Office furniture manufacturer Steelcase (NYSE: SCS) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 7.1% year on year to $779 million. The company expects next quarter’s revenue to be around $875 million, close to analysts’ estimates. Its non-GAAP profit of $0.20 per share was 50% above analysts’ consensus estimates.

Is now the time to buy Steelcase? Find out by accessing our full research report, it’s free.

Steelcase (SCS) Q2 CY2025 Highlights:

- Revenue: $779 million vs analyst estimates of $759.9 million (7.1% year-on-year growth, 2.5% beat)

- Adjusted EPS: $0.20 vs analyst estimates of $0.13 (50% beat)

- Adjusted EBITDA: $64.8 million vs analyst estimates of $52.33 million (8.3% margin, 23.8% beat)

- Revenue Guidance for Q3 CY2025 is $875 million at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for Q3 CY2025 is $0.38 at the midpoint, below analyst estimates of $0.41

- Operating Margin: 3.3%, in line with the same quarter last year

- Free Cash Flow was -$155.1 million compared to -$71.2 million in the same quarter last year

- Market Capitalization: $1.24 billion

“Our first quarter results were a great start to the year,” said Sara Armbruster, president and CEO.

Company Overview

Founded in 1912 when metal office furniture was replacing wooden alternatives, Steelcase (NYSE: SCS) is a global office furniture manufacturer that designs and produces workplace solutions including desks, chairs, architectural products, and services.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $3.22 billion in revenue over the past 12 months, Steelcase is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

