efficient at acquiring new customers, and its CAC payback period checked in at 8.7 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from Integral Ad Science’s Q3 Results

We enjoyed seeing Integral Ad Science beat analysts’ adjusted operating income expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock remained flat at $10.24 immediately following the results.

Indeed, Integral Ad Science had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.