People often ask questions about the INFINOX broker and online trading in general. This article will provide insightful answers for anyone curious about the topic. The text will feature the INFINOX pros and cons, as well as the potential advantages and disadvantages of trading assets online. The readers will find out whether they can trust this broker, why it is not necessary to have large sums of money to start trading, and how people with busy schedules can benefit from the company's services. To provide factual proof, there will be screenshots of the INFINOX trading platform feedback in each answer.

Can I trust INFINOX?

Absolutely. This company has been around since 2009, which is impressive for any business. In the dynamic digital sphere, it is quite an achievement to keep working for almost two decades. The licenses issued by FSC and FCA confirm the organization's integrity.

INFINOX legally provides its services in over 15 countries. Its audience in these territories is steadily expanding, and it collaborates with established local payment providers. Clients can deposit and withdraw funds through ten banking systems that include wire transfers, major cards, digital wallets, and crypto. These brands are selective about businesses that use their services and support only reputable ones.

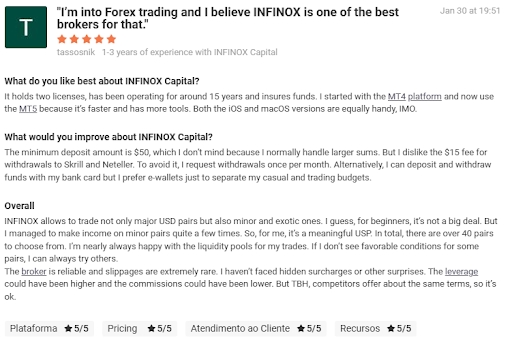

Here is one of the multiple INFINOX reviews that highlight its credibility. The author appreciates that the broker insures funds and acts predictably.

What if online trading is too difficult for me?

If you know how to use casual mobile apps, such as digital wallets or food delivery services, it will not be too challenging for you to master the basics of online trading. To jump-start one's onboarding, it is advisable to use Autochartist. This tool applies varied analytical techniques to monitor the markets and suggests the most promising opportunities to clients. It is up to the customer which of the recommended trades to complete.

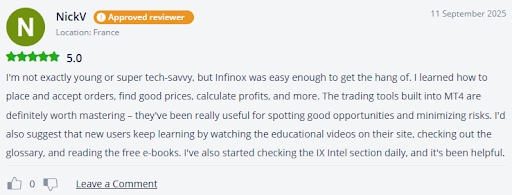

To grow professionally, INFINOX clients can visit the Learn section on the broker's website. The education hub features different formats of materials that facilitate trading: from a glossary for beginners to a live news feed for active traders. The IX Intel section with analytics is especially valuable — despite being in-depth, these articles are not too difficult to understand, their style resembles those of business media for a wide audience.

INFINOX broker reviews show that even those without a technical background can learn on the spot, using the educational environment on the company's website. If one expands their knowledge systematically and keeps carefully experimenting in the trading terminal, they will eventually come up with an approach that works for them.

Can I trade if I'm bad at calculations?

When digital technologies were in their infancy, math skills were indeed indispensable for traders. Now, one does not need to crunch all the numbers manually. Instead, clients rely on automation tools, built inside trading terminals.

INFINOX customers can choose between MT4 and MT5. These trading solutions set the benchmark thanks to their reliability and customer focus. They feature dozens of charts, hints, and indicators that facilitate trading. Users can assess the potential of their trades in a visually comprehensive format, without complex formulas or lengthy equations. They can decide themselves which tools to activate and how many of them to apply simultaneously.

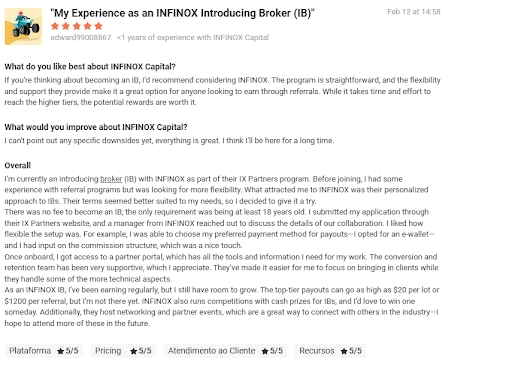

Besides, it is not even necessary to buy and sell assets to make money with INFINOX. This platform also uses Introducing Brokers (IBs) who promote it online. Mentors provide them with guidance and materials in terms of the IX Partners program. The amount of payment depends on how many active traders an online marketer attracts to the platform. The broker provides multiple motivational and educational opportunities for those who let it grow.

The INFINOX trading platform feedback about the IBs program tends to be positive. Here is a detailed review by a person who hopes to earn money on this activity for quite a long time. They accentuate the personalized approach and the ability to select the suitable banking option to receive the payments.

Do I need to spend large sums of money to get an income on trading?

