Over the past six months, Penske Automotive Group’s shares (currently trading at $159.41) have posted a disappointing 5.1% loss, well below the S&P 500’s 9.5% gain. This might have investors contemplating their next move.

Is there a buying opportunity in Penske Automotive Group, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Penske Automotive Group Not Exciting?

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons you should be careful with PAG and a stock we'd rather own.

1. Same-Store Sales Falling Behind Peers

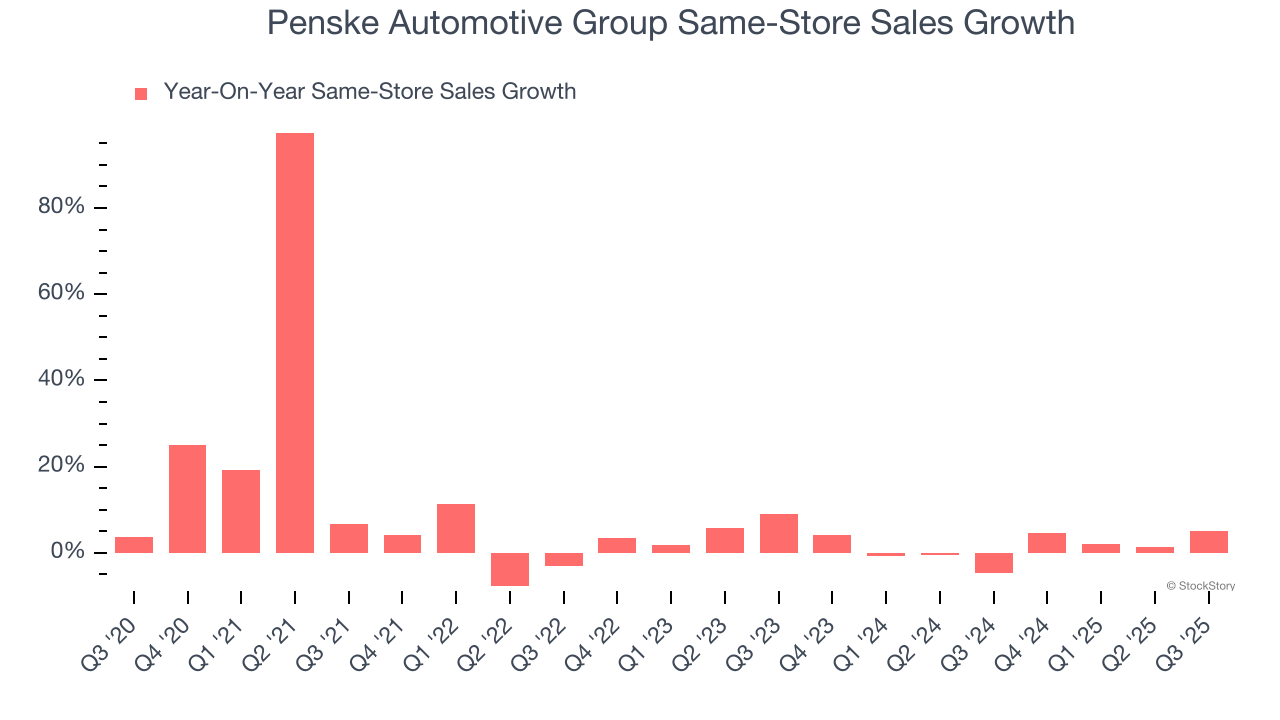

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

Penske Automotive Group’s demand within its existing locations has been relatively stable over the last two years but was below most retailers. On average, the company’s same-store sales have grown by 1.4% per year.

