Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Toast (NYSE: TOST) and its peers.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 14 vertical software stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 4.1% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 1% on average since the latest earnings results.

Toast (NYSE: TOST)

Born from the frustrations of three friends waiting too long for their restaurant bill, Toast (NYSE: TOST) provides a cloud-based digital technology platform with software, payment processing, and hardware solutions built specifically for restaurants.

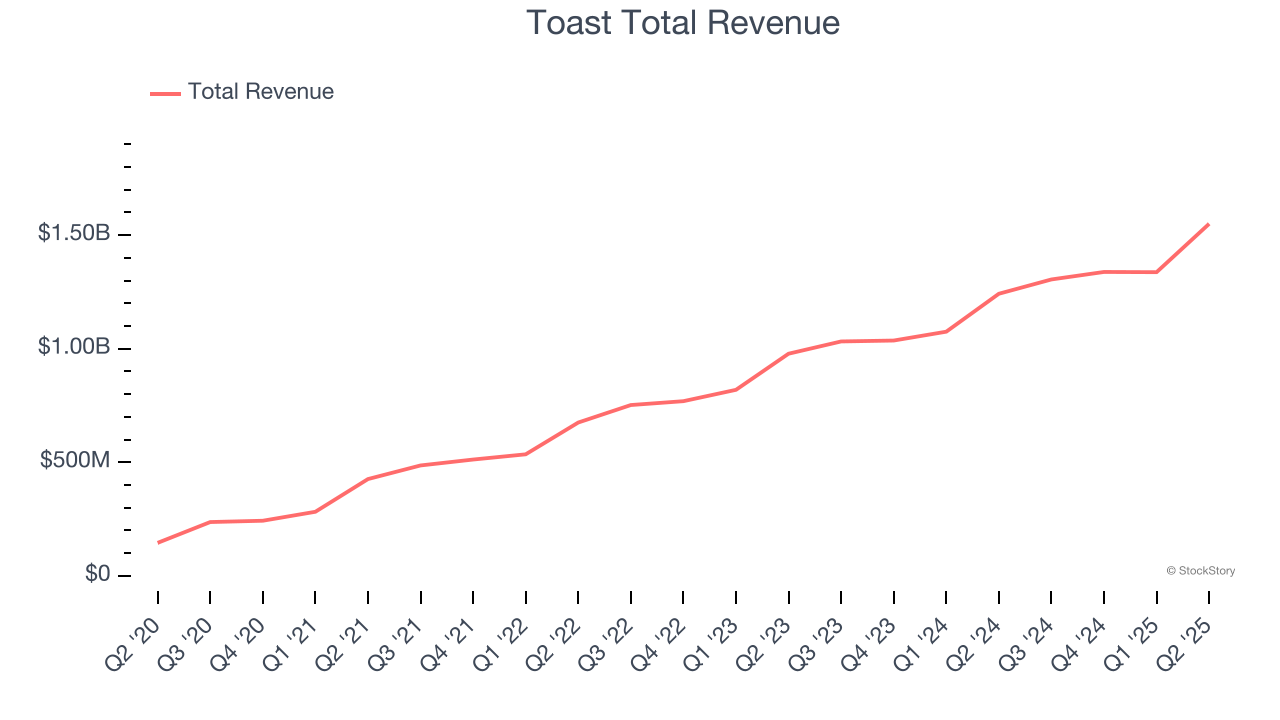

Toast reported revenues of $1.55 billion, up 24.8% year on year. This print exceeded analysts’ expectations by 2.1%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and full-year EBITDA guidance slightly topping analysts’ expectations.

“I’m proud of the team for delivering another strong quarter - we added a record 8,500 net new locations, recurring gross profit1 grew 35% year over year, and Adjusted EBITDA scaled to $161 million. Both our core U.S. restaurant business and our new market segments performed very well, with enterprise, international, and food and beverage retail passing 10,000 live locations. We are thrilled to welcome another 1,300+ unit chain to Toast as we continue to move upmarket and our international team has launched our first customer in Australia. We are also excited to announce the release of Toast Go® 3, our most powerful handheld yet, as well as a partnership with American Express aimed at delivering personalized experiences and expanding guest reach to help our customers provide better hospitality and grow. We’re building a platform to help local businesses thrive and I’ve never been more confident in our ability to deliver on that ambition and lead this industry,” said Aman Narang, Toast CEO and Co-Founder.

Unsurprisingly, the stock is down 14.6% since reporting and currently trades at $40.74.

Is now the time to buy Toast? Access our full analysis of the earnings results here, it’s free.

