Shareholders of LGI Homes would probably like to forget the past six months even happened. The stock dropped 21% and now trades at $47.70. This might have investors contemplating their next move.

Is now the time to buy LGI Homes, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Do We Think LGI Homes Will Underperform?

Despite the more favorable entry price, we're swiping left on LGI Homes for now. Here are three reasons we avoid LGIH and a stock we'd rather own.

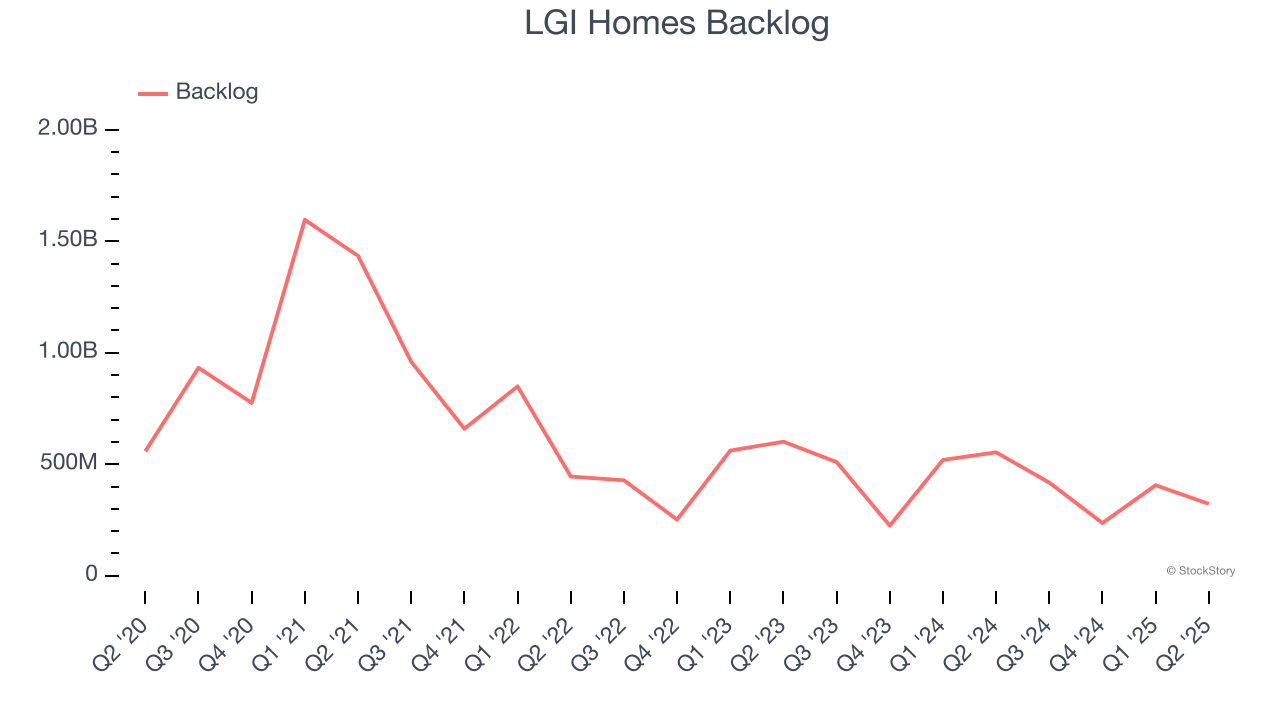

1. Backlog Declines as Orders Drop

In addition to reported revenue, backlog is a useful data point for analyzing Home Builders companies. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into LGI Homes’s future revenue streams.

LGI Homes’s backlog came in at $322.5 million in the latest quarter, and it averaged 10.4% year-on-year declines over the last two years. This performance was underwhelming and shows the company is not winning new orders. It also suggests there may be increasing competition or market saturation.

