XPO has had an impressive run over the past six months as its shares have beaten the S&P 500 by 5.4%. The stock now trades at $142.94, marking a 19.6% gain. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy XPO, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Do We Think XPO Will Underperform?

We’re glad investors have benefited from the price increase, but we're swiping left on XPO for now. Here are three reasons why XPO doesn't excite us and a stock we'd rather own.

1. Revenue Spiraling Downwards

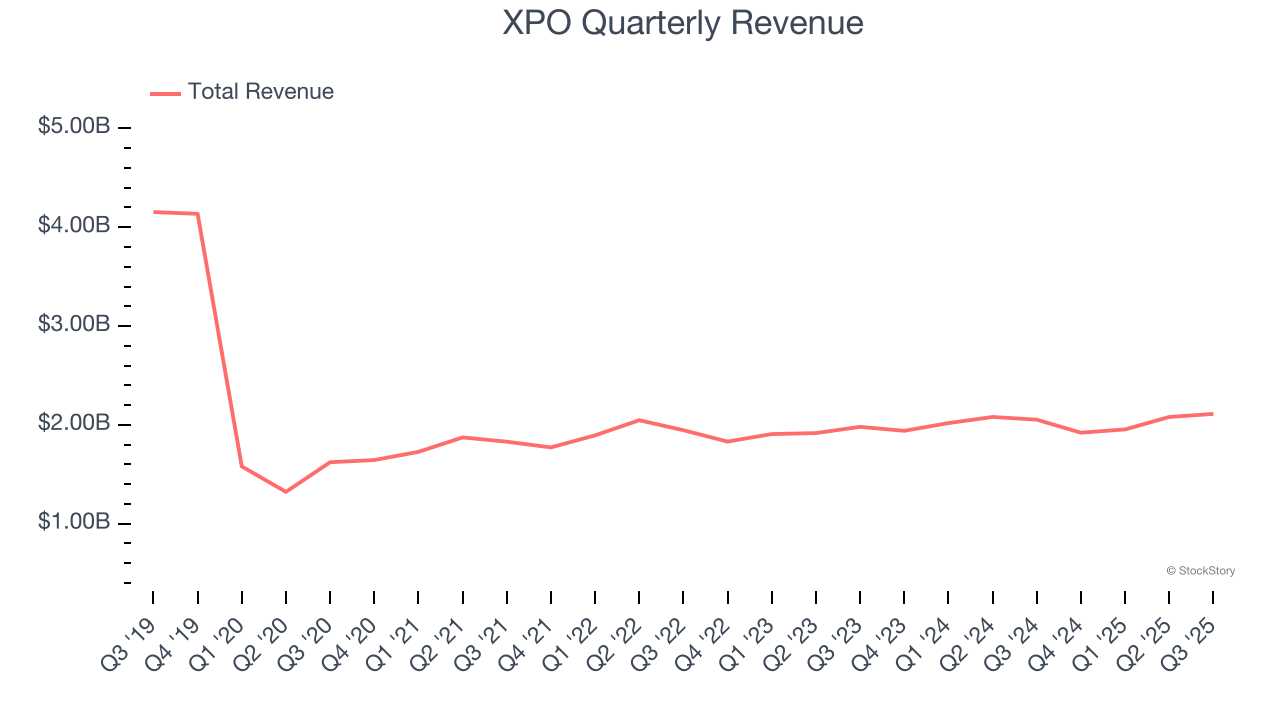

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. XPO’s demand was weak over the last five years as its sales fell at a 1.4% annual rate. This was below our standards and signals it’s a low quality business.

