Cloud communications provider RingCentral (NYSE: RNG) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 4.8% year on year to $644 million. The company expects next quarter’s revenue to be around $642.5 million, close to analysts’ estimates. Its non-GAAP profit of $1.18 per share was 4.1% above analysts’ consensus estimates.

Is now the time to buy RingCentral? Find out by accessing our full research report, it’s free.

RingCentral (RNG) Q4 CY2025 Highlights:

- Revenue: $644 million vs analyst estimates of $642.9 million (4.8% year-on-year growth, in line)

- Adjusted EPS: $1.18 vs analyst estimates of $1.13 (4.1% beat)

- Adjusted Operating Income: $146.7 million vs analyst estimates of $147.1 million (22.8% margin, in line)

- Revenue Guidance for Q1 CY2026 is $642.5 million at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for the upcoming financial year 2026 is $4.87 at the midpoint, beating analyst estimates by 2.1%

- Operating Margin: 6.6%, up from 2.5% in the same quarter last year

- Free Cash Flow Margin: 19.6%, similar to the previous quarter

- Market Capitalization: $2.53 billion

“We delivered a solid fourth quarter that capped a strong year of execution, highlighted by record free cash flow and FCF per share. AI is proving to be a strong tailwind, with ARR from customers who utilize at least one of our monetized AI products more than doubling year over year and now approaching 10% of our overall ARR,” said Vlad Shmunis, founder and CEO of RingCentral.

Company Overview

Built on its proprietary Message Video Phone (MVP) platform that unifies multiple communication methods, RingCentral (NYSE: RNG) provides AI-driven cloud communications and collaboration solutions that enable businesses to connect through voice, video, messaging, and contact center services.

