Evergy Missouri West rates maintain price advantage compared with neighboring states

Evergy, Inc. (NASDAQ: EVRG) filed a request and supporting documentation with the Missouri Public Service Commission today to recover investments made in generation capacity and grid modernization for customers in its Evergy Missouri West service area.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240202673788/en/

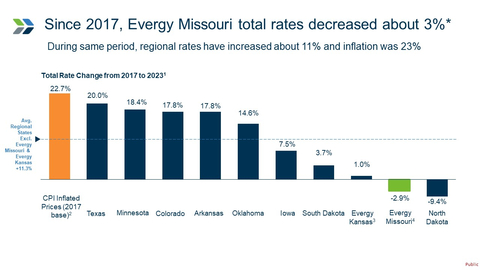

Evergy Missouri rates have decreased since 2017 while rates regionally have increased. See Evergy news release for data sources and graph footnote. (Graphic: Business Wire)

The Evergy Missouri West service area serves more than 340,000 customers and includes St. Joseph, Liberty, Platte City, Harrisonville, and Warrensburg, among other cities. The majority of the Kansas City Metropolitan region is not in the Missouri West service area. Most Kansas City Metropolitan customers are in the Missouri Metro service area. Evergy is not asking for any changes to base rates in its Missouri Metro service area.

As part of today’s filing, Evergy is requesting to increase base rates for Evergy Missouri West customers by about $104 million, or 13.42% percent, excluding fuel. The prices customers pay for electric service are calculated based on actual costs the company incurred and investments the company has made. To justify any price increase, Evergy must demonstrate that the costs were warranted and prudent. The request also includes a 0.57% increase to account for increased fuel costs. Evergy has not requested structural changes to the time-based rate plans that were implemented in 2023.

The filing today begins an 11-month process where regulators and interveners will review, audit and evaluate the request to ensure the resulting prices reflect the actual cost of serving Evergy Missouri West customers. The process will include public hearings later in the year, which are yet to be scheduled. If approved, new rates will become effective on January 1, 2025.

“We are investing strategically to ensure customers have reliable, affordable energy,” said Evergy President and Chief Executive Officer David Campbell. “Our focus continues to be on more efficiently running the business, which despite this period of record inflation has resulted in a reduced increase ask for our customers. While most area states have seen electricity costs increase about 11 percent over the past six years, Evergy’s prices have remained regionally competitive and even declined in some areas,” Campbell continued.

Evergy’s request includes the recovery of investments related to two natural gas plants to help ensure Evergy Missouri West has sufficient generation capacity for customers and to reduce Missouri West’s exposure to market price volatility for electricity purchased from the market. Evergy is also asking to recover investments in the electric grid to improve reliability and resiliency, as well as to recognize the end of a transmission-related credit that had been offsetting costs. Cost reductions, including pension and benefits savings, as well as growth in customer energy demand helped cut about $24.5 million from the request.

As part of this request, Evergy Missouri West has asked the commission to review a pending acquisition of 148 megawatts (or 22.2% interest) of Dogwood Energy Center, a 668 MW natural gas plant in Pleasant Hill, Mo., as a cost-effective resource to serve customers. Evergy Missouri West needs additional capacity and energy resources to meet growing customer demand for energy and reduce reliance on market-priced purchased power.

Crossroads Energy Center, a 300 megawatt natural gas plant in Clarksdale, Miss., serves customers in Evergy Missouri West today and helps ensure customers have the needed energy capacity for their growing energy needs. Evergy is asking to recover the transmission costs associated with the plant as it is a necessary resource. Without approval to recover these costs, the benefits of this capacity will be lost in 2029, requiring the company to find alternative and potentially more costly ways to provide 300 megawatts of generation capacity. In past studies, Crossroads has been identified as the most cost-efficient way to meet capacity requirements for Evergy Missouri West customers.

The request also includes recovery of investments made to upgrade and modernize the power grid. Evergy has replaced a large number of aging power poles, overhead power lines, and underground cables. Along with these projects, newly deployed automation technology communicates grid-health indicators back to Evergy. These new tools inform a predictive-maintenance program to reduce outages and, when outages occur, help to reduce outage length by isolating events and assisting in cause identification and restoration planning.