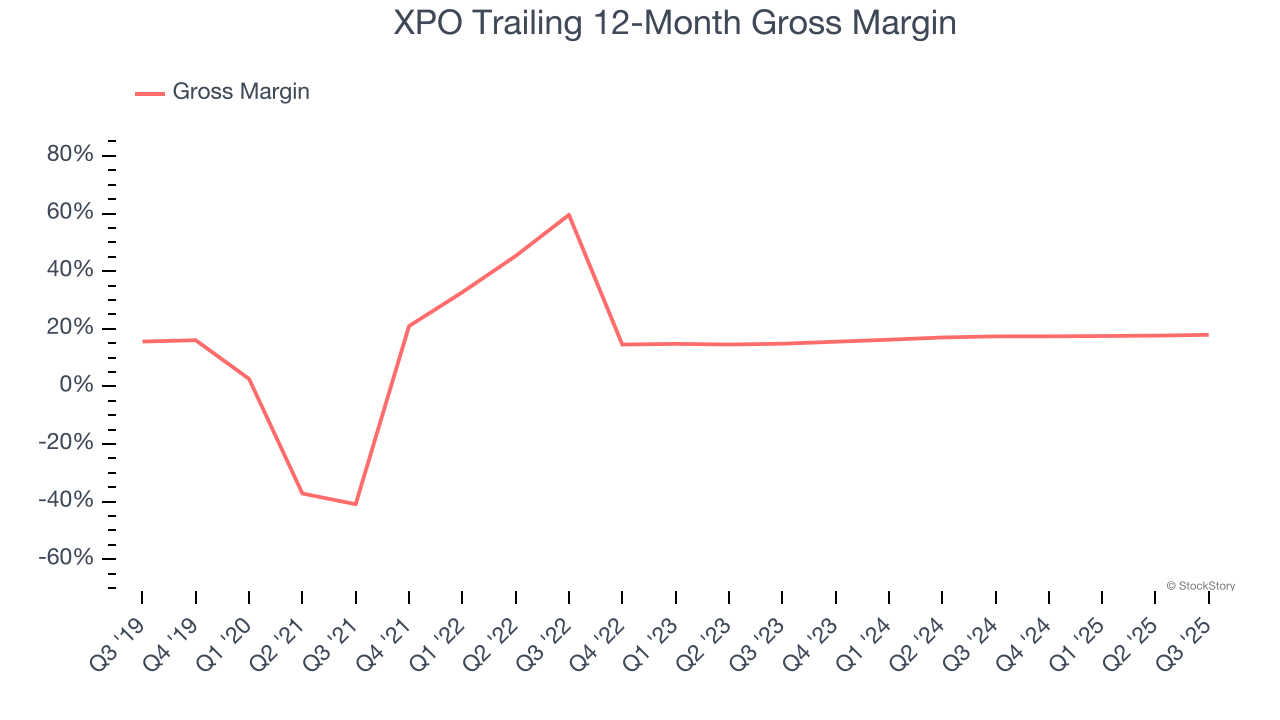

2. Low Gross Margin Reveals Weak Structural Profitability

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

XPO has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 14.7% gross margin over the last five years. Said differently, XPO had to pay a chunky $85.33 to its suppliers for every $100 in revenue.

3. Free Cash Flow Margin Dropping

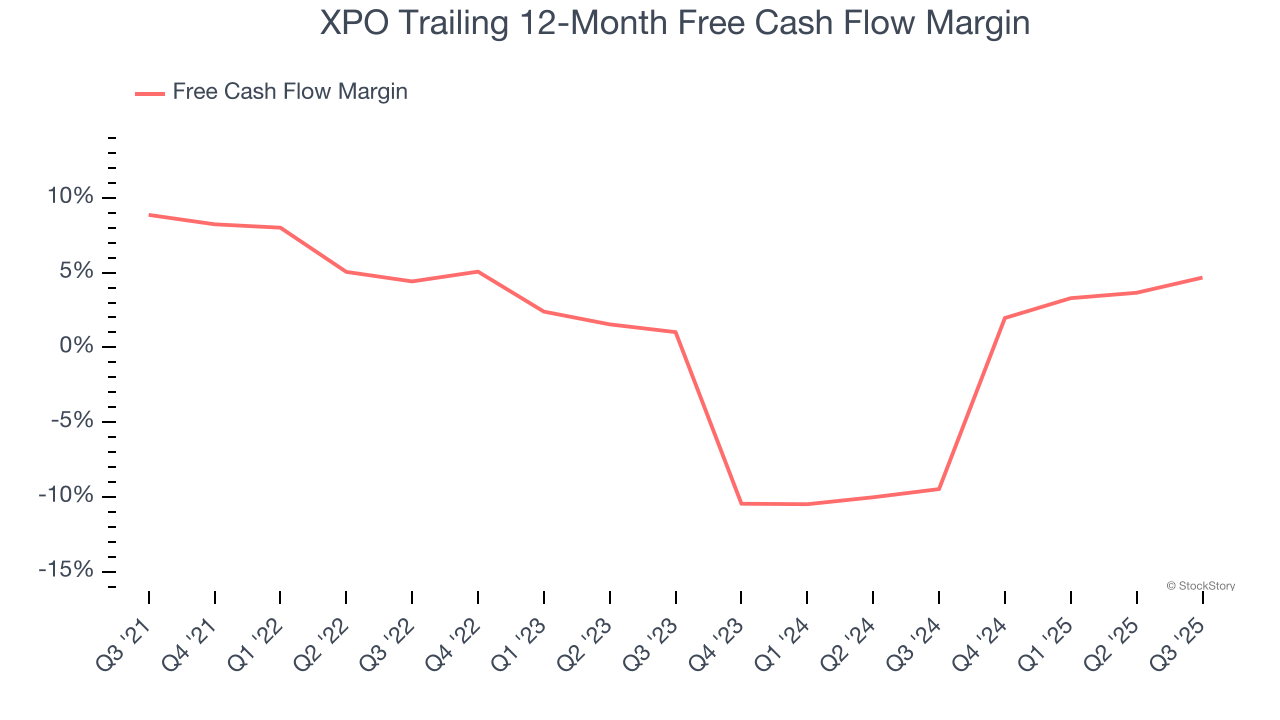

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, XPO’s margin dropped by 4.2 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the longer-term trend returns, it could signal it’s becoming a more capital-intensive business. XPO’s free cash flow margin for the trailing 12 months was 4.7%.

Final Judgment

XPO falls short of our quality standards. With its shares beating the market recently, the stock trades at 33.2× forward P/E (or $142.94 per share). This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere. Let us point you toward one of our all-time favorite software stocks.

Stocks We Like More Than XPO

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.