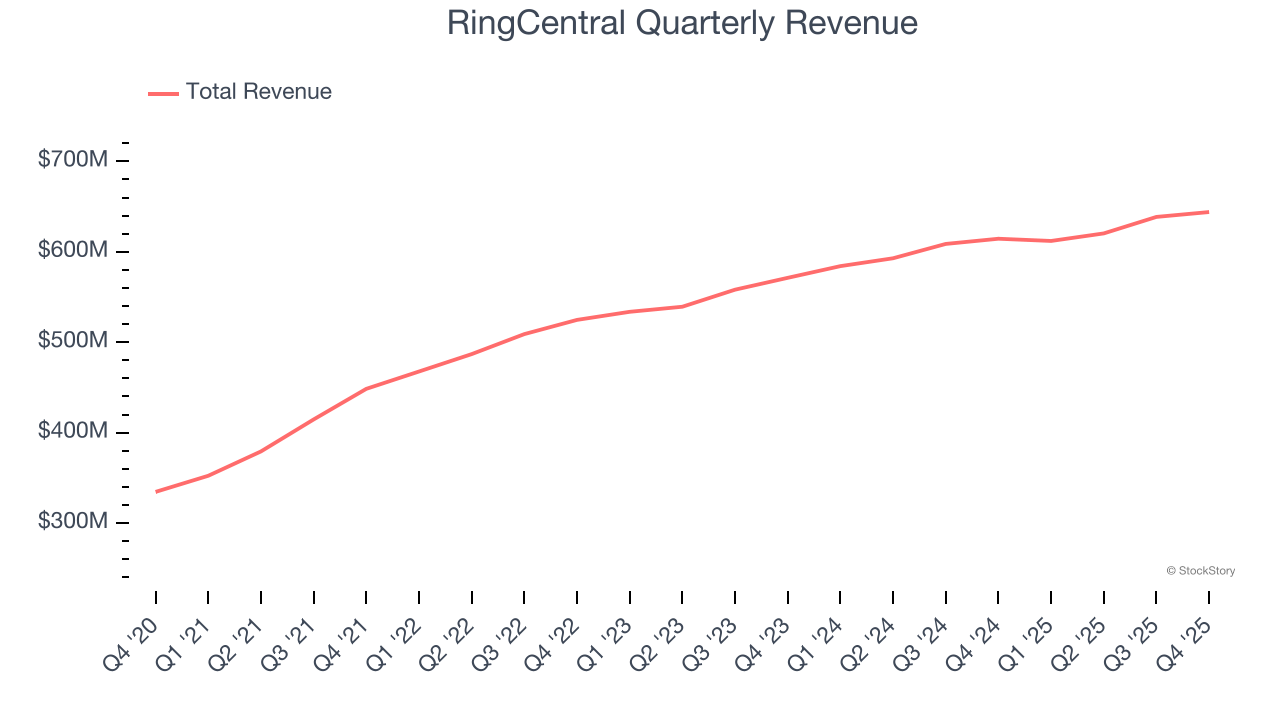

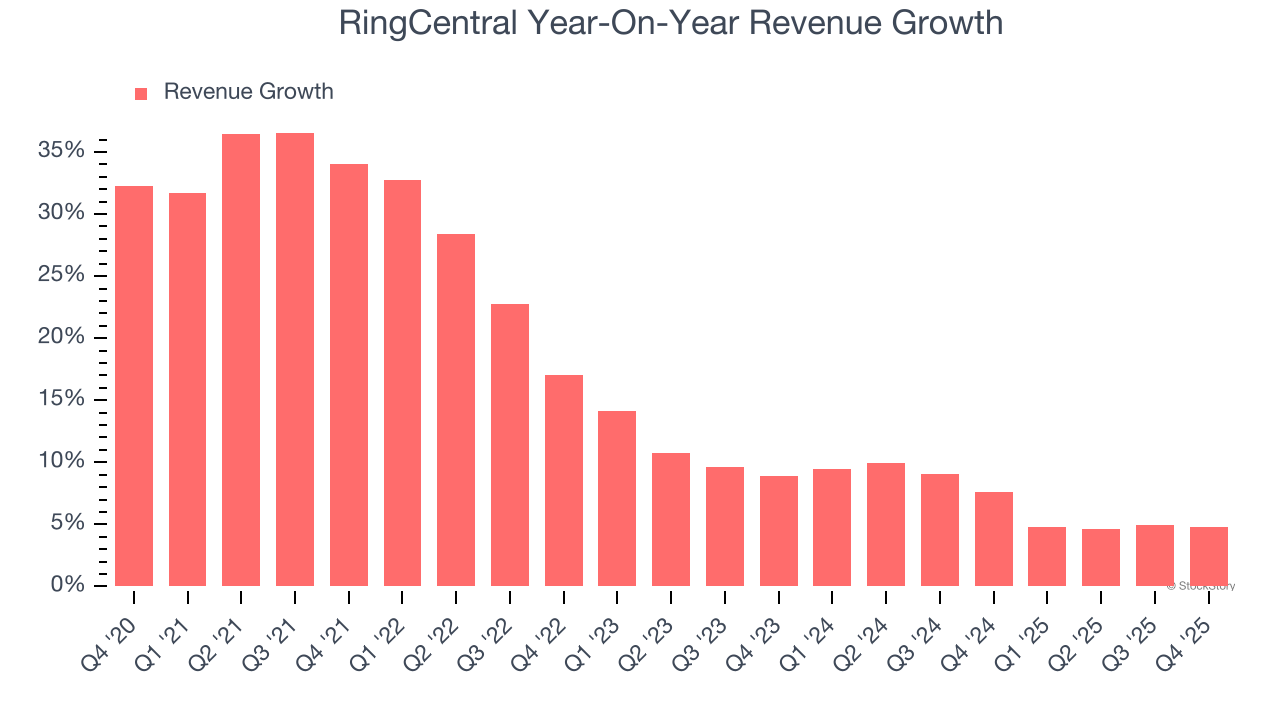

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, RingCentral grew its sales at a 16.3% compounded annual growth rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the software sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. RingCentral’s recent performance shows its demand has slowed as its annualized revenue growth of 6.9% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, RingCentral grew its revenue by 4.8% year on year, and its $644 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.1% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

RingCentral’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between RingCentral’s products and its peers.

Key Takeaways from RingCentral’s Q4 Results

We were impressed by RingCentral’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year EPS guidance exceeded Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 3.5% to $30.42 immediately after reporting.

Indeed, RingCentral had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).