Hartford has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 9.5% to $142.15 per share while the index has gained 6%.

Is now the time to buy Hartford, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Hartford Not Exciting?

We're swiping left on Hartford for now. Here are three reasons why HIG doesn't excite us and a stock we'd rather own.

1. Net Premiums Earned Point to Soft Demand

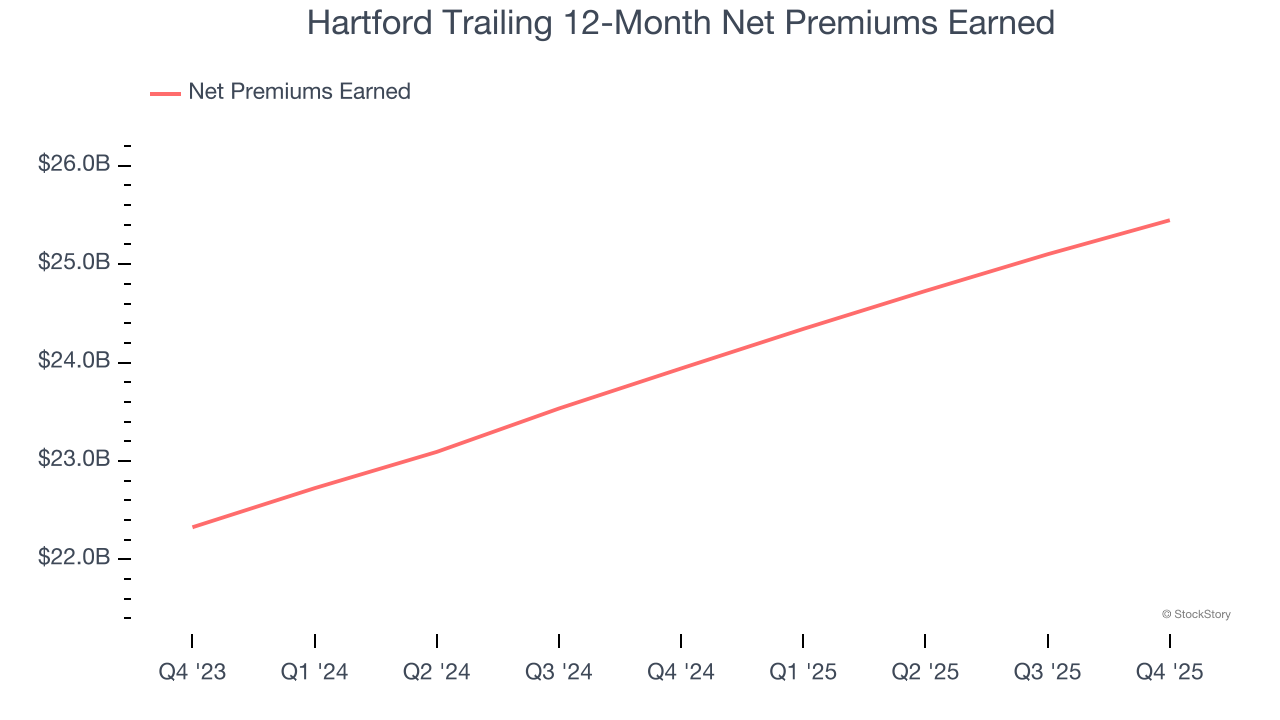

Insurers sell policies then use reinsurance (insurance for insurance companies) to protect themselves from large losses. Net premiums earned are therefore what's collected from selling policies less what’s paid to reinsurers as a risk mitigation tool.

Hartford’s net premiums earned has grown at a 6.5% annualized rate over the last five years, slightly worse than the broader insurance industry and in line with its total revenue.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Hartford’s revenue to drop by 13.7%, a decrease from its 7.5% annualized growth for the past two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

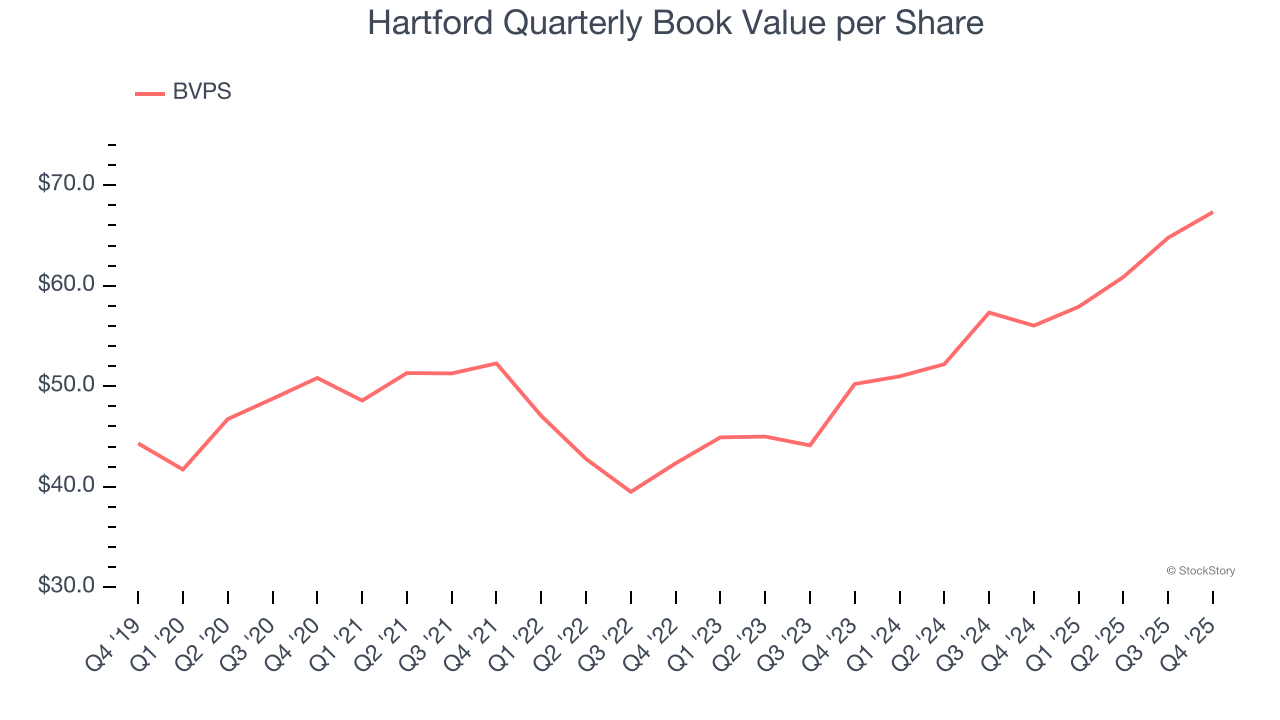

3. Steady Increase in BVPS Highlights Solid Asset Growth

We consider book value per share (BVPS) a critical metric for insurance companies. BVPS represents the total net worth per share, providing insight into a company’s financial strength and ability to meet policyholder obligations.

Although Hartford’s BVPS increased by a meager 5.8% annually over the last five years, the good news is that its growth has recently accelerated as BVPS grew at a solid 15.8% annual clip over the past two years (from $50.23 to $67.33 per share).

Final Judgment

Hartford isn’t a terrible business, but it isn’t one of our picks. That said, the stock currently trades at 1.9× forward P/B (or $142.15 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Like More Than Hartford

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.