Satellite communications company EchoStar (NASDAQGS:SATS) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 7.1% year on year to $3.61 billion. Its GAAP loss of $44.37 per share was significantly below analysts’ consensus estimates.

Is now the time to buy EchoStar? Find out by accessing our full research report, it’s free for active Edge members.

EchoStar (SATS) Q3 CY2025 Highlights:

- Revenue: $3.61 billion vs analyst estimates of $3.73 billion (7.1% year-on-year decline, 3.1% miss)

- EPS (GAAP): -$44.37 vs analyst estimates of -$1.13 (significant miss)

- Adjusted EBITDA: $230.9 million vs analyst estimates of $291 million (6.4% margin, 20.7% miss)

- Operating Margin: -460%, down from -4.1% in the same quarter last year

- Free Cash Flow was -$144.4 million compared to -$57.52 million in the same quarter last year

- Market Capitalization: $20.81 billion

"EchoStar will soon be in the unique position of having substantial available capital, vastly changing its scope of opportunities. Through EchoStar Capital we will fuel EchoStar's growth into new and complementary arenas, beyond its successful pay-TV, wireless and enterprise business units," said Hamid Akhavan, CEO, EchoStar Capital.

Company Overview

Following its 2023 acquisition of DISH Network, EchoStar (NASDAQ: SATS) provides satellite communications, pay-TV services, wireless networks, and broadband solutions across consumer and enterprise markets.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $15.18 billion in revenue over the past 12 months, EchoStar is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices.