“Evergy West customers need additional generation to meet their growing demand for electricity. Our investment in the Dogwood Energy Center and transmission for the Crossroads power plant are a step in the right direction to ensure that our customers have affordable power well into the future,” said Campbell. “These generation investments, along with the improvements we have made to modernize and strengthen the electrical grid, will help ensure customers have electricity that continues to be reliable.”

*Evergy Missouri rates slide footnote information

1) Regional state data is sourced from EIA and is comprised of revenues and sales for all sectors, with 2023 data using a rolling twelve-month average of total revenues and sales ending November 2023. EIA data is preliminary that is subject to change, with 2023 data to be finalized in October 2024. 2) Source: US Bureau of Labor Statistics for historic CPI-U and uses rolling twelve-month average ending November 2023. 3) Evergy pro forma data uses rolling twelve-month average of total revenues and sales ending March 2023 and includes adjustments for the annualized impacts of: ACA/RECA (implemented April 1, 2023). TDC (implemented May 1, 2023); Kansas Income Tax reductions; and Property Tax Surcharge update; outcomes of rate case settlement in docket 23-EKCE-775-RTS. Evergy data is sourced from FERC Form 1 pg. 304 and general ledger and inclusive of customer bill credits. The corresponding change in total rates for Evergy KS Central and Evergy KS Metro were 4.9% and -9.5%, respectively 4) The corresponding change in total rates for Evergy MO Metro and Evergy MO West were -4.0% and 7.9%, respectively.

About Evergy

Evergy, Inc. (NASDAQ: EVRG), serves 1.7 million customers in Kansas and Missouri. Evergy’s mission is to empower a better future. Our focus remains on producing, transmitting and delivering reliable, affordable, and sustainable energy for the benefit of our stakeholders. Today, about half of Evergy’s power comes from carbon-free sources, creating more reliable energy with less impact to the environment. We value innovation and adaptability to give our customers better ways to manage their energy use, to create a safe, diverse and inclusive workplace for our employees, and to add value for our investors. Headquartered in Kansas City, our employees are active members of the communities we serve.

For more information about Evergy, visit us at www.evergy.com.

Cautionary statements regarding certain forward-looking information

Statements made in this document that are not based on historical facts are forward-looking, may involve risks and uncertainties, and are intended to be as of the date when made. Forward-looking statements include, but are not limited to, statements relating to Evergy's strategic plan, including, without limitation, those related to earnings per share, dividend, operating and maintenance expense and capital investment goals; the outcome of legislative efforts and regulatory and legal proceedings; future energy demand; future power prices; plans with respect to existing and potential future generation resources; the availability and cost of generation resources and energy storage; target emissions reductions; and other matters relating to expected financial performance or affecting future operations. Forward-looking statements are often accompanied by forward-looking words such as "anticipates," "believes," "expects," "estimates," "forecasts," "should," "could," "may," "seeks," "intends," "proposed," "projects," "planned," "target," "outlook," "remain confident," "goal," "will" or other words of similar meaning. Forward-looking statements involve risks, uncertainties and other factors that could cause actual results to differ materially from the forward-looking information.

