Flex currently trades at $51.50 and has been a dream stock for shareholders. It’s returned 424% since July 2020, blowing past the S&P 500’s 97.3% gain. The company has also beaten the index over the past six months as its stock price is up 28.1%.

Is there a buying opportunity in Flex, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think Flex Will Underperform?

Despite the momentum, we're cautious about Flex. Here are three reasons why FLEX doesn't excite us and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

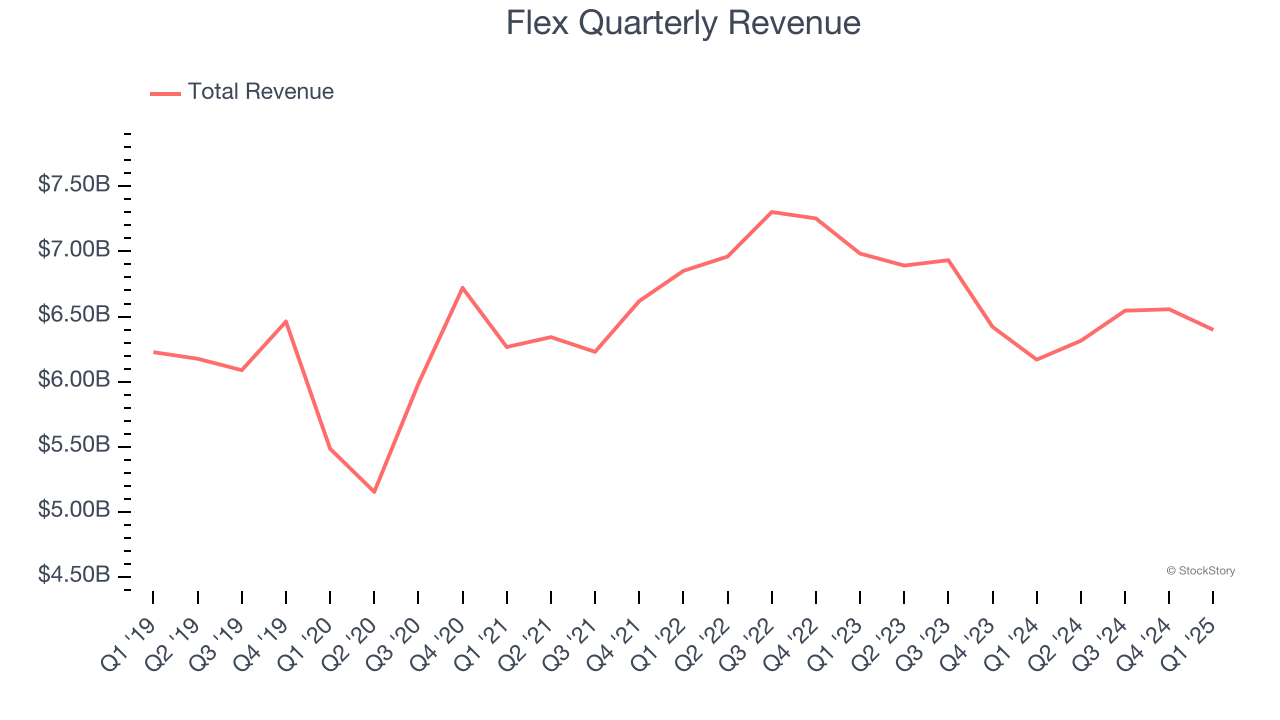

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Flex grew its sales at a sluggish 1.3% compounded annual growth rate. This fell short of our benchmarks.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Flex’s revenue to rise by 1.1%. While this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

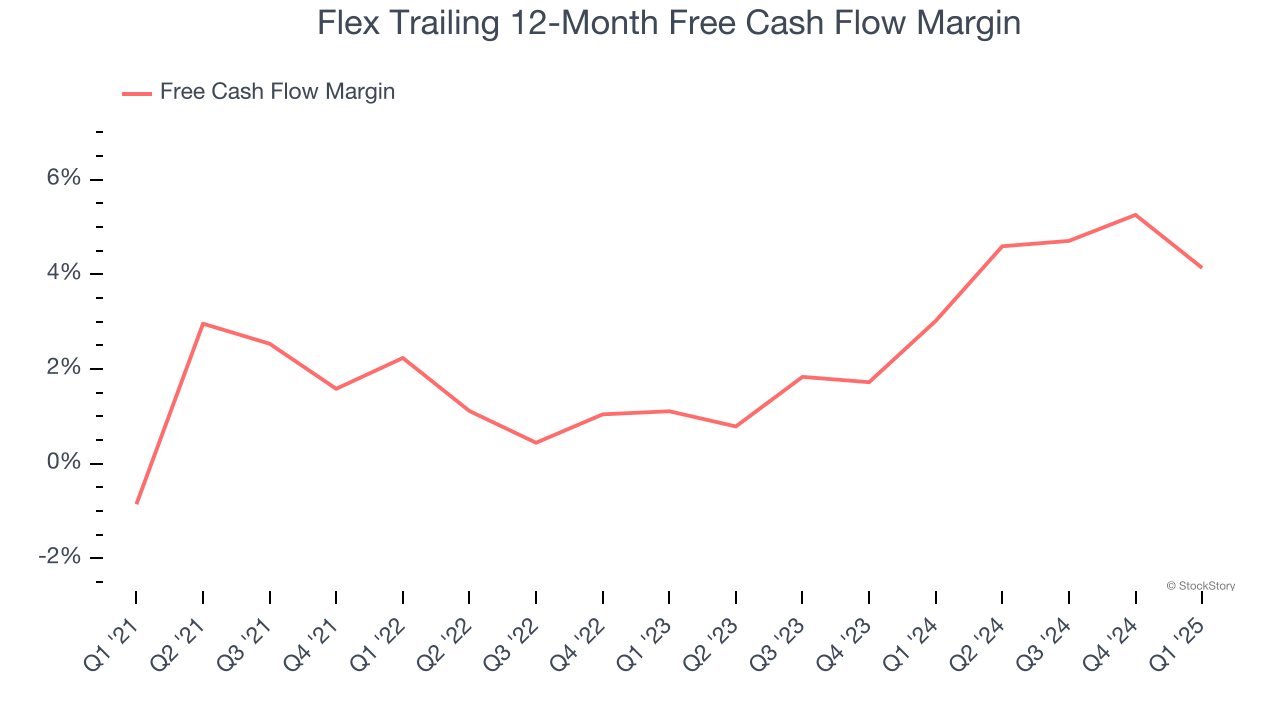

Flex has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.9%, lousy for a business services business.

Final Judgment

We see the value of companies helping their customers, but in the case of Flex, we’re out. With its shares beating the market recently, the stock trades at 18.1× forward P/E (or $51.50 per share). This valuation tells us a lot of optimism is priced in - you can find more timely opportunities elsewhere. We’d recommend looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

High-Quality Stocks for All Market Conditions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.