New Found Gold Corp. (“New Found” or the “Company”) (TSX-V: NFG, NYSE-A: NFGC) is pleased to announce that it has entered into three royalty purchase agreements (the “Royalty Purchase Agreements”) with arm’s length royalty holders (together, the “Vendors” and each, a “Vendor”), whereby New Found will purchase part of each Vendor’s royalty interest.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240730895545/en/

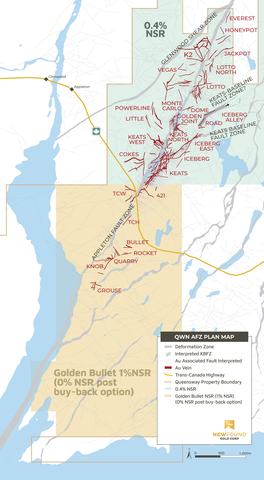

Figure 1. Queensway North plan map including location of Golden Bullet royalty. (Graphic: Business Wire)

Highlights:

- Pursuant to the Royalty Purchase Agreements, the Company will purchase, in aggregate, 0.6% of the Vendors’ 1.6% net smelter returns royalty on the Company’s Golden Bullet property (the “Royalty Interests”). New Found granted the Vendors the Royalty Interests under a Mining Option Agreement dated as of November 11, 2016 (the “Original Agreement”).

- Under the terms of the Royalty Purchase Agreements, as consideration for the Royalty Interests, New Found will pay $650,000 cash consideration and issue 100,000 common shares in the capital of the Company (the “Common Shares”) to each Vendor, for an aggregate cash consideration of $1,950,000 and aggregate share consideration of 300,000 Common Shares.

- The Company has the right to purchase the remaining 1% net smelter returns royalty from the Vendors for an aggregate price equal to $1,000,000 (the “Repurchase Price”) by November 12, 2024, payable by (i) an aggregate of $100,000 and (ii) an additional $4,950, in the aggregate, per year until the Repurchase Price has been satisfied.

- The Golden Bullet property covers a key target area on the Company’s Queensway Project including the extension of Keats South, as well as the TCH, Knob, Bullet, Rocket, and Quarry zones, (Figure 1).

- This is the second such royalty purchase completed by New Found. In November of 2021, New Found acquired a 0.6% royalty underlying its Keats-Golden Joint-Lotto-Iceberg discovery area, leaving a minimal 0.4% royalty burden.

Greg Matheson, COO of New Found, stated: “Following this transaction, all significant mineralized zones along the Appleton Fault Zone will be covered by a minimal royalty burden. As shown in Figure 1 below, at Golden Bullet, we have the opportunity to remove all royalties by exercising our right to buy back the remaining 1% NSR. Golden Bullet encompasses the recent discovery of deep mineralization at Keats South, as well as several other notable zones along a 5km segment of the Appleton Fault. Immediately to the north, there is a small 0.4% royalty covering our remaining significant zones including Keats, Iceberg, Lotto, and Golden Joint. Too often mineral projects suffer from high royalty burdens, which can have significant negative effects on their future potential. Through careful consideration and working closely with the original optionors, we have avoided this potential pitfall and feel we are in a strong position to maximize the future potential of Queensway.”

The Royalty Purchase Agreements are subject to the satisfaction of customary closing conditions, including TSX Venture Exchange and NYSE-American approval.

All securities issued pursuant to the Royalty Purchase Agreements will be subject to a hold period under applicable Canadian securities laws, which will expire four months plus one day from the date of closing of the Royalty Purchase Agreements.

The securities to be issued under the Royalty Purchase Agreements have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the U.S. Securities Act. This news release does not constitute an offer to sell or a solicitation of an offer to buy any of New Found’s securities in the United States.

About New Found Gold Corp.

New Found holds a 100% interest in the Queensway Project, located 15km west of Gander, Newfoundland and Labrador, and just 18km from Gander International Airport. The project is intersected by the Trans-Canada Highway and has logging roads crosscutting the project, high voltage electric power lines running through the project area, and easy access to a highly skilled workforce. The Company is currently undertaking a 650,000m drill program at Queensway and is well funded for this program with cash and marketable securities of approximately $54 million as of July 2024.

Please see the Company’s website at www.newfoundgold.ca and the Company’s SEDAR+ profile at www.sedarplus.ca.

Acknowledgements

New Found acknowledges the financial support of the Junior Exploration Assistance Program, Department of Natural Resources, Government of Newfoundland and Labrador.

Contact

To contact the Company, please visit the Company’s website, www.newfoundgold.ca and make your request through our investor inquiry form. Our management has a pledge to be in touch with any investor inquiries within 24 hours.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statement Cautions

This press release contains certain “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of applicable Canadian securities legislation and the United States securities legislation, relating to the Royalty Purchase Agreements, repurchase of the remaining net smelter royalty from the Vendors, remaining royalty burdens, including the effects on future potential of the Queensway project, TSX Venture Exchange and NYSE American acceptance of the Royalty Purchase Agreements and the timing for closing of the Royalty Purchase Agreements, drilling and mineralization discoveries on the Queensway gold project and funding of the drill program. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts; they are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “aims”, “suggests”, “potential”, “goal”, “objective”, “prospective”, “possibly”, and similar expressions, or that events or conditions “will”, “would”, “may”, “can”, “could” or “should” occur, or are those statements, which, by their nature, refer to future events. The Company cautions that forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made, and they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange or the NYSE American, the Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include risks associated with the Company’s ability to satisfy the conditions to close the Royalty Purchase Agreements, including the Company’s ability to obtain the TSX Venture Exchange and NYSE American approval, possible accidents and other risks associated with mineral exploration operations, the risk that the Company will encounter unanticipated geological factors, the possibility that the Company may not be able to secure permitting and other governmental clearances necessary to carry out the Company's exploration plans, the risk that the Company will not be able to raise sufficient funds to carry out its business plans, and the risk of political uncertainties and regulatory or legal changes that might interfere with the Company's business and prospects. The reader is urged to refer to the Company’s Annual Information Form and Management’s discussion and Analysis, publicly available through the Canadian Securities Administrators’ System for Electronic Document Analysis and Retrieval (SEDAR+) at www.sedarplus.ca for a more complete discussion of such risk factors and their potential effects.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240730895545/en/

Contacts

New Found Gold Corp.

Per: “Collin Kettell”

Collin Kettell, Chief Executive Officer

Email: ckettell@newfoundgold.ca

Phone: +1 (845) 535-1486