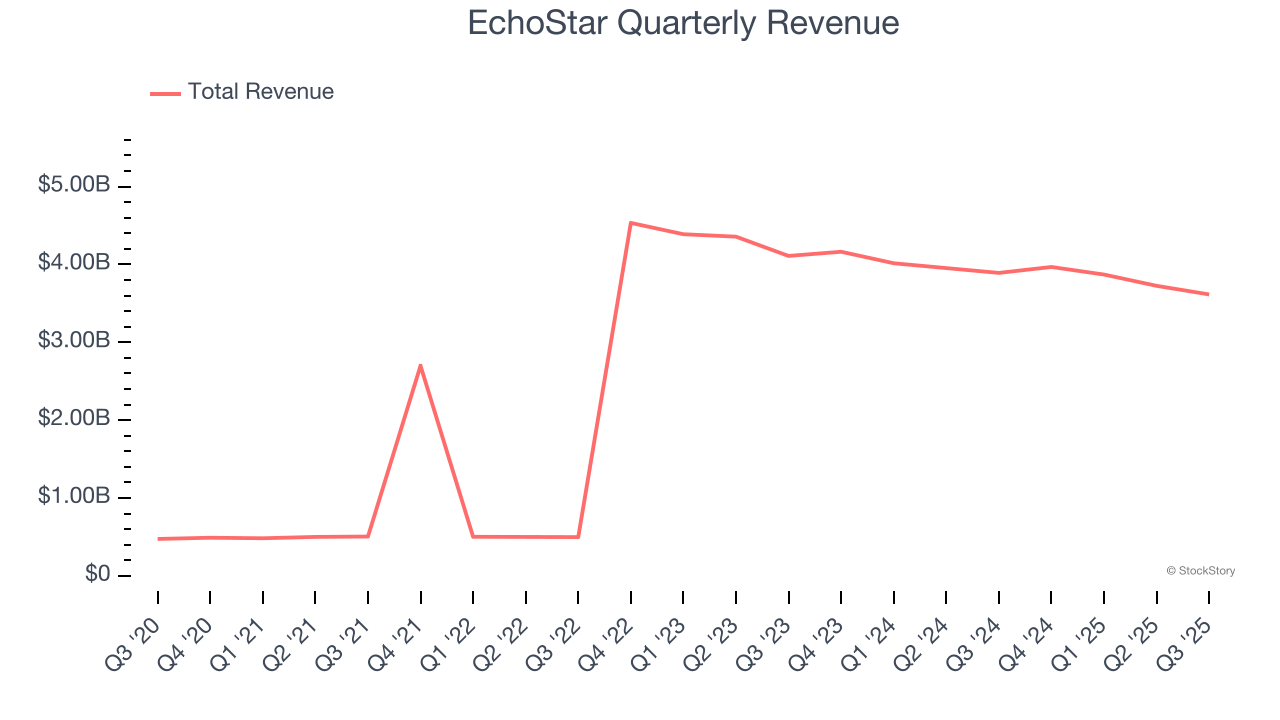

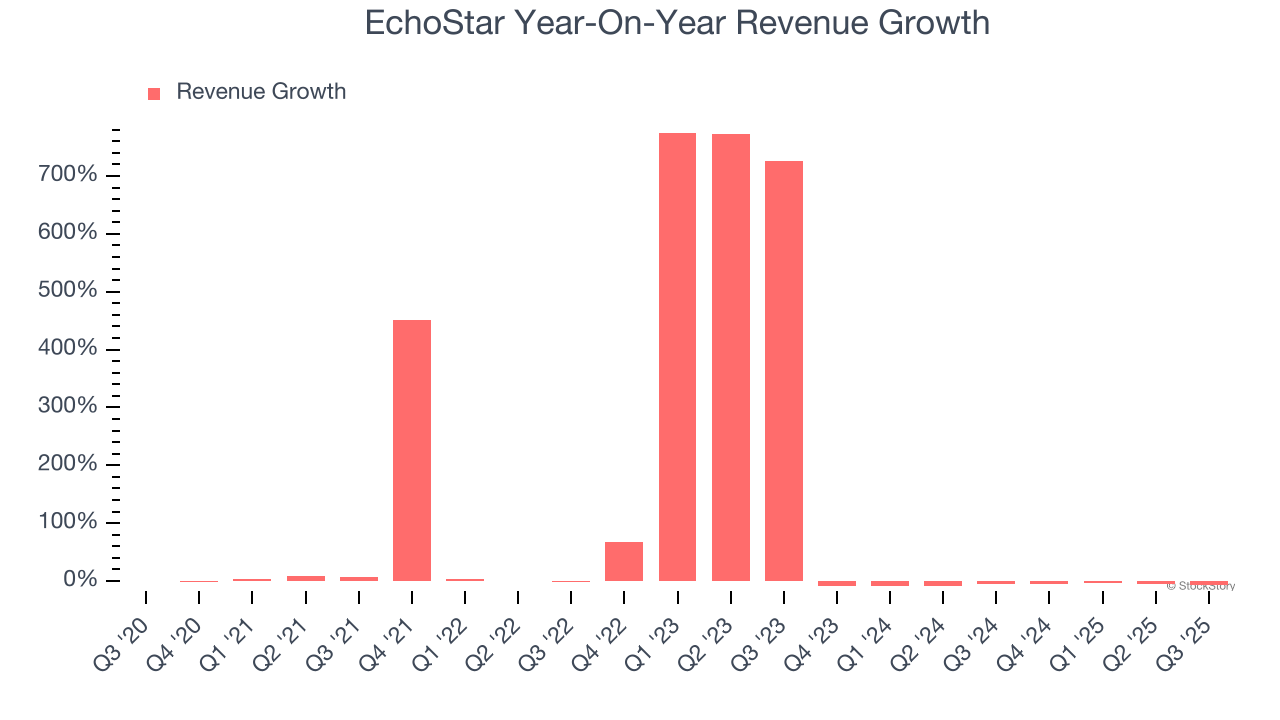

As you can see below, EchoStar’s 51.6% annualized revenue growth over the last five years was incredible. This shows it had high demand, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. EchoStar’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 6.6% over the last two years.

