Diamond drilling has commenced at the Majorodam project in Suriname, and at the Tamakay project in Guyana. At Majorodam, recent channel sampling along a roadcut that lies between two drill target areas exposed a mineralized quartz vein grading 18 m @ 6.39 g/t Au.

Further soil grid geochemical results from the Igab project in Suriname have added to the definition of multiple targets in the northern half of the land package. A drone magnetics survey is underway, and drilling is expected to commence in the fourth quarter.

Appointment of Timothy (Tim) Stubley as Senior Manager, Exploration. Tim will oversee the Company's activities across the Guiana Shield and brings over 15 years of mineral exploration experience to the team.

Longueuil, Québec--(Newsfile Corp. - September 2, 2025) - Greenheart Gold Inc. (TSXV: GHRT) (OTCQX: GHRTF) (the "Company" or "Greenheart Gold") is pleased to announce that it currently has drill programs underway at both its Majorodam (Suriname) and Tamakay (Guyana) projects. In addition, the Company wishes to provide a general update on exploration progress on the portfolio of projects held in both Suriname and Guyana. This includes noteworthy trench results from Majorodam, and the addition of experienced senior management through the appointment of Tim Stubley as Senior Manager, Exploration.

Majorodam Project (Suriname)

The Company has commenced drilling at the Heuvel Prospect on the Majorodam project, collaring the first ever diamond drill hole on the project, on August 15, 2025. Drilling continues to progress well, with three holes totalling 610 meters (m) completed to date. This Phase 2 drill program of 2,500 m aims to follow up and expand on the reverse circulation (RC) drill results announced previously on May 7, 2025.

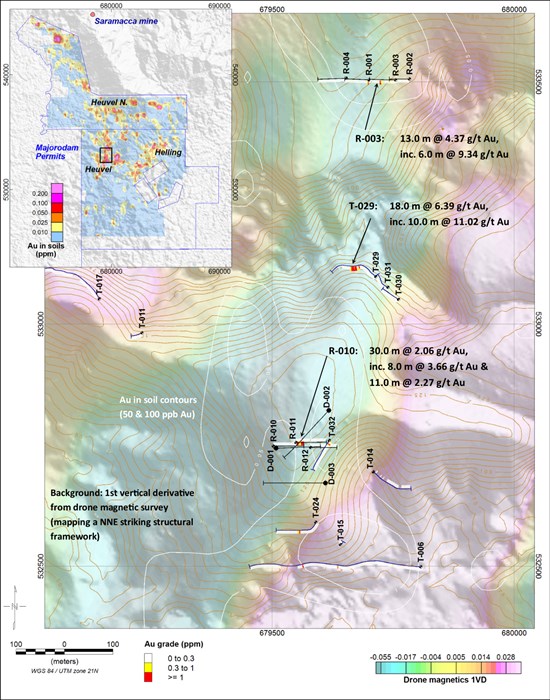

In addition to the commencement of drilling, and as shown in Figure 1, the Company has continued with the construction of new roads that provide access to possible drill sites and create geological exposure for mapping and sampling. One roadcut that sits approximately mid-way between two previously drilled RC target areas at Heuvel, returned with a significant interval of 18.0 m @ 6.39 grams per tonne of gold (g/t Au), which includes a high-grade quartz vein (sub-vertical, striking NNE) which assayed 4.0 m @ 24.07 g/t Au. This is a noteworthy result as the roadcut provides the only exposure bisecting an 800 m trend between the previously announced results within RC holes MAJR25-003 (6.0 m @ 9.34 g/t Au) and MAJR25-010 (30.0 m @ 2.06 g/t Au). As Figure 1 shows, the two RC holes and this new trench appear to be coincident with local magnetic lineations.

The Company has also recently completed a high-resolution low-altitude 50 m line spacing drone magnetics survey over the Heuvel drill targets. This survey has added significant detail to the fixed wing magnetics survey (high-altitude, 150 m line spacing) previously flown by the titleholder. This survey is currently being processed and incorporated into a geological framework supported by drill and trench logging and results.