2. Low Gross Margin Reveals Weak Structural Profitability

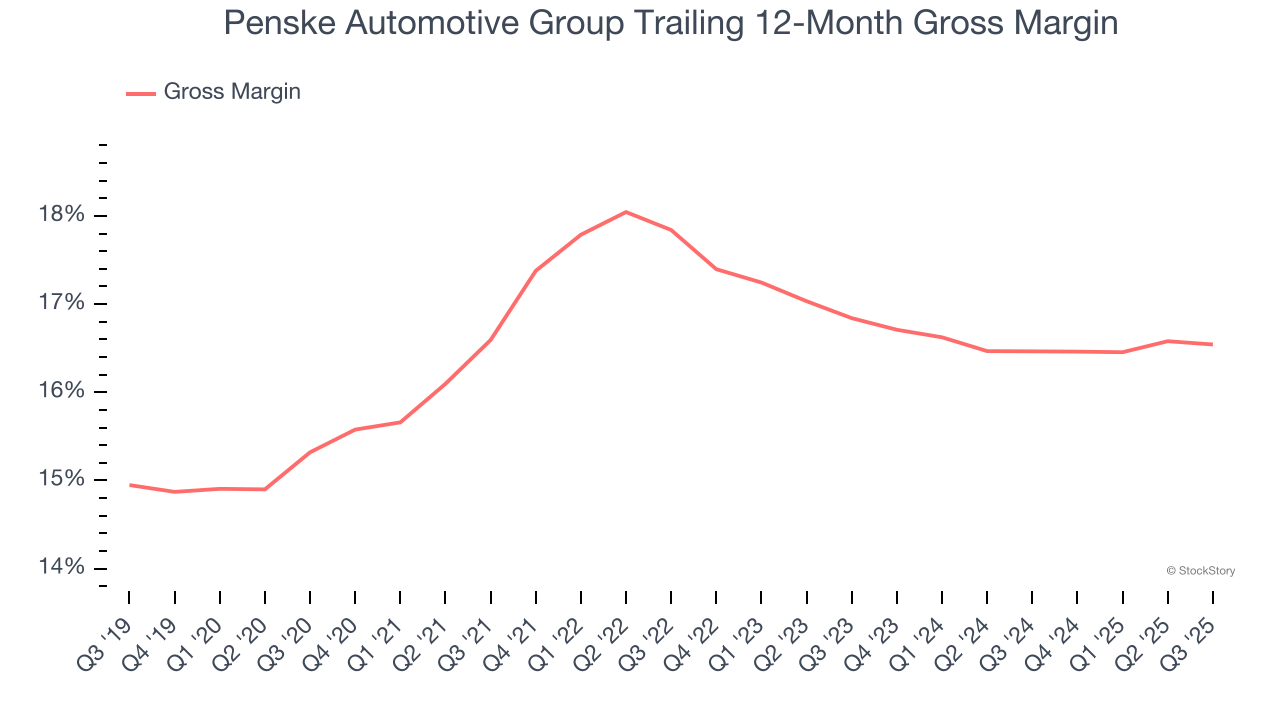

We prefer higher gross margins because they not only make it easier to generate more operating profits but also indicate product differentiation, negotiating leverage, and pricing power.

Penske Automotive Group has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 16.5% gross margin over the last two years. Said differently, Penske Automotive Group had to pay a chunky $83.50 to its suppliers for every $100 in revenue.

3. EPS Trending Down

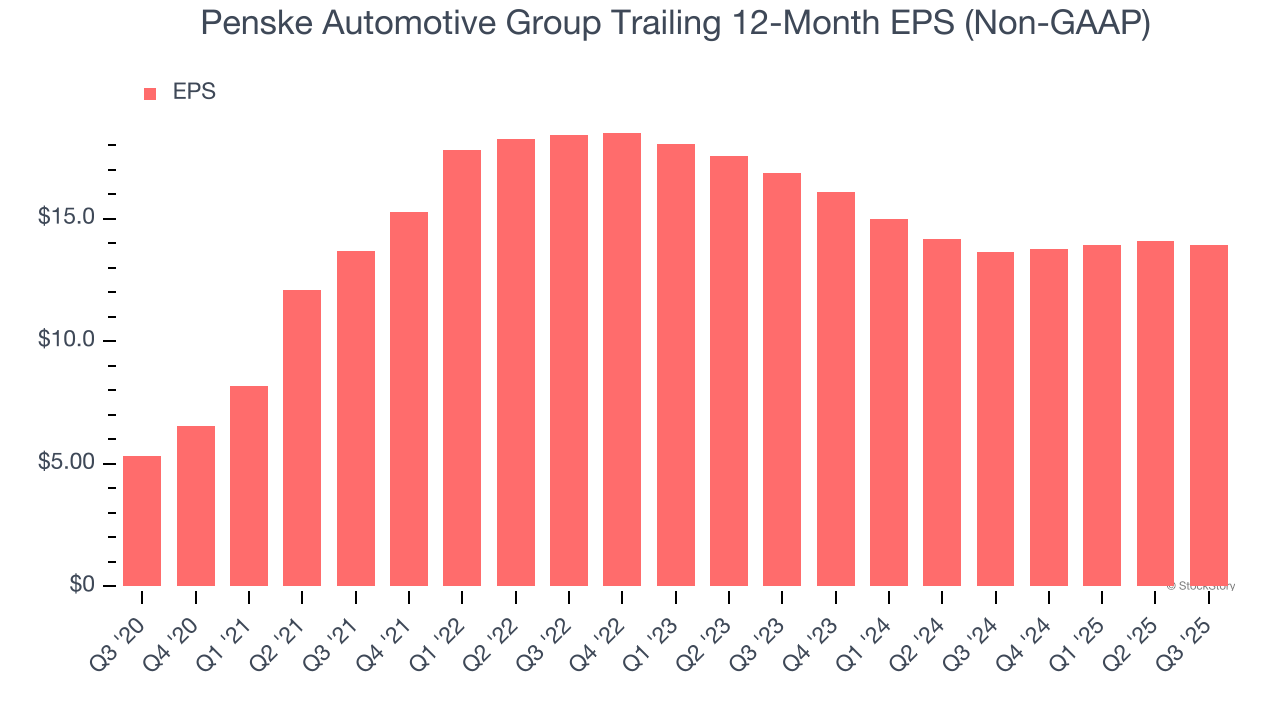

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Penske Automotive Group, its EPS declined by 8.8% annually over the last three years while its revenue grew by 4.2%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Penske Automotive Group isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 11.9× forward P/E (or $159.41 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere. We’d recommend looking at the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of Penske Automotive Group

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.