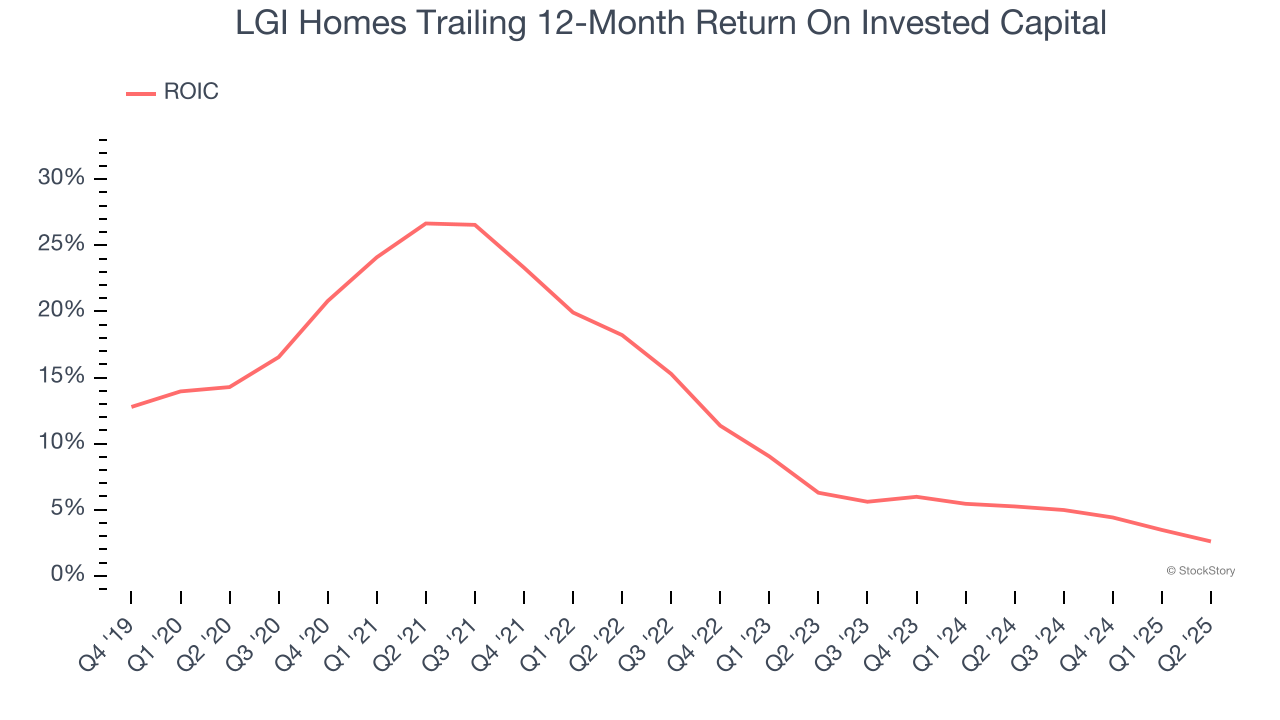

2. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, LGI Homes’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

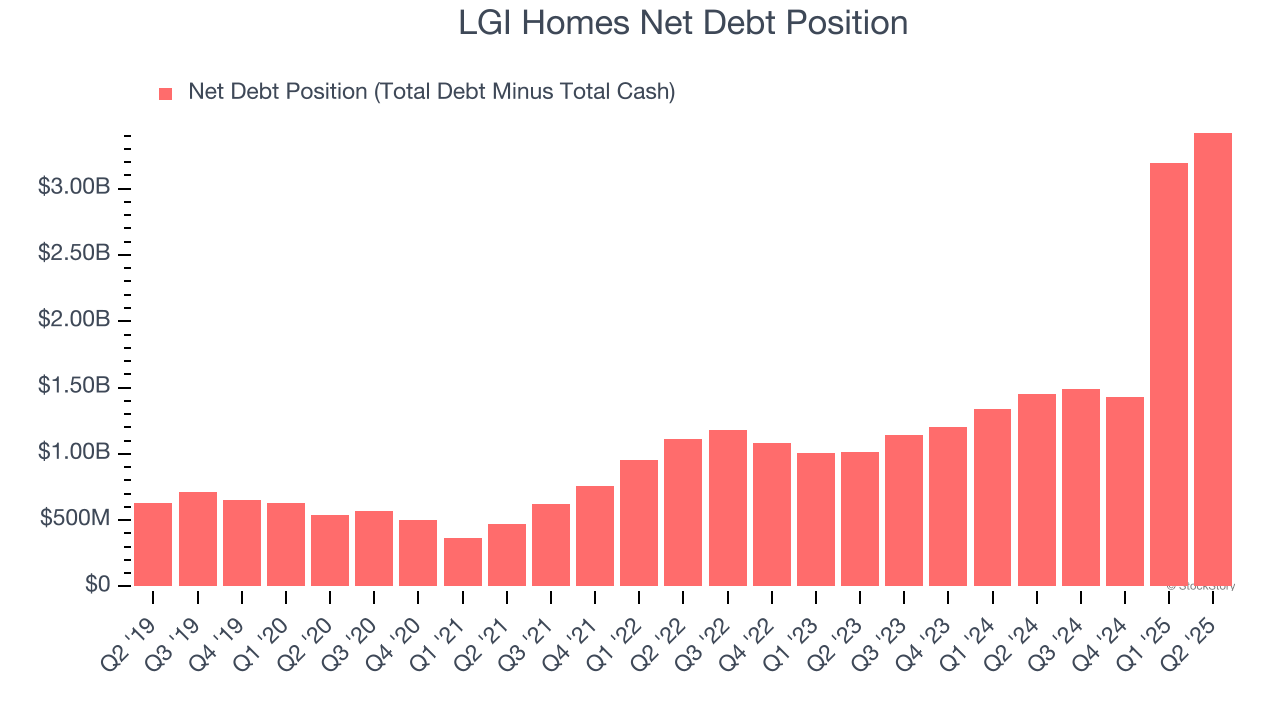

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

LGI Homes burned through $158.4 million of cash over the last year, and its $3.48 billion of debt exceeds the $59.56 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the LGI Homes’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of LGI Homes until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

We see the value of companies helping their customers, but in the case of LGI Homes, we’re out. Following the recent decline, the stock trades at 11.4× forward P/E (or $47.70 per share). This valuation tells us a lot of optimism is priced in - you can find more timely opportunities elsewhere. Let us point you toward one of our top digital advertising picks.

Stocks We Would Buy Instead of LGI Homes

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.