Programmatic advertising platform Pubmatic (NASDAQ: PUBM) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 5.7% year on year to $71.1 million. On the other hand, next quarter’s revenue guidance of $63.5 million was less impressive, coming in 10.8% below analysts’ estimates. Its non-GAAP profit of $0.05 per share was significantly above analysts’ consensus estimates.

Is now the time to buy PubMatic? Find out by accessing our full research report, it’s free.

PubMatic (PUBM) Q2 CY2025 Highlights:

- Revenue: $71.1 million vs analyst estimates of $68.08 million (5.7% year-on-year growth, 4.4% beat)

- Adjusted EPS: $0.05 vs analyst estimates of $0.01 (significant beat)

- Adjusted EBITDA: $14.21 million vs analyst estimates of $10.94 million (20% margin, 29.9% beat)

- Revenue Guidance for Q3 CY2025 is $63.5 million at the midpoint, below analyst estimates of $71.18 million

- EBITDA guidance for Q3 CY2025 is $8.5 million at the midpoint, below analyst estimates of $14.6 million

- Operating Margin: -7.7%, down from -5.9% in the same quarter last year

- Free Cash Flow Margin: 13%, up from 11.4% in the previous quarter

- Market Capitalization: $530.5 million

“We delivered a strong second quarter, with revenue and adjusted EBITDA exceeding expectations. We added new publishers, streamers and ad buyers to the platform, continued to scale Activate and commerce media, and saw significant growth in sell side targeting,” said Rajeev Goel, co-founder and CEO at PubMatic.

Company Overview

Founded in 2006 as an online ad platform helping ad sellers, Pubmatic (NASDAQ: PUBM) is a fully integrated cloud-based programmatic advertising platform.

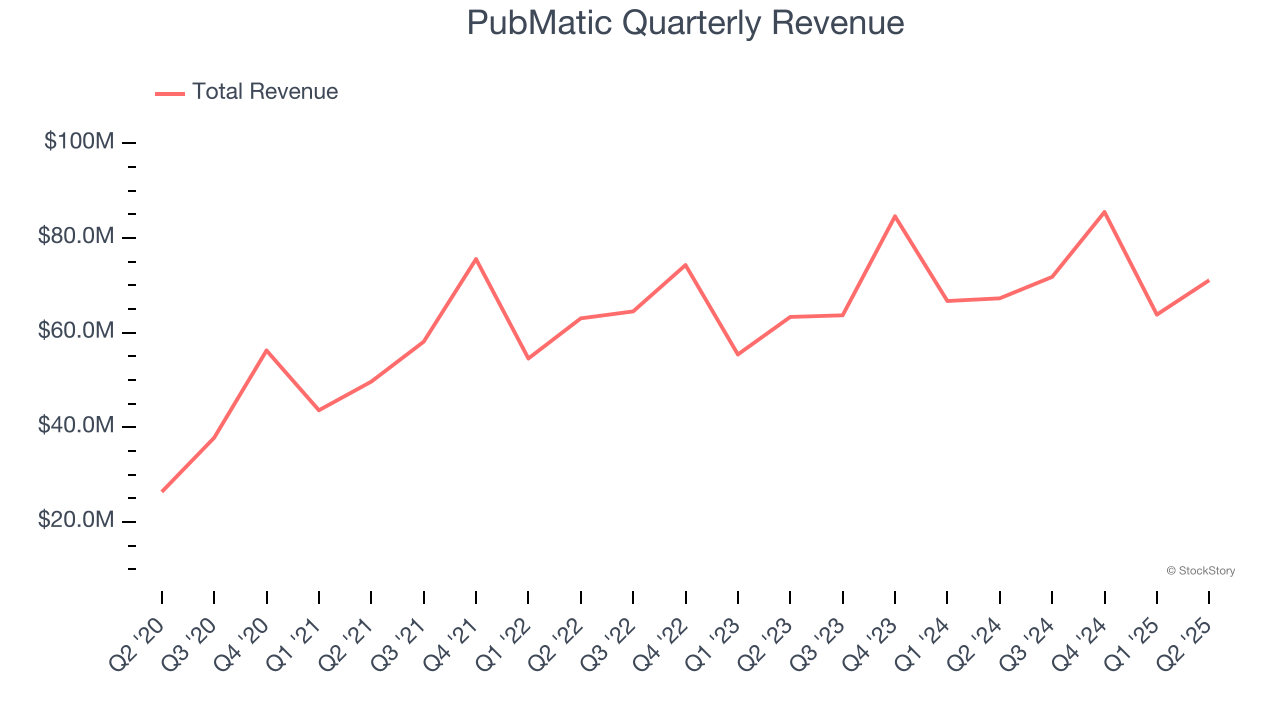

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, PubMatic’s 5.2% annualized revenue growth over the last three years was weak. This was below our standard for the software sector and is a tough starting point for our analysis.

This quarter, PubMatic reported year-on-year revenue growth of 5.7%, and its $71.1 million of revenue exceeded Wall Street’s estimates by 4.4%. Company management is currently guiding for a 11.5% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.1% over the next 12 months, similar to its three-year rate. This projection is underwhelming and indicates its newer products and services will not catalyze better top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

PubMatic is extremely efficient at acquiring new customers, and its CAC payback period checked in at 10.8 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from PubMatic’s Q2 Results

We were impressed by how significantly PubMatic blew past analysts’ EBITDA expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed and its EBITDA guidance for next quarter fell short of Wall Street’s estimates. This is clearly weighing on shares, and the stock traded down 22.7% to $8.16 immediately following the results.

PubMatic’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.