Not at all. The lowest threshold for deposits at INFINOX is USD 50. One can start with replenishing their balance with this amount and gradually increase it. The more funds one handles, the larger income they can generate — but it is realistic to make a profit even with USD 50.

To get started, it is not necessary to spend a single cent. The broker provides a free demo account to anyone interested in it. New clients can train without real-money expenses for a full month. If they do not feel ready for trading after that, they can leave the platform — however, many customers get involved and make a deposit when they feel confident enough.

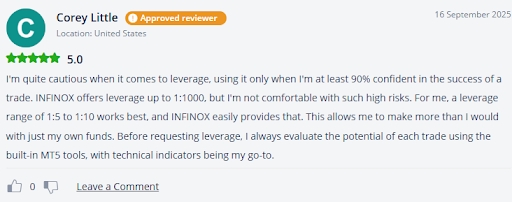

Clients can borrow money from the platform to complete their trades, get their profit, and return the debt. The funds that the broker provides them with is known as leverage. Its maximum possible amount is 1:1000 — if one has USD 100 on their balance, they can borrow up to USD 100,000 to benefit from a favorable situation on the market. The best thing about the leverage at INFINOX is that it is dynamic. It is higher for small trades and lower for larger ones, which is vital for risk mitigation. A comprehensive table on the broker's website displays the exact ratios and margins for various types of assets, so that users can check it before making deals.

This INFINOX Forex review expresses the thoughts and feelings of a trader who uses leverage responsibly. It is a wise approach for those who aim to remain efficient in the long run.

Is it true that I can lose money with INFINOX?

Just like any business, online trading can incur both income and losses. To maximize the former and minimize the latter, it is essential to carefully think over every decision and keep learning. Once a trade is confirmed, it becomes impossible to cancel it. Being a responsible service provider, INFINOX offers negative balance protection — it means that even in the most turbulent market environment, one can lose only the money that they deposited but not a single cent on top.

Here is an example of how one can lose money. A trader can fail to familiarize themselves with the recent market news and analytics. They might invest a large sum of money into an asset whose price, as they hope, will increase soon. In fact, the price decreases considerably due to bad industry news, and is unlikely to go up any time soon. The trader might need the money urgently, so they might sell the asset at a loss. In such a situation, INFINOX should not be blamed for its customer's mistakes.

And here is an example of how a client can make money with the broker. They open an account of one of the two available types and adjust their trading strategies to it. The account types differ in their spreads and fees — each client can have both, but it would be reasonable to start with just one. Leveraging the analytical tools, the trader detects the most lucrative deals and executes them at an opportune moment. They keep an eye on the swaps and do not forget about the fees when calculating the profitability of each step they take.

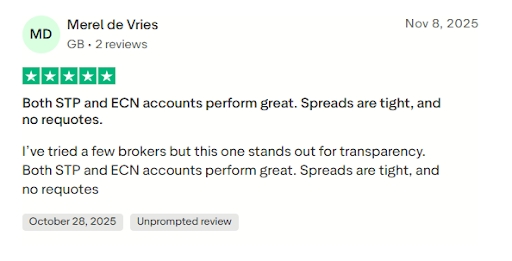

Here is an opinion of a customer who has tried both account varieties and is pretty much satisfied with them. The author of this review also emphasizes transparency and lack of requotes.

Can INFINOX prevent me from withdrawing the money that I earned from trading?

No, this can not happen. INFINOX freely allows its users to withdraw funds. In most cases, the broker does not charge fees for processing such transactions. However, if one withdraws through Skrill, Neteller, or bank wire more often than once per month, there will be a USD 15 fee. To avoid expenses, customers can use other payment providers or request withdrawals once every 30 or 31 days.

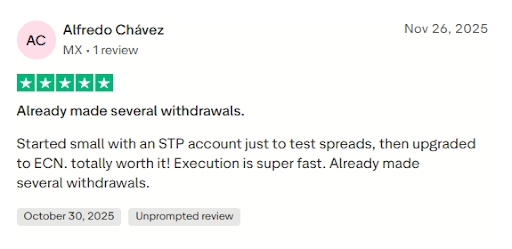

Have a look at one of the INFINOX broker reviews that show how easy it is to withdraw money. Even those who got started not too long ago successfully transfer the earnings to their cards, accounts, or e-wallets.

Do I have to spend all day long in front of my computer to become a successful trader?

Not necessarily. Yes, those who trade full-time to a large extent spend a lot of time in front of their computers. However, many processes can be automated. Among the most useful tools that one should learn are stop-loss and take-profit orders. They help to automatically complete a deal when the asset price reaches a pre-defined level. Because of this, one does not need to constantly monitor the market to detect lucrative opportunities.

