Agricultural finance company Farmer Mac (NYSE: AGM) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 10.2% year on year to $107.9 million. Its non-GAAP profit of $3.66 per share was 19.1% below analysts’ consensus estimates.

Is now the time to buy Farmer Mac? Find out by accessing our full research report, it’s free.

Farmer Mac (AGM) Q4 CY2025 Highlights:

- Revenue: $107.9 million vs analyst estimates of $107.5 million (10.2% year-on-year growth, in line)

- Pre-tax Profit: $60.47 million (56% margin)

- Adjusted EPS: $3.66 vs analyst expectations of $4.53 (19.1% miss)

- Market Capitalization: $1.86 billion

"Farmer Mac delivered another strong year in 2025, highlighted by record net effective spread and outstanding business volumes, and our tenth consecutive year of record annual core earnings results," said Chief Executive Officer, Brad Nordholm.

Company Overview

Created by Congress in 1987 to build a bridge between Wall Street and rural America, Farmer Mac (NYSE: AGM) provides a secondary market for agricultural and rural loans, helping lenders increase their liquidity and lending capacity to serve rural America.

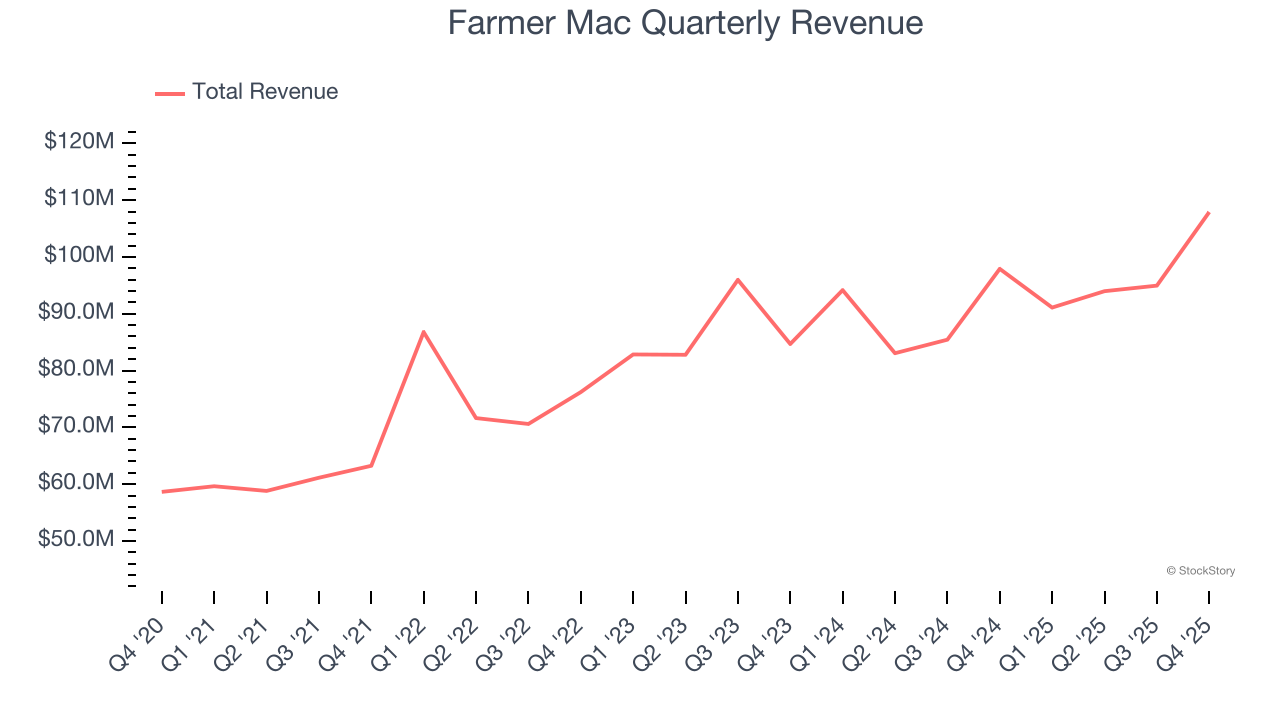

Revenue Growth

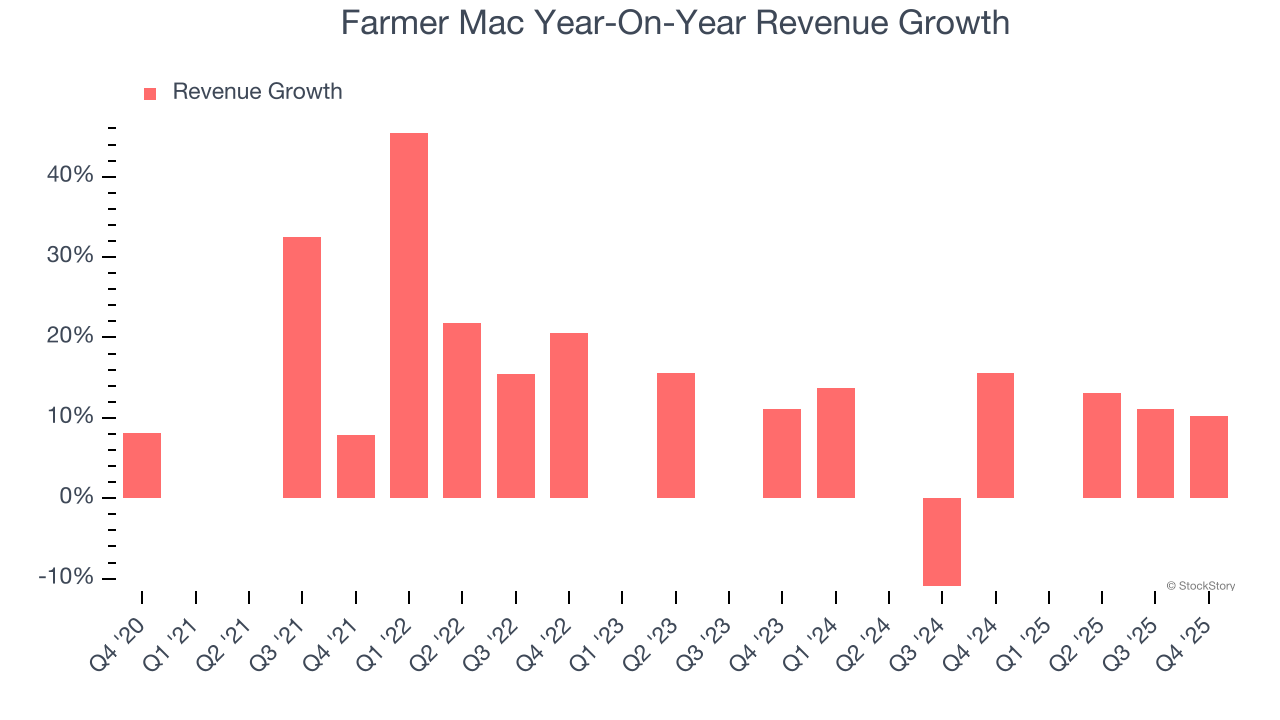

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Farmer Mac grew its revenue at an impressive 14.7% compounded annual growth rate. Its growth beat the average financials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Farmer Mac’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 5.8% over the last two years was well below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Farmer Mac’s year-on-year revenue growth was 10.2%, and its $107.9 million of revenue was in line with Wall Street’s estimates.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Key Takeaways from Farmer Mac’s Q4 Results

We struggled to find many positives in these results. Overall, this was a weaker quarter. The stock traded down 3.1% to $168.50 immediately after reporting.

Farmer Mac’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).