Medical technology company Inspire Medical Systems (NYSE: INSP) announced better-than-expected revenue in Q1 CY2025, with sales up 22.7% year on year to $201.3 million. The company expects the full year’s revenue to be around $947.5 million, close to analysts’ estimates. Its GAAP profit of $0.10 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Inspire Medical Systems? Find out by accessing our full research report, it’s free.

Inspire Medical Systems (INSP) Q1 CY2025 Highlights:

- Revenue: $201.3 million vs analyst estimates of $195.2 million (22.7% year-on-year growth, 3.1% beat)

- EPS (GAAP): $0.10 vs analyst estimates of -$0.24 (beat)

- Adjusted EBITDA: $33.19 million vs analyst estimates of $16.51 million (16.5% margin, significant beat)

- The company reconfirmed its revenue guidance for the full year of $947.5 million at the midpoint

- EPS (GAAP) guidance for the full year is $2.25 at the midpoint, beating analyst estimates by 4.1%

- Operating Margin: -0.7%, up from -9.3% in the same quarter last year

- Market Capitalization: $4.76 billion

“We are very proud of our performance in the first quarter which included strong revenue growth and continued progress on profitability. We achieved a tremendous milestone with over 100,000 patients receiving Inspire therapy and we are still just getting started in growing awareness and adoption,” said Tim Herbert, Chairman and CEO of Inspire Medical Systems.

Company Overview

Offering an alternative for the millions who struggle with traditional CPAP machines, Inspire Medical Systems (NYSE: INSP) develops and sells an implantable neurostimulation device that treats obstructive sleep apnea by stimulating nerves to keep airways open during sleep.

