As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the construction and maintenance services industry, including Great Lakes Dredge & Dock (NASDAQ: GLDD) and its peers.

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

The 13 construction and maintenance services stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 3.5% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 7.4% on average since the latest earnings results.

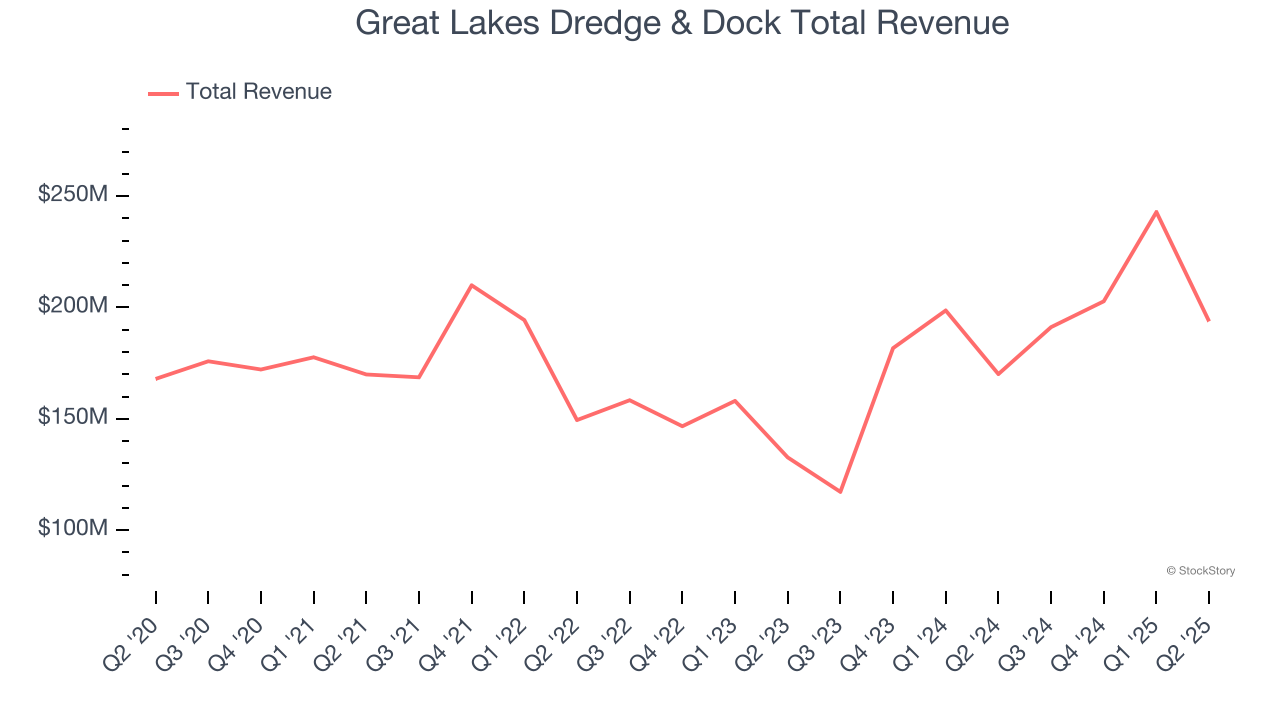

Great Lakes Dredge & Dock (NASDAQ: GLDD)

Founded as Lydon & Drews dredging company, Great Lakes Dredge & Dock (NASDAQ: GLDD) provides dredging services, land reclamation, and coastal protection projects in the United States and internationally.

Great Lakes Dredge & Dock reported revenues of $193.8 million, up 13.9% year on year. This print exceeded analysts’ expectations by 9%. Overall, it was an incredible quarter for the company with a beat of analysts’ EPS and EBITDA estimates.

Lasse Petterson, President and Chief Executive Officer, commented, “Great Lakes delivered a solid second quarter, driven by strong project execution and high equipment utilization. We ended the quarter with revenue of $193.8 million, net income of $9.7 million, and adjusted EBITDA of $28.0 million, despite four dredges undergoing their regulatory drydocking. Our substantial dredging backlog stood at approximately $1.0 billion as of the end of the second quarter, with an additional $215.4 million in low bids and options pending award, providing expected revenue visibility for the remainder of 2025 and well into 2026. Capital and coastal protection projects account for 93% of our dredging backlog, which typically yield higher margins.

Interestingly, the stock is up 15% since reporting and currently trades at $12.20.

Is now the time to buy Great Lakes Dredge & Dock? Access our full analysis of the earnings results here, it’s free.

