Real estate developer Howard Hughes Holdings (NYSE: HHH) reported Q4 CY2025 results exceeding the market’s revenue expectations, but sales fell by 36.5% year on year to $624.4 million. Its GAAP profit of $0.10 per share was 75.1% below analysts’ consensus estimates.

Is now the time to buy Howard Hughes Holdings? Find out by accessing our full research report, it’s free.

Howard Hughes Holdings (HHH) Q4 CY2025 Highlights:

- Revenue: $624.4 million vs analyst estimates of $592.1 million (36.5% year-on-year decline, 5.5% beat)

- EPS (GAAP): $0.10 vs analyst expectations of $0.40 (75.1% miss)

- Adjusted EBITDA: $75.68 million (12.1% margin, 75.5% year-on-year decline)

- Operating Margin: 4.2%, down from 26.5% in the same quarter last year

- Market Capitalization: $4.90 billion

“Howard Hughes Communities continues to be the nation’s leading real estate platform, with record NOI in 2025 demonstrating once again how exceptional quality drives premium land values and robust market demand across our communities,” said David R. O’Reilly, Chief Executive Officer of Howard Hughes.

Company Overview

Named after the eccentric business magnate and aviator whose legacy lives on in real estate development, Howard Hughes Holdings (NYSE: HHH) develops, owns, and manages master-planned communities and commercial properties across the United States.