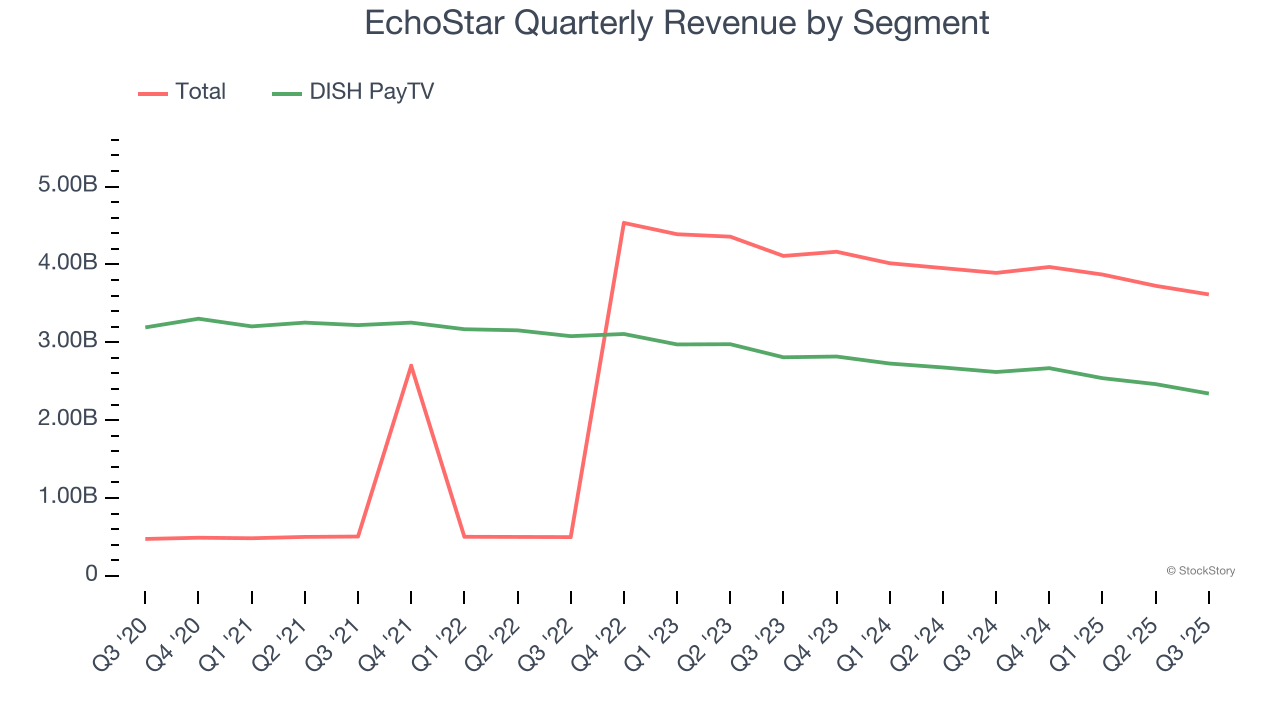

EchoStar also breaks out the revenue for its most important segment, DISH PayTV. Over the last two years, EchoStar’s DISH PayTV revenue averaged 8.1% year-on-year declines. This segment has lagged the company’s overall sales.

This quarter, EchoStar missed Wall Street’s estimates and reported a rather uninspiring 7.1% year-on-year revenue decline, generating $3.61 billion of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 3.3% over the next 12 months. Although this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