Sales Growth

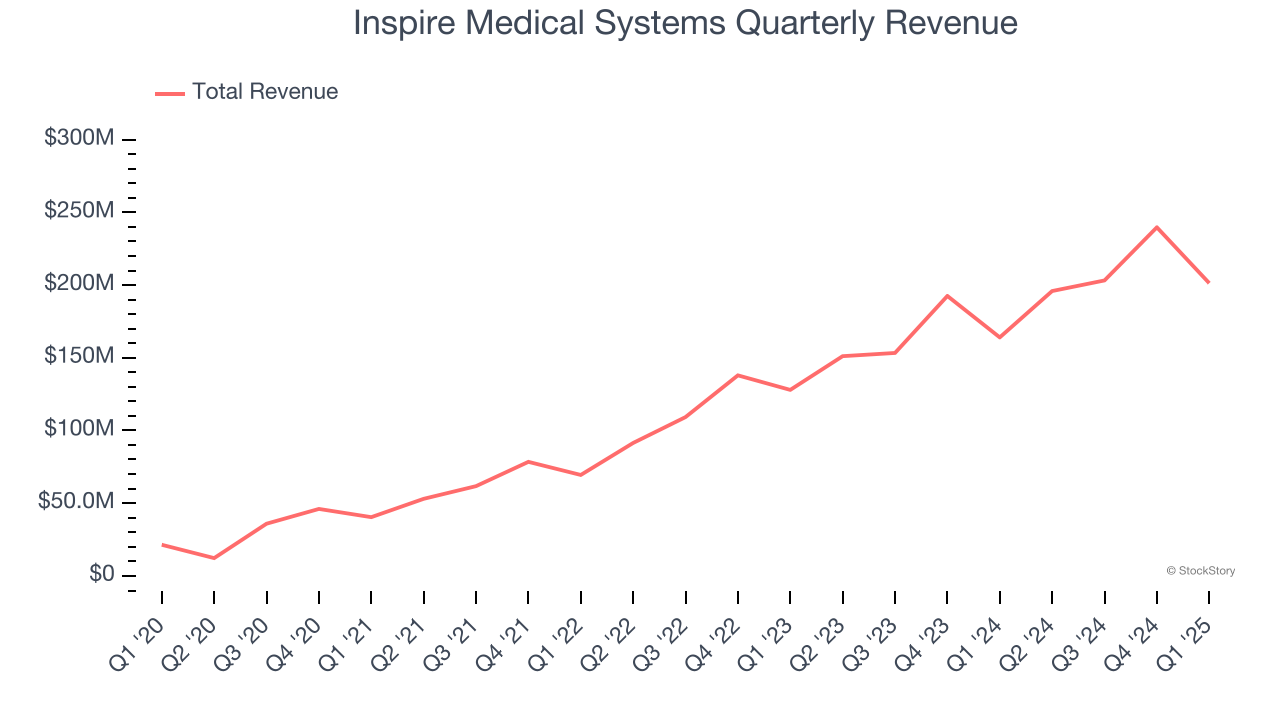

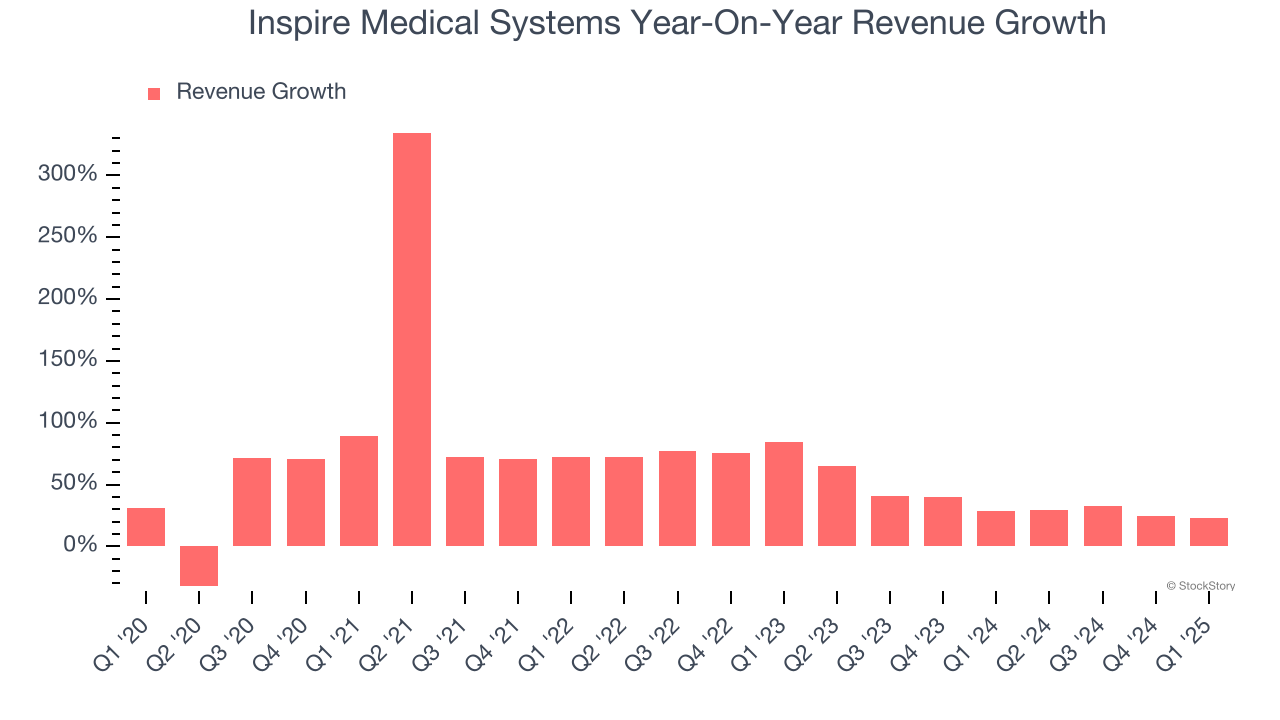

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Inspire Medical Systems grew its sales at an incredible 57.3% compounded annual growth rate. Its growth surpassed the average healthcare company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Inspire Medical Systems’s annualized revenue growth of 34.2% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Inspire Medical Systems reported robust year-on-year revenue growth of 22.7%, and its $201.3 million of revenue topped Wall Street estimates by 3.1%.

Looking ahead, sell-side analysts expect revenue to grow 18.2% over the next 12 months, a deceleration versus the last two years. Still, this projection is admirable and implies the market is forecasting success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