Best Q2: Olo (NYSE: OLO)

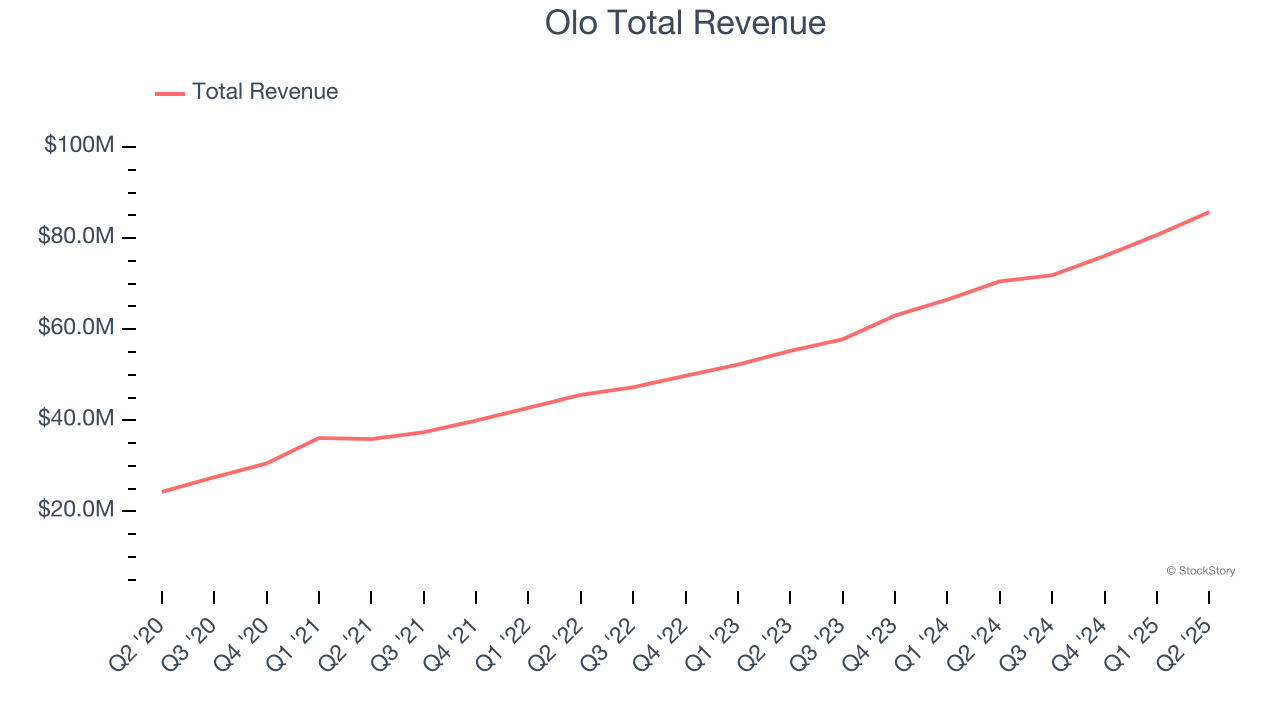

Processing over two million orders daily across 80,000 restaurant locations nationwide, Olo (NYSE: OLO) provides an enterprise-grade SaaS platform that powers digital ordering, delivery, and payment systems for restaurant brands across the United States.

Olo reported revenues of $85.72 million, up 21.6% year on year, outperforming analysts’ expectations by 4.2%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ billings estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 1.1% since reporting. It currently trades at $10.26.

Is now the time to buy Olo? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Agilysys (NASDAQ: AGYS)

With a tech stack that powers everything from check-in to checkout at some of the world's top hospitality venues, Agilysys (NASDAQ: AGYS) develops and provides cloud-based and on-premise software solutions for hotels, resorts, casinos, and restaurants to manage operations and enhance guest experiences.

Agilysys reported revenues of $76.68 million, up 20.7% year on year, exceeding analysts’ expectations by 3.1%. Still, it was a slower quarter as it posted a significant miss of analysts’ EBITDA estimates.

Agilysys delivered the weakest full-year guidance update in the group. As expected, the stock is down 6.9% since the results and currently trades at $109.05.

Read our full analysis of Agilysys’s results here.

Veeva Systems (NYSE: VEEV)

Originally named "Verticals onDemand" before rebranding in 2009, Veeva Systems (NYSE: VEEV) provides cloud software, data solutions, and consulting services that help life sciences companies develop and bring products to market more efficiently.

Veeva Systems reported revenues of $789.1 million, up 16.7% year on year. This print beat analysts’ expectations by 2.7%. Zooming out, it was a satisfactory quarter as it also logged EPS guidance for next quarter beating analysts’ expectations but a miss of analysts’ billings estimates.

The stock is down 6.8% since reporting and currently trades at $274.

Read our full, actionable report on Veeva Systems here, it’s free.

Upstart (NASDAQ: UPST)

Using over 2,500 data variables and trained on nearly 82 million repayment events, Upstart (NASDAQ: UPST) is an AI-powered lending platform that uses machine learning to help banks and credit unions more accurately assess borrower risk for personal loans, auto loans, and home equity lines of credit.

Upstart reported revenues of $257.3 million, up 102% year on year. This result topped analysts’ expectations by 13.6%. It was an exceptional quarter as it also produced EBITDA guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

Upstart scored the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The stock is down 25.1% since reporting and currently trades at $61.95.

Read our full, actionable report on Upstart here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.