Revenue Growth

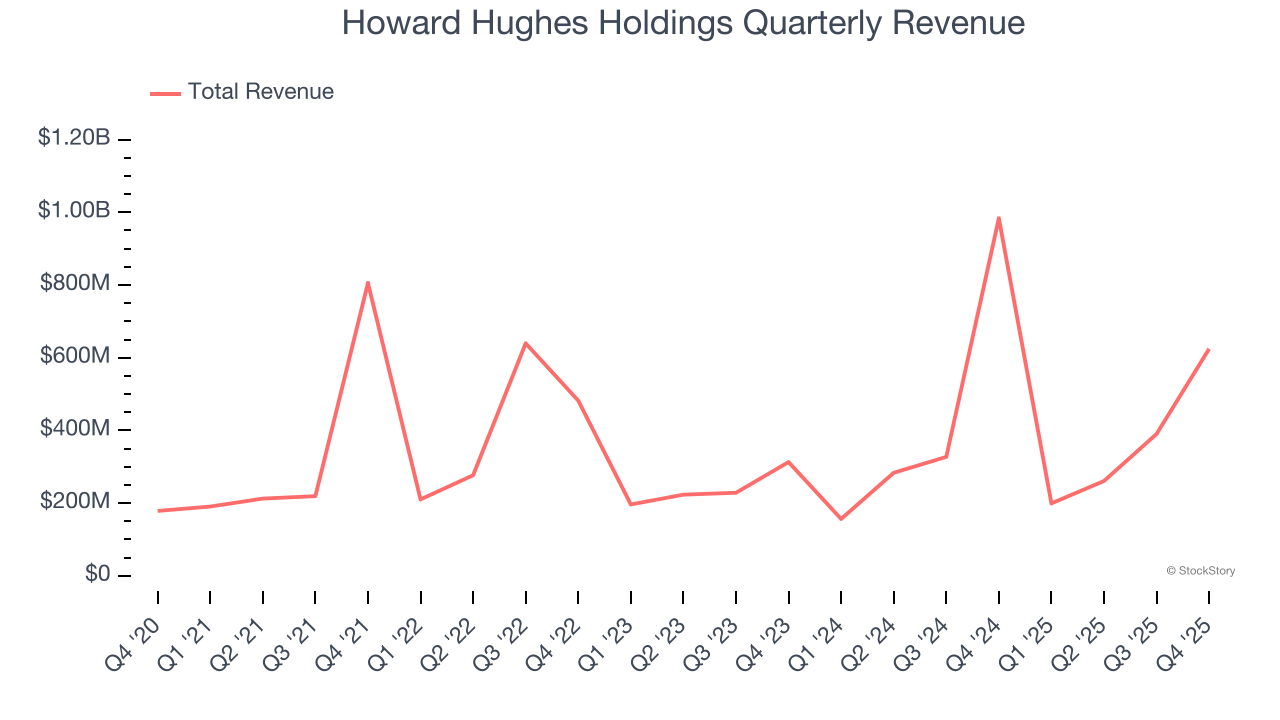

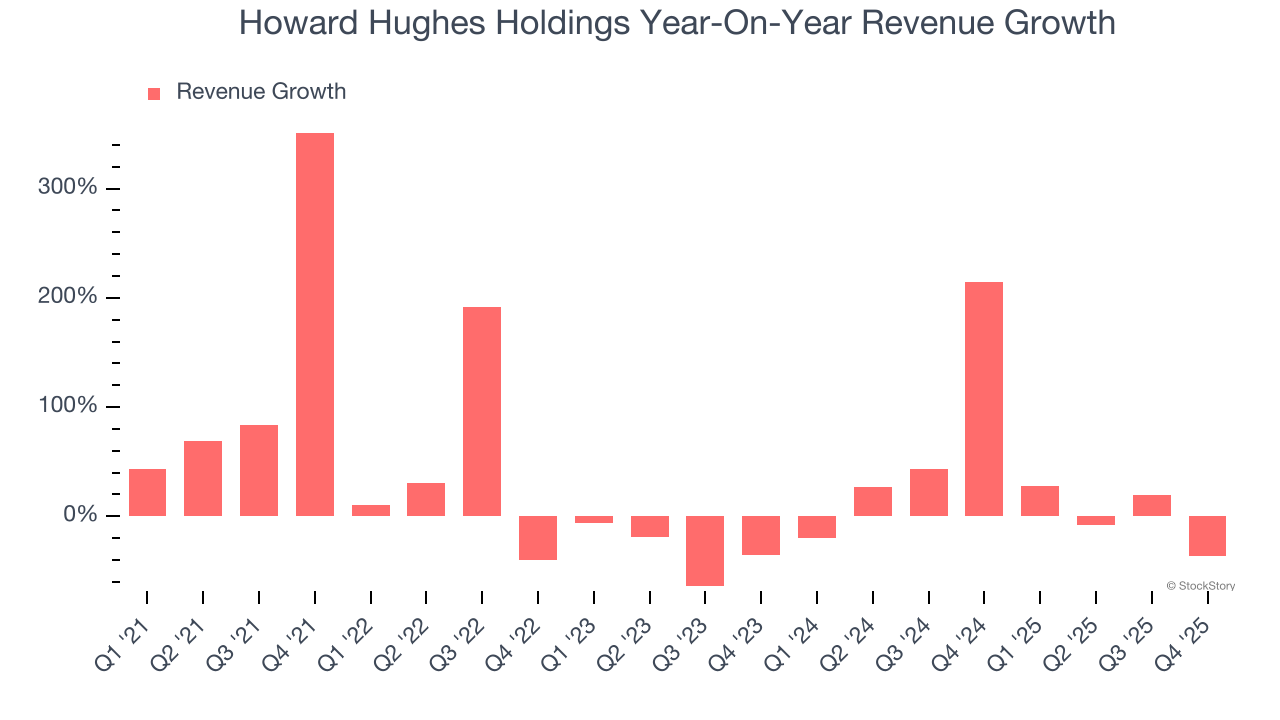

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Howard Hughes Holdings grew its sales at a 21.5% compounded annual growth rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the consumer discretionary sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Howard Hughes Holdings’s annualized revenue growth of 23.9% over the last two years is above its five-year trend, which is encouraging.

This quarter, Howard Hughes Holdings’s revenue fell by 36.5% year on year to $624.4 million but beat Wall Street’s estimates by 5.5%.

Looking ahead, sell-side analysts expect revenue to grow 18.5% over the next 12 months, a deceleration versus the last two years. Still, this projection is noteworthy and implies the market sees success for its products and services.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