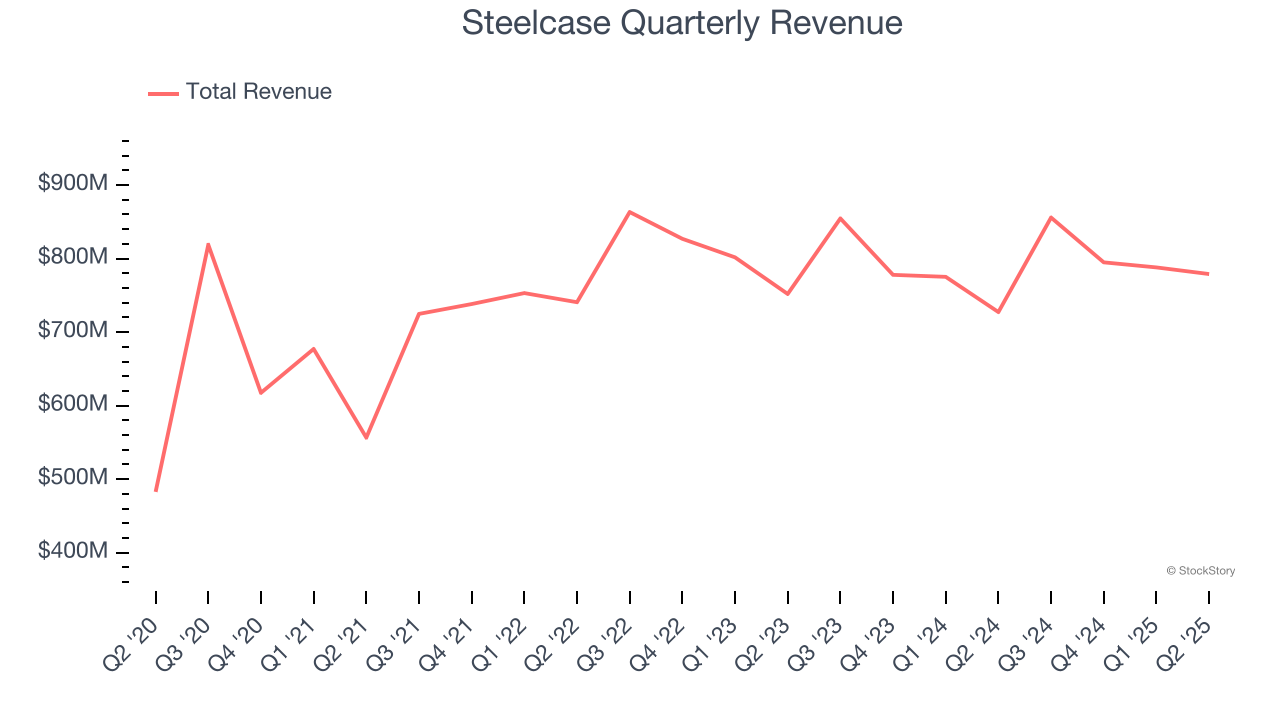

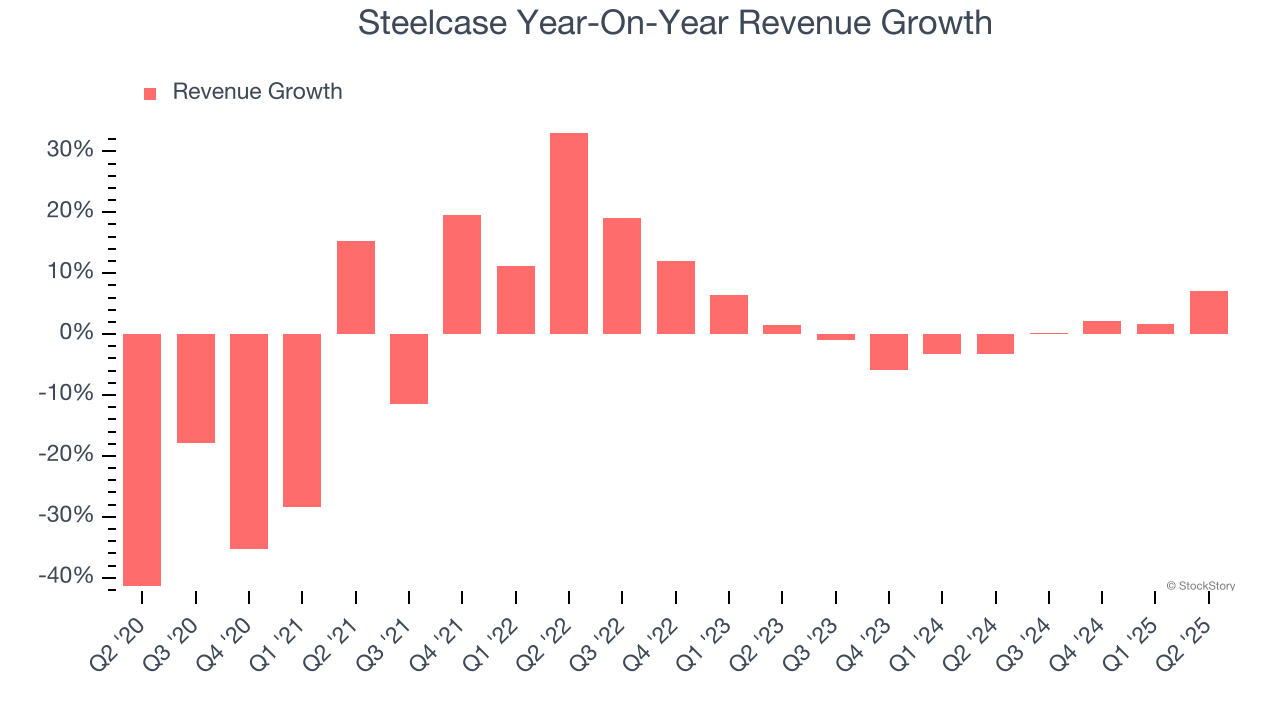

As you can see below, Steelcase struggled to increase demand as its $3.22 billion of sales for the trailing 12 months was close to its revenue five years ago. This shows demand was soft, a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Just like its five-year trend, Steelcase’s revenue over the last two years was flat, suggesting it is in a slump.

This quarter, Steelcase reported year-on-year revenue growth of 7.1%, and its $779 million of revenue exceeded Wall Street’s estimates by 2.5%. Company management is currently guiding for a 2.2% year-on-year increase in sales next quarter.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