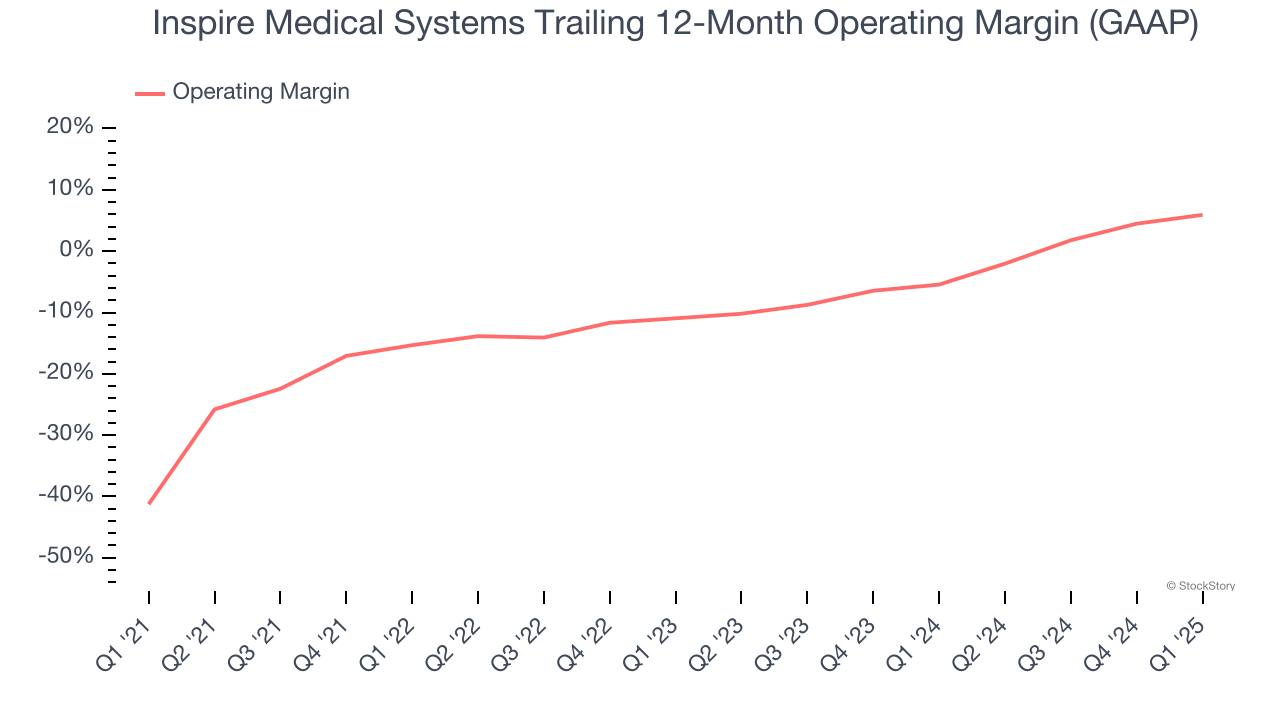

Although Inspire Medical Systems broke even this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 5.6% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Inspire Medical Systems’s operating margin rose by 47.2 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 16.9 percentage points on a two-year basis. These data points are very encouraging and shows momentum is on its side.

In Q1, Inspire Medical Systems generated a negative 0.7% operating margin.

Earnings Per Share

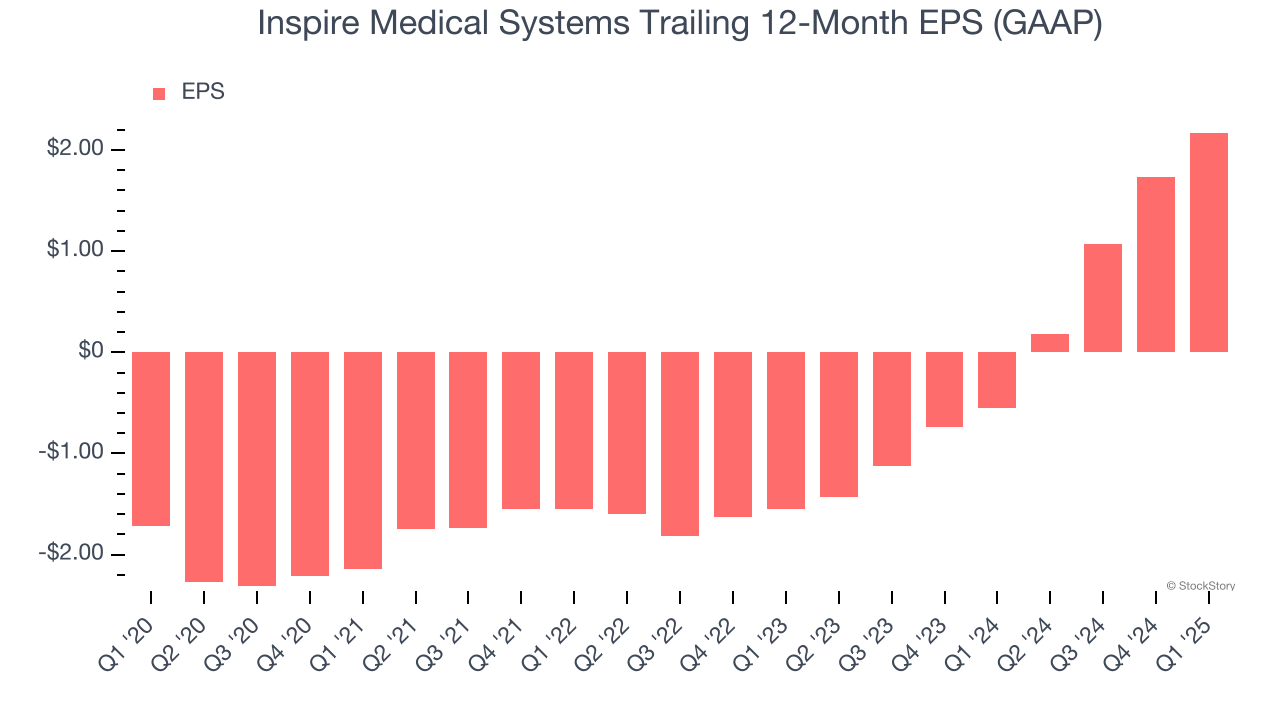

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Inspire Medical Systems’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

In Q1, Inspire Medical Systems reported EPS at $0.10, up from negative $0.34 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Inspire Medical Systems’s full-year EPS of $2.17 to grow 26.7%.

Key Takeaways from Inspire Medical Systems’s Q1 Results

We liked that Inspire Medical Systems beat across the board, exceeding analysts’ revenue, adjusted EBITDA, and EPS expectations this quarter. Its full-year EPS guidance outperformed Wall Street’s estimates, as the company maintained its outlook from the previously-provided one. Zooming out, we think this quarter featured some important positives. The stock traded up 6.8% to $170 immediately after reporting.

Inspire Medical Systems put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.