Outside of the Heuvel prospect, the Company continues to follow up with trench and channel sampling on the Helling prospect, which represents the 5-km long soil anomaly on the eastern half of the project. Infill soils, mapping and sampling are also underway on Heuvel North prospect where the gold-in-soil anomaly continues onto the Majorodam North project (Figure 1).

Tamakay Project (Guyana)

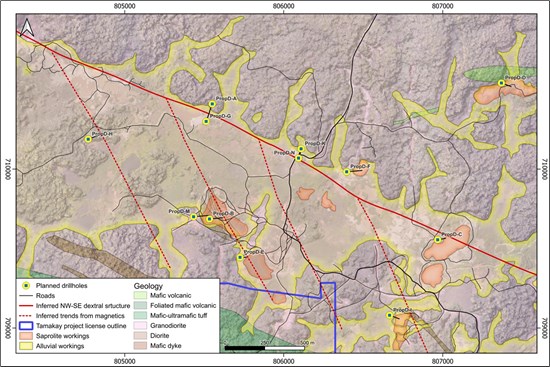

An initial 1,200 m Phase 1 diamond drill program commenced at Tamakay in mid-August 2025. This program is designed to follow up several known gold bearing quartz vein occurrences at Tamakay that were uncovered by previous artisanal mining activities and confirmed by the Company's exploration programs to date (Figure 2). Drilling is designed to test the down dip continuity of gold bearing quartz veins that have been previously mined, as well as test for possible stacked veins, zones of mineralization within the granitic wall rock, and test a shear zone that underlies numerous historical small scale mining pits where no outcrop is available for sampling. This shear zone target is also identified by a combination of ground magnetic and induced polarization geophysical surveys.

Igab Project (Suriname)

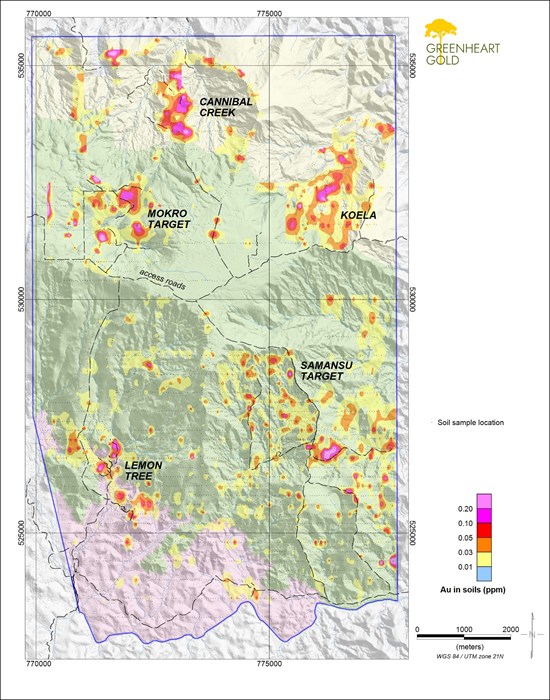

Early results from the Igab project had produced numerous gold-in-soil anomalies from ridge and spur sampling at the +100 ppb Au threshold (a threshold that the Company sees as significant based on prior Guiana Shield exploration experience). Grid soil sampling at a 400 m line spacing, with infill to 200 m, has continued on the project, and further refined these early results into five distinct prospects as shown on Figure 3: Lemon Tree, Samansu, Morko, Koela and Cannibal Creek.

At Lemon Tree, where a channel sample (previously reported on February 10, 2025) of a sheared and altered granite outcrop returned 31.0 m @ 1.36 g/t Au, the Company continues its trenching, mapping and sampling programs to better define the structure and orientation of this target prior to planned drill testing. More recently, the Company has uncovered a further 50 m of this altered outcrop to the northeast and is currently awaiting results from additional channel samples. The Company anticipates that it will begin drilling this target, as well as an area of known gold bearing quartz veins that lie approximately 500 m north of Lemon Tree, in the fourth quarter of 2025.