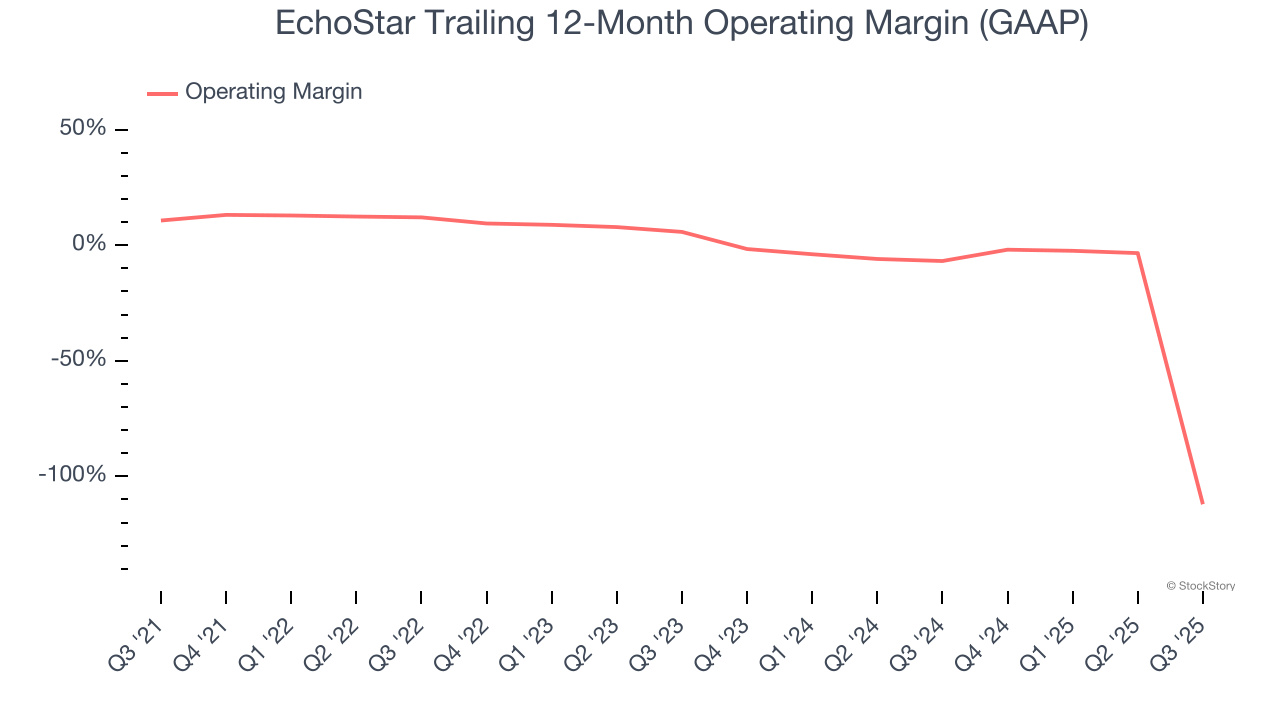

EchoStar’s high expenses have contributed to an average operating margin of negative 29.9% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, EchoStar’s operating margin decreased significantly over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. EchoStar’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q3, EchoStar generated a negative 460% operating margin.

