New data shows U.S. firms adopting accounting automation are seeing sharp declines in fraud and financial errors.

NEW YORK, NY, January 16, 2026 /24-7PressRelease/ -- A quiet but significant shift is underway in how American companies manage their finances.

Over the past year, U.S. firms that have adopted automated accounting systems have reported an estimated 80 percent decline in fraud and accounting-related errors, according to recent industry data and financial oversight analyses.

The figures reflect a broader transformation in corporate finance, as companies move away from manual, people-dependent accounting processes toward real-time, system-driven financial control powered by artificial intelligence and automation.

For decades, accounting was largely treated as a retrospective function — records were reviewed after transactions occurred, discrepancies were investigated later, and internal controls relied heavily on human oversight. That model, experts say, left room for both intentional misconduct and unintentional errors to accumulate unnoticed.

Several high-profile failures underscored those vulnerabilities. In 2022, the collapse of FTX exposed how fragmented accounting systems and weak internal controls could allow massive misuse of funds to go undetected until it was too late. While FTX operated in the crypto sector, the lessons reverberated far beyond it, prompting companies across industries to reassess how financial oversight was structured.

"In the aftermath of those failures, many companies realized that strengthening rules alone was not enough," said a U.S.-based financial controls specialist. "The real issue was structural — too much depended on people catching problems after they happened."

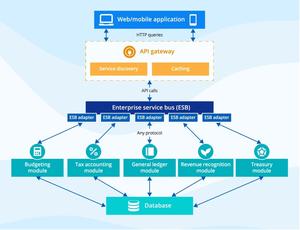

Accounting automation emerged as a response to that realization. Modern systems now integrate transaction data, approval records, audit trails, and financial reporting into a single, continuously monitored environment. Rather than flagging issues weeks or months later, anomalies are detected as transactions occur, allowing firms to intervene earlier.

Analysts say this shift has fundamentally changed how financial risk is managed. Automated systems reduce reliance on manual reconciliation and individual discretion, making it harder for irregular activity — whether fraudulent or accidental — to persist undetected.

The transition has not been without consequences. As automation takes over repetitive tasks such as bookkeeping, reconciliation, and basic verification, the demand for traditional accounting roles has declined in some areas. At the same time, companies are redefining the role of finance professionals, placing greater emphasis on analysis, judgment, and system oversight rather than routine processing.

Despite concerns about job displacement, adoption has accelerated across the corporate spectrum. Startups, mid-sized firms, and large enterprises alike are embracing automated accounting, driven by the promise of stronger controls and greater transparency.

"What we're seeing isn't just efficiency gains," said one senior finance executive at a Fortune 500 company. "It's a redesign of how financial authority and accountability work inside organizations."

Experts caution that automation is not a cure-all, but many agree that it represents a structural improvement over legacy models. By shifting financial oversight from periodic review to continuous control, companies are reshaping accounting into what some describe as an operational infrastructure, rather than a back-office function.

As artificial intelligence continues to mature, analysts expect this model to become the default rather than the exception — signaling a lasting change in how corporate finance is governed in the United States.

---

Press release service and press release distribution provided by https://www.24-7pressrelease.com