At the Mokro, Cannibal Creek and Koela targets in the northern half of the property, infill soil sampling programs are underway and the recent addition of an excavator and bulldozer to the project is allowing for more direct access as well as exposing outcrop for sampling and mapping. The Company has now commenced a drone magnetics survey which is expected to complete within the coming month. This will significantly assist in the geological and structural interpretation across the project.

Igab Option Agreement

The definitive option agreement for the Igab project (the "IGAB Option Agreement") was signed on September 1, 2025, between the Company and IGAB N.V. ("IGAB"), the titleholder of the project's mineral right, under terms agreed under the September 2024 Heads of Agreement. General terms of this four-year option agreement include making option payments totaling US$3,400,000, with the initial option payment of US$400,000 payable no later than the 1st anniversary of the IGAB Option Agreement, US$1,000,000 payable no later than the 2nd anniversary of the IGAB Option Agreement and US$2,000,000 payable no later than the 3rd anniversary of the IGAB Option Agreement, as well as other contingent considerations based on future gold reserves and production. The IGAB Option Agreement can be terminated by the Company upon providing a 30-day prior written notice to IGAB without further financial obligations.

Greenheart Gold Strengthens its Exploration Team

Greenheart Gold is pleased to announce the appointment of Tim Stubley as Senior Manager, Exploration. Tim brings over 15 years of experience in mineral exploration across a range of deposit types and locations, with a particular focus on orogenic gold deposits. Prior to joining Greenheart Gold, Tim served as Principal Geologist and Project Manager for the Kerr-Addison project in Ontario, where he was responsible for the planning and execution of a 150 km resource drill program.

Greenheart Gold CEO, Justin van der Toorn, commented, "We are very pleased to welcome Tim to Greenheart Gold where he will be overseeing the Company's operations across our exploration projects in Suriname and Guyana. As we see continued positive results across the portfolio, we feel that Tim's experience is an ideal addition to our existing team as we continue to fulfil our commitment to both a systematic and a technically driven exploration approach."

Sample Collection, Assaying and Data Management

Significant intervals in this press release have been calculated using a grade cut-off of 0.3 g/t Au, a minimum length of 5 m, and a maximum length of 5 m of consecutive internal waste. Included significant intervals have been calculated using a grade cut-off of 1.0 g/t Au, a minimum length of 3 m, and a maximum length of 2 m of consecutive internal waste. Gold grades are uncapped. Mineralized intersection lengths are not necessarily true widths. RC drill samples are weighed in their entirety at the rig side to ensure consistent sample collection, then split, bagged, and tagged. All samples are shipped to the Actlabs preparation laboratory in Paramaribo, Suriname while respecting best-practice chain of custody procedures. At the preparation laboratory, samples are dried, crushed to 80% passing 2 mm, riffle split (to 250 g), and pulverized to 95% passing 105 μm. Coarse blanks are inserted by the Company, and are used between and following suspected high-grade intervals. Barren sand flushes are inserted by the analytical laboratory after each sample is pulverized to clean the bowl. Pulverized samples are transported for analysis to the Actlabs laboratory in Georgetown, Guyana (an ISO 9001 certified laboratory) where gold assay is carried out using a 30 g or 50 g fire assay with an atomic absorption finish. Initial assays with results above 3.0 g/t Au are re-assayed with a gravimetric finish. Certified reference materials and blanks are inserted at a rate of 5% of samples shipped to the laboratories. RC field duplicates pulp duplicates are also generated at a rate of 5% of samples. Assay data is subject to QA/QC prior to accepting into the Company database managed by an independent consultant.

Qualified Person

All scientific and technical information in this press release has been reviewed and approved by Justin van der Toorn, CGeol FGS, EurGeol, President and CEO of Greenheart Gold, and a Qualified Person under Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Greenheart Gold Inc.

