Over the past six months, Chubb has been a great trade, beating the S&P 500 by 13.1%. Its stock price has climbed to $324.85, representing a healthy 19% increase. This performance may have investors wondering how to approach the situation.

Is now the time to buy Chubb, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Chubb Not Exciting?

We’re happy investors have made money, but we don't have much confidence in Chubb. Here are two reasons you should be careful with CB and a stock we'd rather own.

1. Recent EPS Growth Below Our Standards

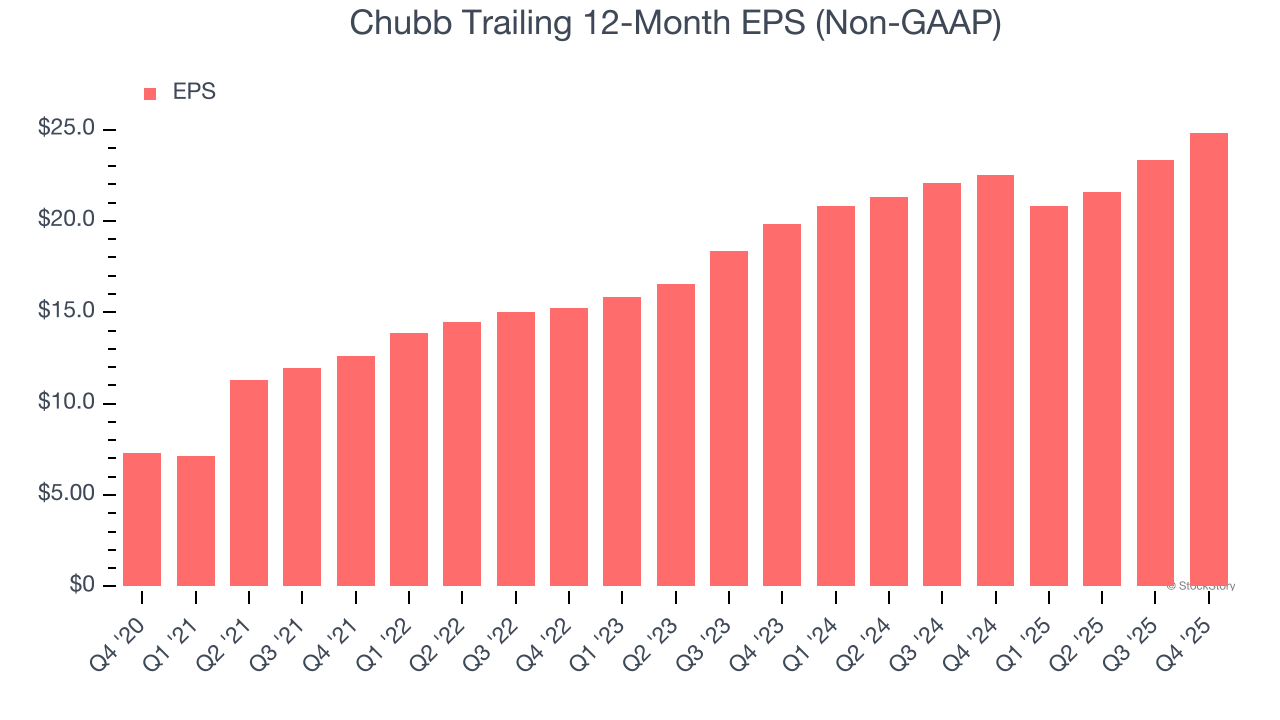

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Chubb’s EPS grew at a weak 11.9% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its 8.4% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

2. BVPS Growth Demonstrates Strong Asset Foundation

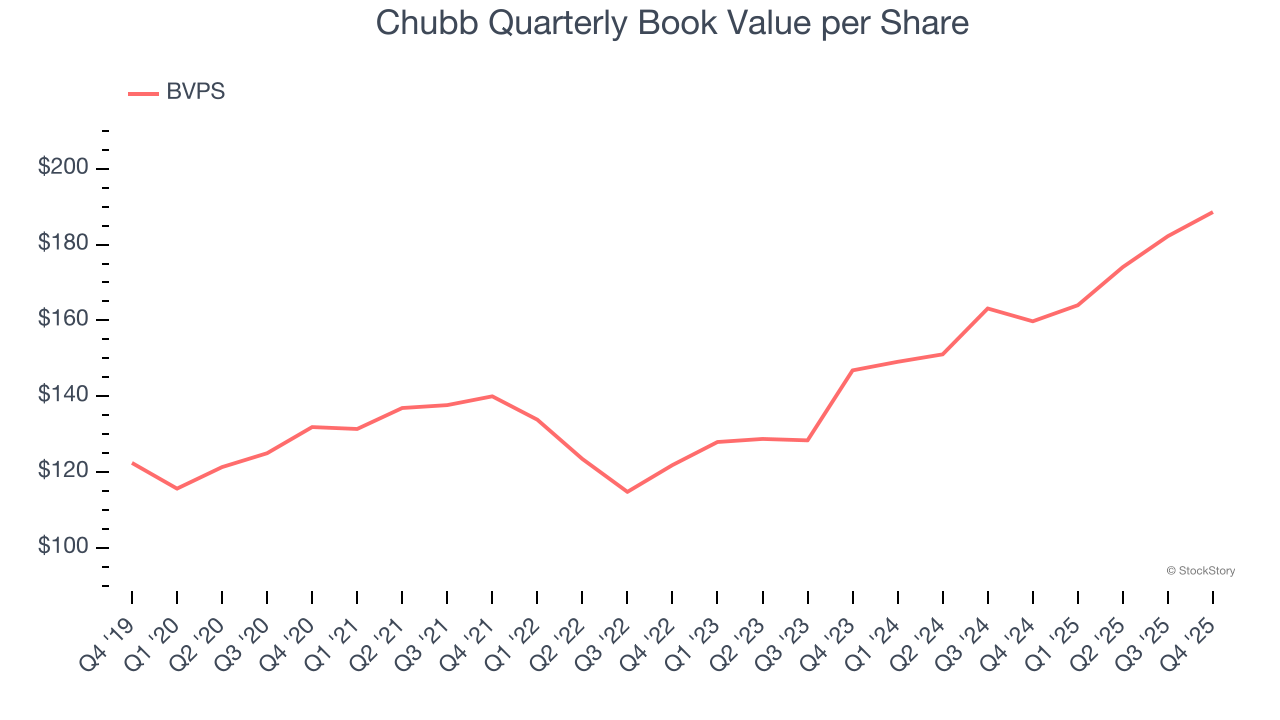

Book value per share (BVPS) serves as a key indicator of an insurer’s financial stability, reflecting a company’s ability to maintain adequate capital levels and meet its long-term obligations to policyholders.

Although Chubb’s BVPS increased by a meager 7.4% annually over the last five years, the good news is that its growth has recently accelerated as BVPS grew at a decent 13.3% annual clip over the past two years (from $146.83 to $188.59 per share).

Final Judgment

Chubb isn’t a terrible business, but it doesn’t pass our bar. With its shares topping the market in recent months, the stock trades at 1.6× forward P/B (or $324.85 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d recommend looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Chubb

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.