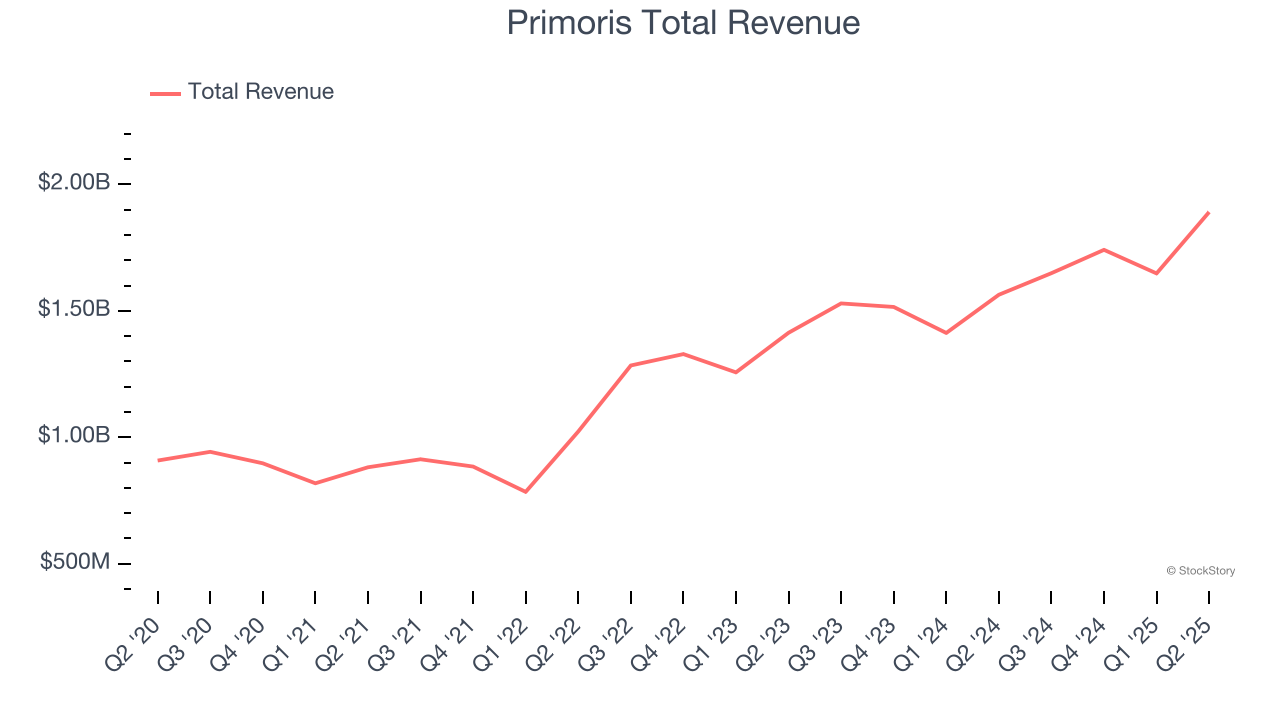

Primoris (NYSE: PRIM)

Listed on the NASDAQ in 2008, Primoris (NYSE: PRIM) builds, maintains, and upgrades infrastructure in the utility, energy, and civil construction industries.

Primoris reported revenues of $1.89 billion, up 20.9% year on year, outperforming analysts’ expectations by 12.1%. The business had an incredible quarter with a beat of analysts’ EPS and EBITDA estimates.

Primoris pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 32% since reporting. It currently trades at $122.96.

Is now the time to buy Primoris? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Matrix Service (NASDAQ: MTRX)

Founded in Oklahoma, Matrix Service (NASDAQ: MTRX) provides engineering, fabrication, construction, and maintenance services primarily to the energy and industrial markets.

Matrix Service reported revenues of $216.4 million, up 14.2% year on year, falling short of analysts’ expectations by 6.8%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Matrix Service delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 9.8% since the results and currently trades at $12.85.

Read our full analysis of Matrix Service’s results here.

MYR Group (NASDAQ: MYRG)

Constructing electrical and phone lines in the American Midwest dating back to the 1890s, MYR Group (NASDAQ: MYRG) is a specialty contractor in the electrical construction industry.

MYR Group reported revenues of $900.3 million, up 8.6% year on year. This print beat analysts’ expectations by 6%. Overall, it was a strong quarter as it also put up an impressive beat of analysts’ adjusted operating income estimates.

The stock is down 11.6% since reporting and currently trades at $177.03.

Read our full, actionable report on MYR Group here, it’s free.

Comfort Systems (NYSE: FIX)

Formed through the merger of 12 companies, Comfort Systems (NYSE: FIX) provides mechanical and electrical contracting services.

Comfort Systems reported revenues of $2.17 billion, up 20.1% year on year. This number surpassed analysts’ expectations by 10.6%. It was an incredible quarter as it also recorded a solid beat of analysts’ backlog and EPS estimates.

The stock is up 36.3% since reporting and currently trades at $767.10.

Read our full, actionable report on Comfort Systems here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.