Sustainable ingredients producer Darling Ingredients (NYSE: DAR) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 20.6% year on year to $1.71 billion. Its GAAP profit of $0.35 per share was in line with analysts’ consensus estimates.

Is now the time to buy Darling Ingredients? Find out by accessing our full research report, it’s free.

Darling Ingredients (DAR) Q4 CY2025 Highlights:

- Revenue: $1.71 billion vs analyst estimates of $1.53 billion (20.6% year-on-year growth, 11.8% beat)

- EPS (GAAP): $0.35 vs analyst estimates of $0.35 (in line)

- Adjusted EBITDA: $336.1 million vs analyst estimates of $274.7 million (19.7% margin, 22.4% beat)

- Operating Margin: 5.7%, down from 8.6% in the same quarter last year

- Market Capitalization: $7.7 billion

“Our commitment to operational excellence drove a strong fourth quarter, delivering solid EBITDA growth and sequential gross margin improvement, despite lower fat prices. While Diamond Green Diesel (DGD) had a challenging year, our best-in-class operations led the industry and produced industry-leading results,” said Randall C. Stuewe, Chairman and Chief Executive Officer.

Company Overview

Turning what others consider waste into valuable resources, Darling Ingredients (NYSE: DAR) collects and transforms animal by-products, used cooking oil, and other bio-nutrients into valuable ingredients for food, feed, fuel, and industrial applications.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $6.14 billion in revenue over the past 12 months, Darling Ingredients carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

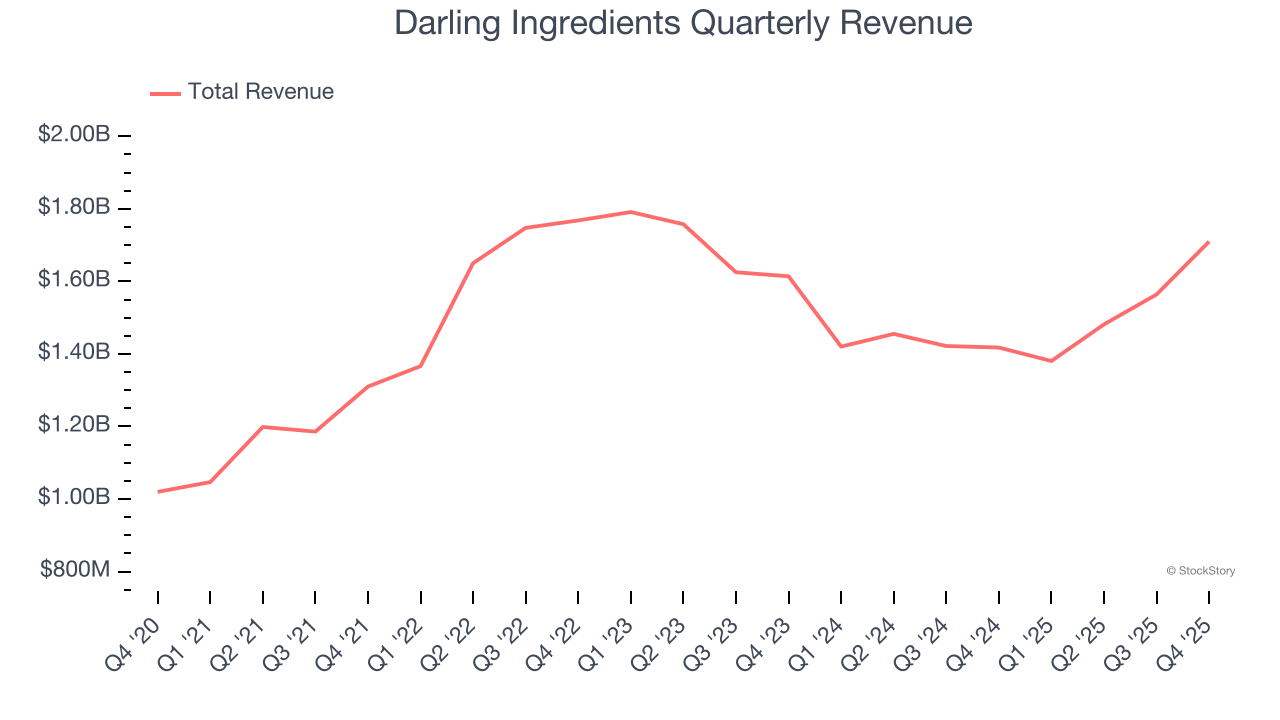

As you can see below, Darling Ingredients’s revenue declined by 2.1% per year over the last three years, a poor baseline for our analysis.