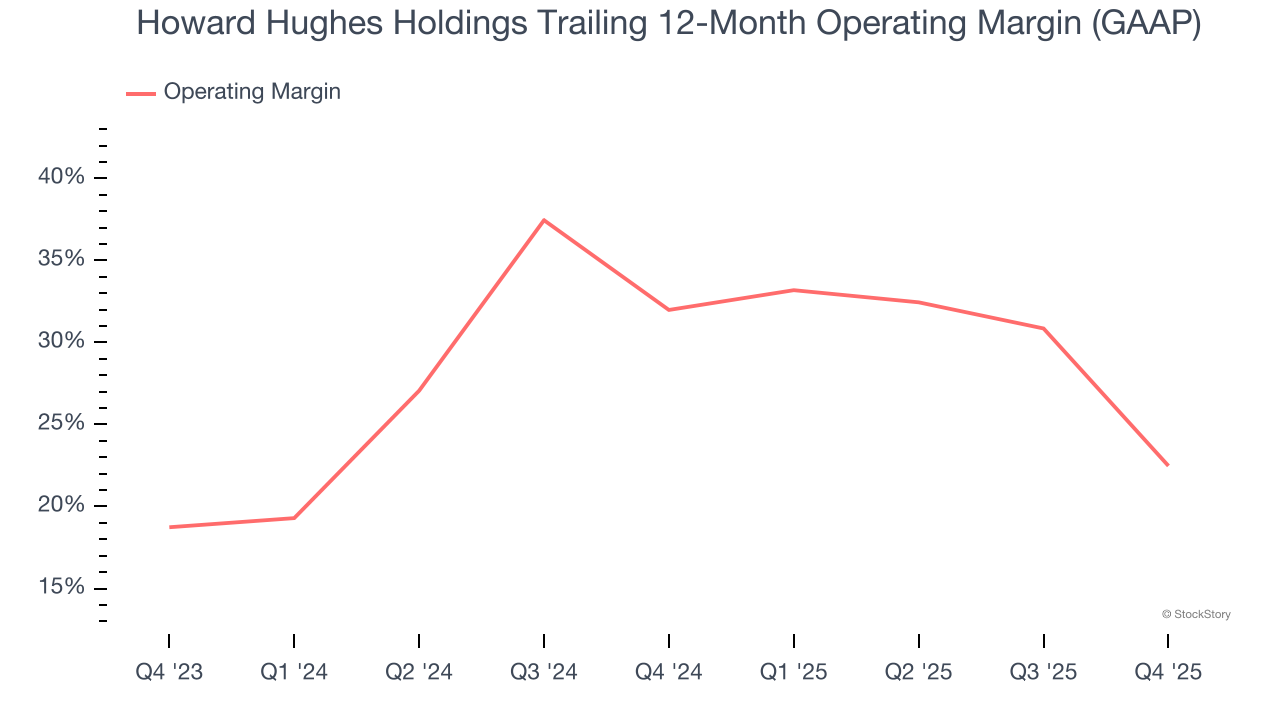

Howard Hughes Holdings’s operating margin has been trending down over the last 12 months and averaged 27.6% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Howard Hughes Holdings generated an operating margin profit margin of 4.2%, down 22.3 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

Earnings Per Share

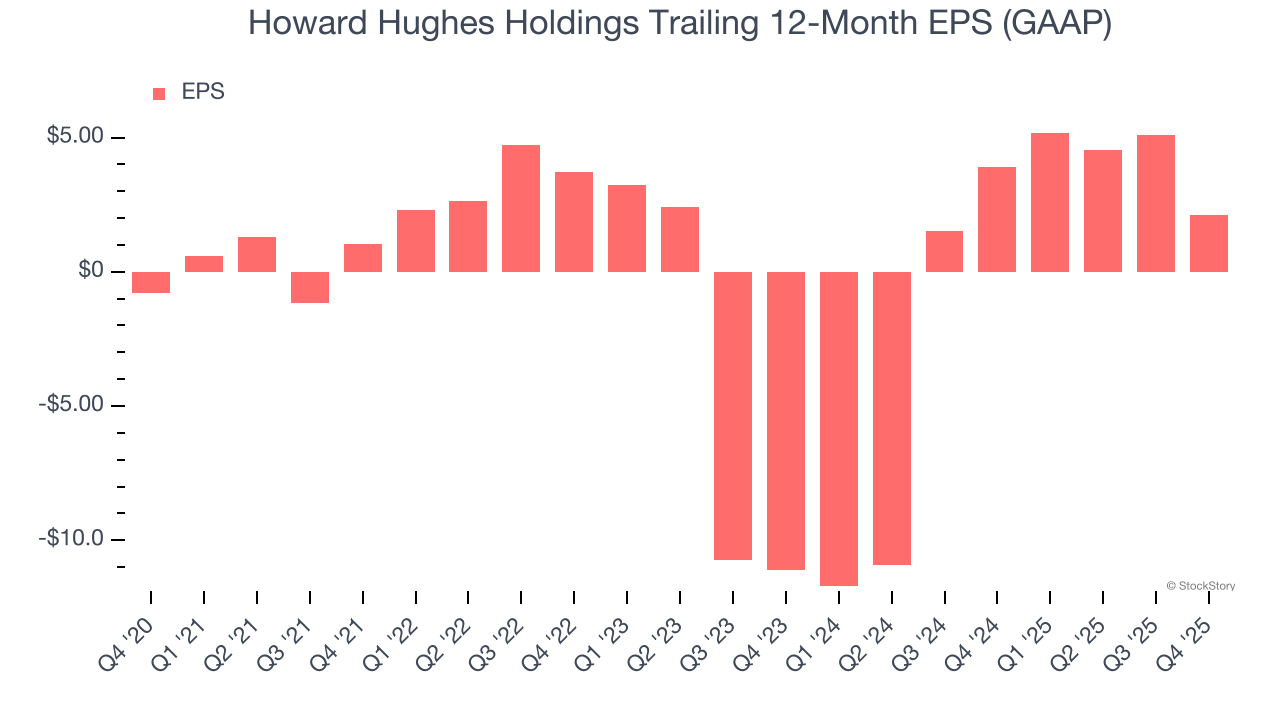

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Howard Hughes Holdings’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Howard Hughes Holdings reported EPS of $0.10, down from $3.10 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Howard Hughes Holdings’s full-year EPS of $2.11 to grow 88.2%.

Key Takeaways from Howard Hughes Holdings’s Q4 Results

We enjoyed seeing Howard Hughes Holdings beat analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Overall, this quarter could have been better. The stock remained flat at $81.49 immediately after reporting.

Howard Hughes Holdings may have had a tough quarter, but does that actually create an opportunity to invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).