In connection with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Evergy, Inc., Evergy Kansas Central, Inc. and Evergy Metro, Inc. (collectively the Evergy Companies) are providing a number of risks, uncertainties and other factors that could cause actual results to differ from the forward-looking information. These risks, uncertainties and other factors include, but are not limited to: economic and weather conditions and any impact on sales, prices and costs; changes in business strategy or operations; the impact of federal, state and local political, legislative, judicial and regulatory actions or developments, including deregulation, re-regulation, securitization and restructuring of the electric utility industry; decisions of regulators regarding, among other things, customer rates and the prudency of operational decisions such as capital expenditures and asset retirements; changes in applicable laws, regulations, rules, principles or practices, or the interpretations thereof, governing tax, accounting and environmental matters, including air and water quality and waste management and disposal; the impact of climate change, including increased frequency and severity of significant weather events and the extent to which counterparties are willing to do business with, finance the operations of or purchase energy from the Evergy Companies due to the fact that the Evergy Companies operate coal-fired generation; prices and availability of electricity and natural gas in wholesale markets; market perception of the energy industry and the Evergy Companies; the impact of future Coronavirus (COVID-19) variants on, among other things, sales, results of operations, financial condition, liquidity and cash flows, and also on operational issues, such as supply chain issues and the availability and ability of the Evergy Companies' employees and suppliers to perform the functions that are necessary to operate the Evergy Companies; changes in the energy trading markets in which the Evergy Companies participate, including retroactive repricing of transactions by regional transmission organizations (RTO) and independent system operators; financial market conditions and performance, disruptions in the banking industry, including changes in interest rates and credit spreads and in availability and cost of capital and the effects on derivatives and hedges, nuclear decommissioning trust and pension plan assets and costs; impairments of long-lived assets or goodwill; credit ratings; inflation rates; effectiveness of risk management policies and procedures and the ability of counterparties to satisfy their contractual commitments; impact of physical and cybersecurity breaches, criminal activity, terrorist attacks, acts of war and other disruptions to the Evergy Companies' facilities or information technology infrastructure or the facilities and infrastructure of third-party service providers on which the Evergy Companies rely; impact of the Ukrainian and Middle East conflicts on the global energy market; ability to carry out marketing and sales plans; cost, availability, quality and timely provision of equipment, supplies, labor and fuel; ability to achieve generation goals and the occurrence and duration of planned and unplanned generation outages; delays and cost increases of generation, transmission, distribution or other projects; the Evergy Companies' ability to manage their transmission and distribution development plans and transmission joint ventures; the inherent risks associated with the ownership and operation of a nuclear facility, including environmental, health, safety, regulatory and financial risks; workforce risks, including those related to the Evergy Companies' ability to attract and retain qualified personnel, maintain satisfactory relationships with their labor unions and manage costs of, or changes in, wages, retirement, health care and other benefits; disruption, costs and uncertainties caused by or related to the actions of individuals or entities, such as activist shareholders or special interest groups, that seek to influence Evergy's strategic plan, financial results or operations; the impact of changing expectations and demands of the Evergy Companies' customers, regulators, investors and stakeholders, including heightened emphasis on environmental, social and governance concerns; the possibility that strategic initiatives, including mergers, acquisitions and divestitures, and long-term financial plans, may not create the value that they are expected to achieve in a timely manner or at all; difficulties in maintaining relationships with customers, employees, regulators or suppliers; and other risks and uncertainties.

This list of factors is not all-inclusive because it is not possible to predict all factors. You should also carefully consider the information contained in the Evergy Companies' other filings with the Securities and Exchange Commission (SEC). Additional risks and uncertainties are discussed from time to time in current, quarterly and annual reports filed by the Evergy Companies with the SEC. New factors emerge from time to time, and it's not possible for the Evergy Companies to predict all such factors, nor can the Evergy Companies assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained or implied in any forward-looking statement. Given these uncertainties, undue reliance should not be placed on these forward-looking statements. The Evergy Companies undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

Available Information

The SEC maintains an internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at sec.gov. Additionally, information about the Evergy Companies, including their combined annual reports on Form 10-K, combined quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed with the SEC, is also available through the Evergy Companies' website, http://investors.evergy.com. Such reports are accessible at no charge and are made available as soon as reasonably practical after such material is filed with or furnished to the SEC.

Investors should note that the Evergy Companies announce material financial information in SEC filings, press releases and public conference calls. In accordance with SEC guidelines, the Evergy Companies also use the Investor Relations section of their website, http://investors.evergy.com, to communicate with investors. It is possible that the financial and other information posted there could be deemed to be material information. The information on the Evergy Companies' website is not part of this document.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240202673788/en/

Contacts

Media Contact:

Gina Penzig

Director, Corporate Communications

Phone: 785-508-2410

Gina.Penzig@evergy.com

Media line: 888-613-0003

Courtney Lewis

Sr. Communications Manager, Media

Phone: 816-878-9650

Courtney.Lewis@evergy.com

Media line: 888-613-0003

Investor Contact:

Pete Flynn

Director, Investor Relations

Phone: 816-652-1060

Peter.Flynn@evergy.com