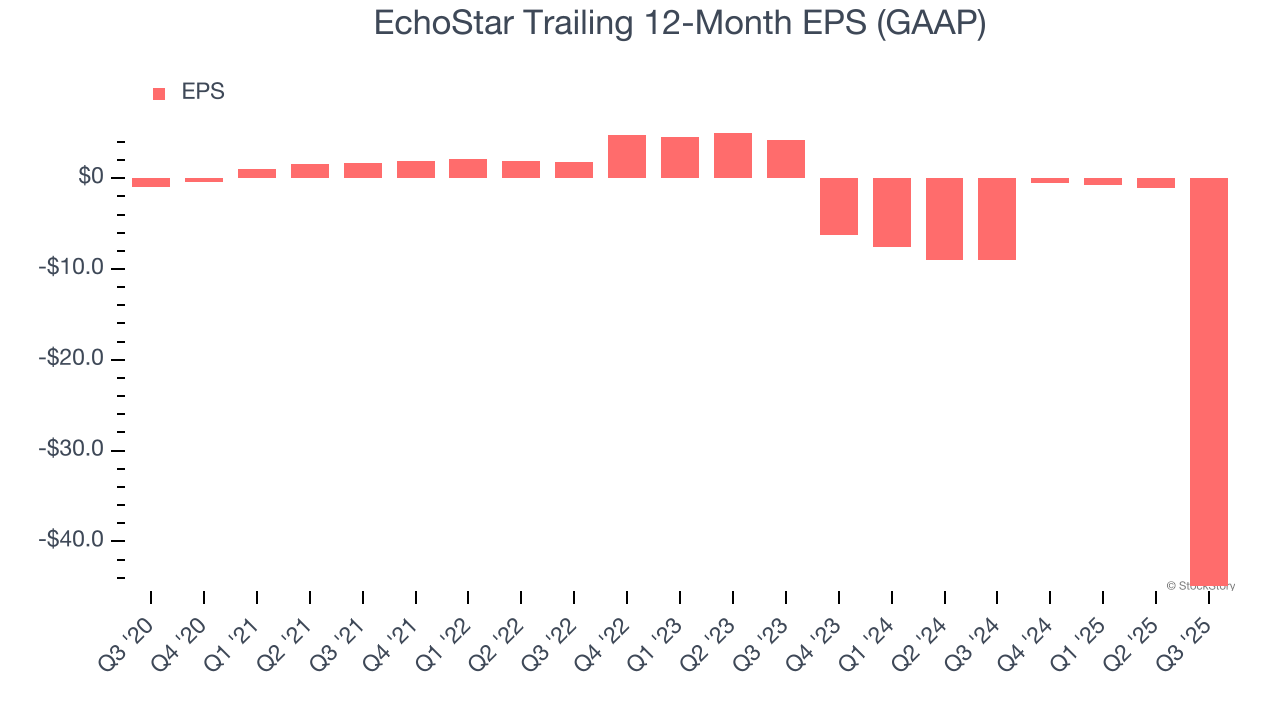

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

EchoStar’s earnings losses deepened over the last five years as its EPS dropped 116% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, EchoStar’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for EchoStar, its EPS declined by more than its revenue over the last two years, dropping 255%. This tells us the company struggled to adjust to shrinking demand.

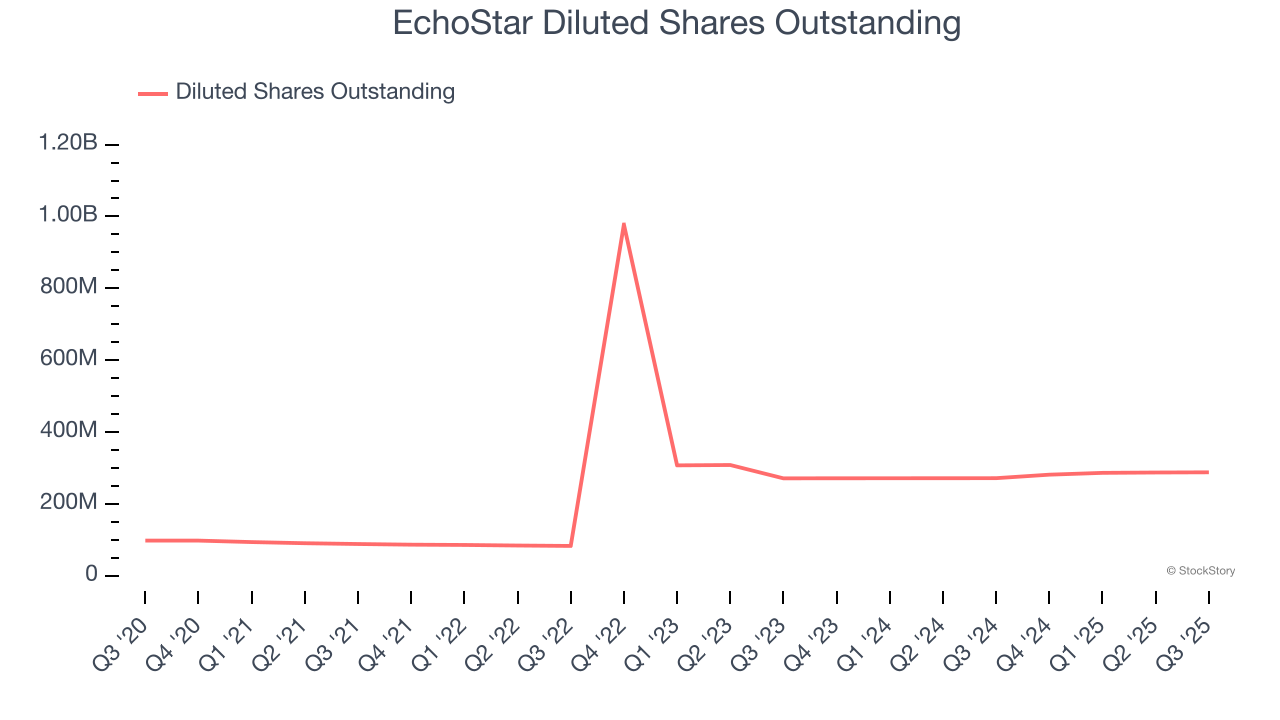

Diving into the nuances of EchoStar’s earnings can give us a better understanding of its performance. EchoStar’s operating margin has declined over the last two yearswhile its share count has grown 6.2%. This means the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q3, EchoStar reported EPS of negative $44.37, down from negative $0.52 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects EchoStar to improve its earnings losses. Analysts forecast its full-year EPS of negative $44.95 will advance to negative $4.49.

Key Takeaways from EchoStar’s Q3 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 2.9% to $70.25 immediately following the results.

EchoStar may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.