If one lacks previous experience, it is highly advisable to invest time in the initial education. However, it is not always possible for those with busy schedules. As an option, they can consider joining the IX Social mobile app for Android. There, skilled traders allow anyone to copy their deals in exchange for reasonable remuneration. The performance statistics of every expert are publicly available, so that their followers can make a conscious and data-driven choice. Some people manage to gain a handsome income from IX Social with minimum effort. The most challenging part is being able to switch from one expert to another when the market situation changes, and the strategies that used to be profitable temporarily lose their competitive edge.

Alternatively, one can entrust their funds to a percentage allocation module manager (PAMM). There are many of them on the platform, and clients can select the expert whose strategies and approaches suit them best. PAMMs trade through several solutions to boost their performance. The distribution of the profits takes place automatically, proportionally to each participant's share. The clients of PAMMs do not have to place and accept orders themselves — their involvement comes down to providing money and monitoring the results through a handy dashboard.

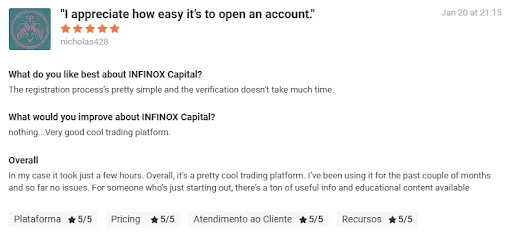

To sum it up, the broker puts substantial efforts into saving its customers' time. Even registration is as fast as the legal requirements permits — the author of this INFINOX Forex review confirms it.

Do I have to abandon trading in an economic crisis?

Not at all. Any crisis also provides space for growth and development. While the prices of some assets plummet, others become more expensive. To generate an income, a trader should monitor the markets, detect opportunities, and jump on them. Simultaneous investments in several asset classes are known as portfolio diversification. The earlier one masters it, the better.

INFINOX offers over 900 instruments to clients. They include indices, commodities, Forex pairs, futures, bonds, and equities. The terms for trading them are publicly available on the broker's website. One can freely switch between them and leverage the most suitable trading tools for each class of asset.

Quite a few INFINOX opinions confirm that this broker is optimal for diversification. Usually, a client sticks to a handful of their favorite instruments — but when the latter fail to provide them with a sufficient income, they consider alternatives. It is equally convenient to handle all options thanks to the affordable fees and the lack of glitches.

How can I evolve as a trader with INFINOX?

Usually, beginner-level traders first learn to make an income with one chosen class of assets, one account type, and a handful of strategies. Over time, they can try other instruments, open additional accounts, and experiment with tools, bots, and strategies. Plus, they can learn to handle larger budgets. The best-performing ones can become PAMMs or offer others an opportunity to copy their deals in the IX Social app.

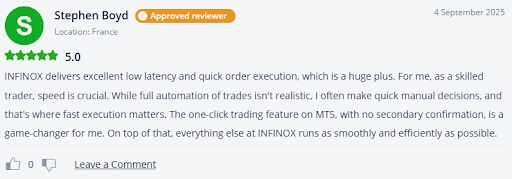

One can easily come across INFINOX broker reviews written by skilled traders. They confirm that this broker has created a comfortable environment for them. In particular, this user praises one-click trading and fast execution, which lets them seize the moment.

Why do some people leave negative reviews about INFINOX?

Any business generates not only positive, but also negative feedback. It is inevitable because people have different experience levels, requirements, and expectations. Some might have illusions about online trading, others might have prejudice against it. INFINOX opinions can be negative if a person failed to familiarize themselves properly with the documents and terms. Eccentric personalities might blame the platform for their reckless decisions or not too favorable market conditions.

Besides, marketers can use platforms with client feedback to promote dubious projects. They create posts that look like an INFINOX Forex review — yet in fact, it is an advertisement for scam services. For instance, the author can claim that they allegedly entrusted their funds to the broker, and something went wrong. Then, they would share the contacts of an organization or person who reportedly helped them retrieve their funds. There are no reasons to trust these attempts to tarnish business reputation. INFINOX has been around for much longer than shell corporations promoted by such posts. The company holds robust licenses and a large pool of loyal clients — which scam projects obviously lack.

Honest INFINOX broker reviews sometimes mention shortcomings, too. However, their authors usually admit that the company works well, in general, and list several of its advantages. Here is an example of how a person can express their balanced opinion about the financial service provider.

Conclusion

Hopefully, this article is a comprehensive summary of the INFINOX pros and cons in the format of questions and answers, backed up with screenshots. Despite minor shortcomings, this broker offers decent opportunities for making money online.

The entry threshold is low, and the minimum required budget is only USD 50. One does not need to be good at math or have any specific set of skills to succeed at buying and selling assets. Thanks to automation tools, copy trading, and the services of percentage allocation module managers, nearly anyone can try to increase their income with INFINOX. The payouts will be fair, and the free educational materials will help aspiring traders learn and improve.

Media Contact

Company Name: Universal Media Ltd

Contact Person: Jacob Mallinder

Email: Send Email

Country: United Kingdom

Website: https://www.finance-monthly.com/