Greenheart Gold is an exploration company that builds on a proven legacy of discoveries within the Guiana Shield, a highly prospective geological terrain that hosts numerous gold deposits yet remains relatively under-explored. The Company is led by former executives and members of the exploration group of Reunion Gold, a team that was most recently noted for the discovery and delineation of the multimillion-ounce Oko West deposit in Guyana. Greenheart Gold intends to build on its technical knowledge, strong contact base and previous success from exploring in the Guiana Shield to assemble, maintain and explore a portfolio of early-stage exploration projects in Guyana and Suriname that are prospective for orogenic gold deposits.

Additional information about the Company is available on SEDAR+ (www.sedarplus.ca) and the Company's website (www.greenheartgold.com).

For further information, please contact:

GREENHEART GOLD INC.

Justin van der Toorn, President and CEO, or

Doug Flegg CFA, Senior Vice President Corporate Development

E: d.flegg@greenheartgold.com

E: info@greenheartgold.com

Telephone: +1 450-800-2882

Cautionary Statement on Forward-Looking Information

All statements, other than statements of historical fact, contained in this press release constitute "forward-looking information" and "forward-looking statements" within the meaning of certain securities laws and are based on expectations and projections as of the date of this press release. Forward-looking statements contained in this press release include, without limitation, those related to the Company's plans and objectives, the timing of and execution of planned exploration activities, geological interpretation, potential favorable setting and mineralization, other statements relating to the business prospects of Greenheart Gold and, more generally, the section entitled "About Greenheart Gold Inc."

Forward-looking statements are based on beliefs, expectations, estimates and projections as of the time of this press release. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the Company as of the time of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. These estimates and assumptions may prove to be incorrect. Such assumptions include, without limitation, those underlying the statements in the section entitled "About Greenheart Gold Inc."

Many of these uncertainties and contingencies can directly or indirectly affect, and could cause, actual results to differ materially from those expressed or implied in any forward-looking statements. By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific in nature, including among others, those risks and uncertainties set forth in the Company's audited consolidated financial statements and related notes for the initial period from April 19, 2024 to December 31, 2024 and the associated management's discussion & analysis, and other documents and reports filed by the Company with Canadian securities regulators available under the Company's profile on SEDAR+ at www.sedarplus.ca, and the risk that estimates, forecasts, projections and other forward-looking statements will not be achieved or that assumptions do not reflect future outcomes. Forward-looking statements are provided for the purpose of providing information about management's expectations and plans relating to the future. Readers are cautioned not to place undue reliance on these forward-looking statements as a number of important risk factors and future events could cause the actual outcomes to differ materially from the beliefs, plans, objectives, expectations, anticipations, estimates, assumptions and intentions expressed in such forward-looking statements. The Company cautions that the list of factors set forth in the Company's filings that may affect future results is not exhaustive, and new, unforeseeable risks may arise from time to time. The Company disclaims any intention or obligation to update or revise any forward-looking statements or to explain any material difference between subsequent actual events and such forward-looking statements, except to the extent required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Figure 1 - Overview of RC drill and trench traces, with results received, on the Heuvel Prospect, with drone magnetics as background. Inset map shows soil results received to date and the location of the property in relation to the Saramacca mine, 12 km north of Heuvel. Diamond drill holes are labeled as D-###, RC drill holes as R-###, and Trench/Channels as T-###. Significant intervals shown have been calculated using a grade cut-off of 0.3 g/t Au, a minimum length of 5 m, and a maximum length of 5 m of consecutive internal waste. Included significant intervals have been calculated using a grade cut-off of 1.0 g/t Au, a minimum length of 3 m, and a maximum length of 2 m of consecutive internal waste.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11642/264886_29570cc7e434fa46_002full.jpg

Figure 2 - Location of planned drill holes at the Tamakay project, overlain on geology showing the extent of alluvial and small-scale mining activities. Current drilling is labeled as TAMD25-001 & 002. Small pits (transparent red) are labeled with the names ascribed to them by the local pork-knockers.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11642/264886_29570cc7e434fa46_003full.jpg

Figure 3 - Geological map of the Igab project, showing named prospects based on results received to date from grid soil sampling.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11642/264886_29570cc7e434fa46_004full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/264886