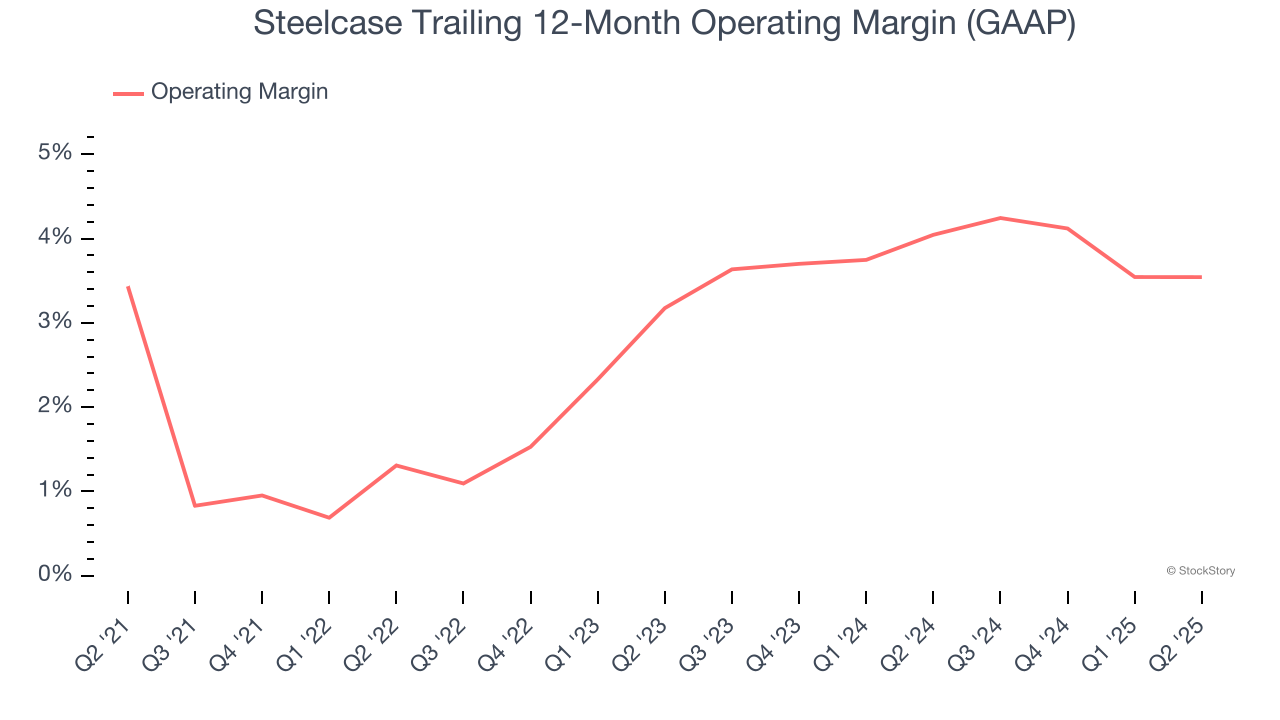

Steelcase’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 3.1% over the last five years. This profitability was lousy for a business services business and caused by its suboptimal cost structure.

Analyzing the trend in its profitability, Steelcase’s operating margin might fluctuated slightly but has generally stayed the same over the last five years, meaning it will take a fundamental shift in the business model to change.

In Q2, Steelcase generated an operating margin profit margin of 3.3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

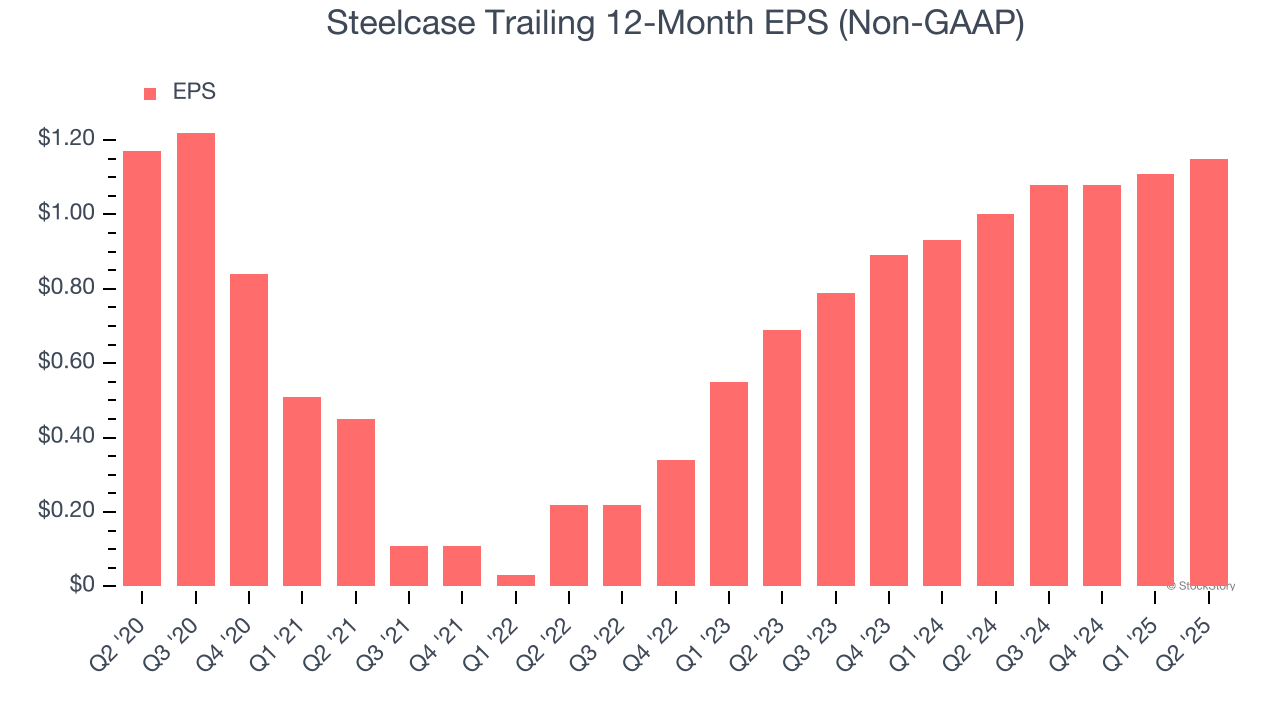

Steelcase’s EPS was flat over the last five years, just like its revenue. This performance was underwhelming across the board.

In Q2, Steelcase reported EPS at $0.20, up from $0.16 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Steelcase’s full-year EPS of $1.15 to shrink by 4.3%.

Key Takeaways from Steelcase’s Q2 Results

We were impressed by how significantly Steelcase blew past analysts’ EPS and EBITDA expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed. Zooming out, we think this was a mixed quarter, especially because competitor MillerKnoll guided above. The market seemed to be hoping for more, and the stock traded down 6% to $9.99 immediately following the results.

So should you invest in Steelcase right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.