This quarter, Darling Ingredients reported robust year-on-year revenue growth of 20.6%, and its $1.71 billion of revenue topped Wall Street estimates by 11.8%.

Looking ahead, sell-side analysts expect revenue to grow 1.8% over the next 12 months. Although this projection implies its newer products will catalyze better top-line performance, it is still below the sector average.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

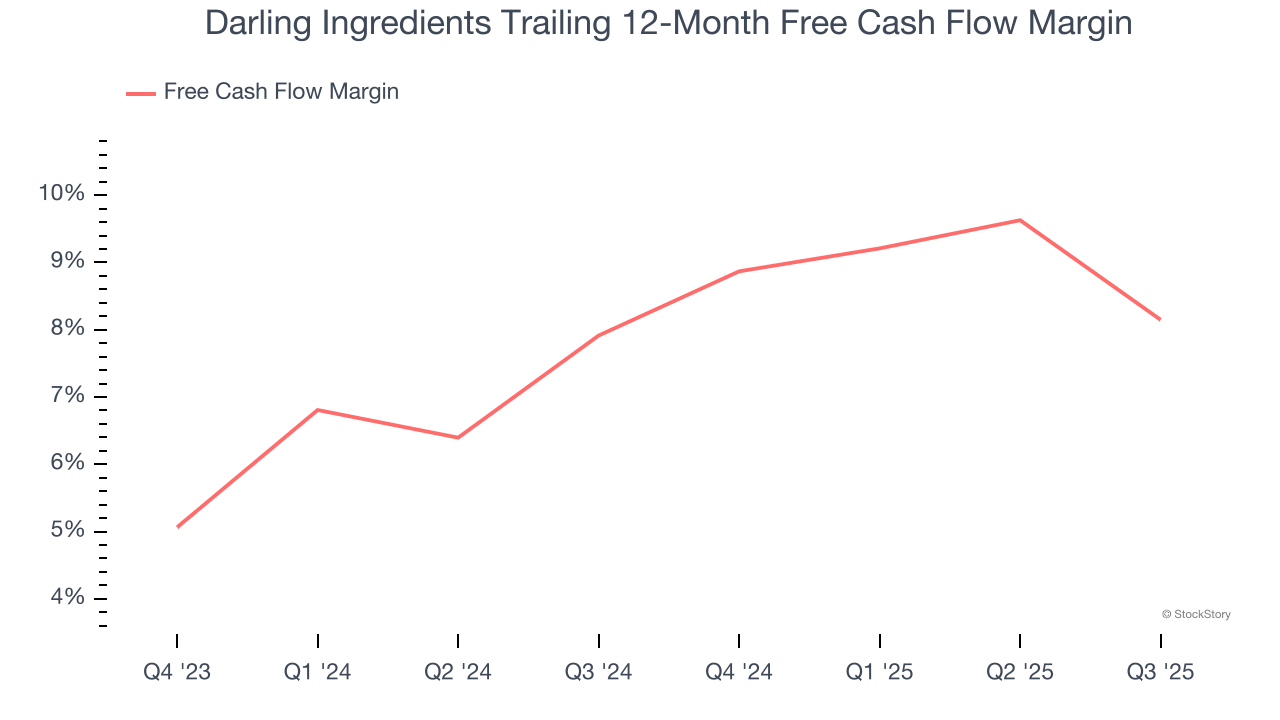

Darling Ingredients has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 8.9% over the last two years, better than the broader consumer staples sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Key Takeaways from Darling Ingredients’s Q4 Results

We were impressed by how significantly Darling Ingredients blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. Investors were likely hoping for more, and shares traded down 3.1% to $48.01 immediately following the results.

Is Darling Ingredients an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).