The noise is getting louder. Whether it’s the headlines, social media posts, commodity and currency market activity, or just the feeling that “this time is different,” the “sell America” trade — the idea of reallocating a part of portfolios away from the U.S. — is taking hold. We’ll see if it sticks.

I’m skeptical of the “sell America” trade. Not necessarily because of the intentions, but because markets are electronically linked to a degree we’ve never seen. Even if the sentiment of “increase international” is growing among some part of U.S.-based investors, there’s an elephant in the room. It's this:

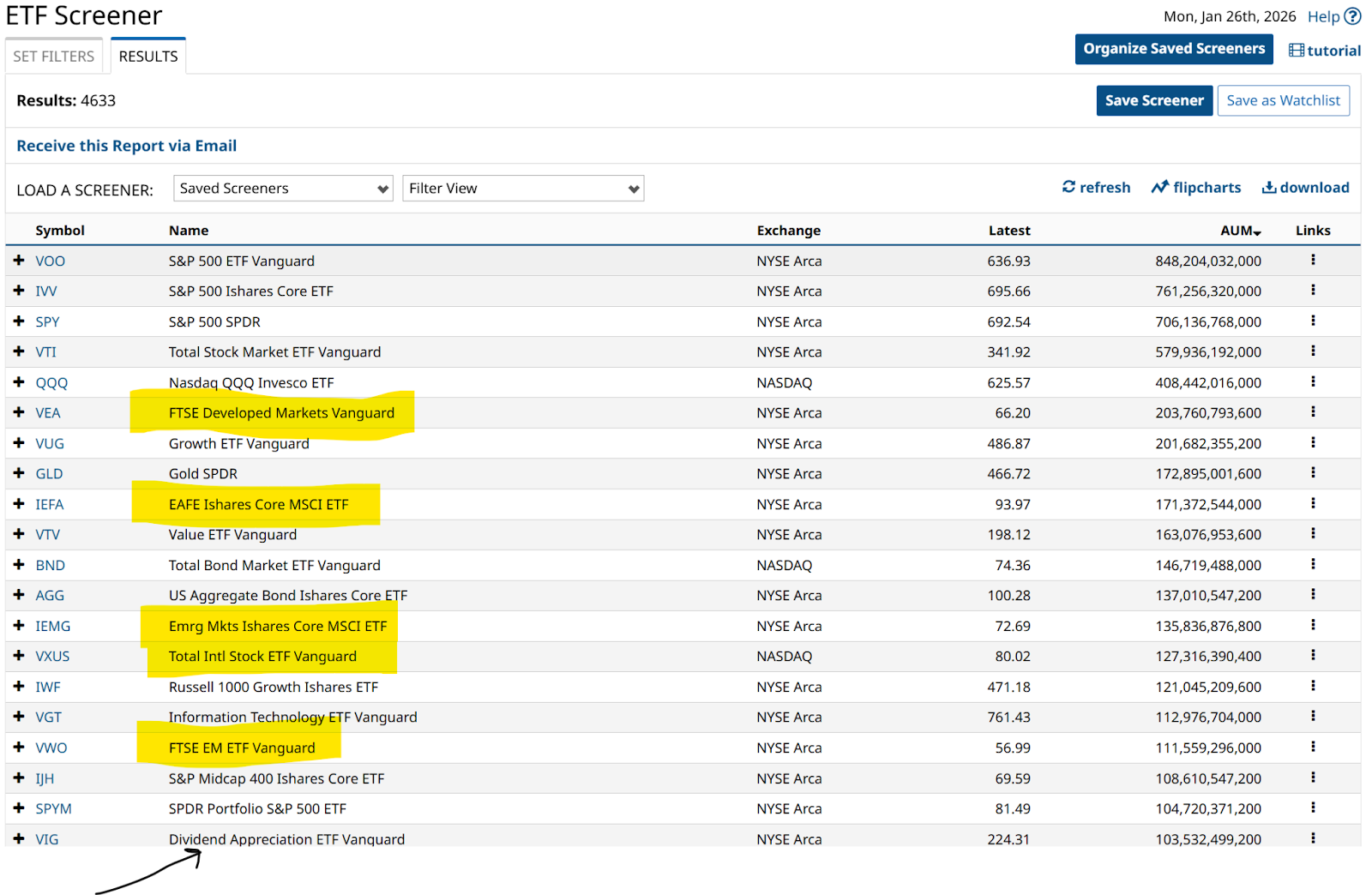

These are the 20 U.S.-listed exchange-traded funds (ETFs) with at least $100 billion in assets as of Monday morning. There are a few focused on non-U.S. stocks, but they are dwarfed by the top handful of dominant U.S. stock funds. And those, in turn, own a small number of mega-cap tech stocks. So, my question is, how will the market accomplish a sustainable shift of assets from where they are sitting now, to international stocks? The global markets are too closely linked, in large part due to the indexation of investing, that it will take a shift more like turning a cruise ship than a small yacht.

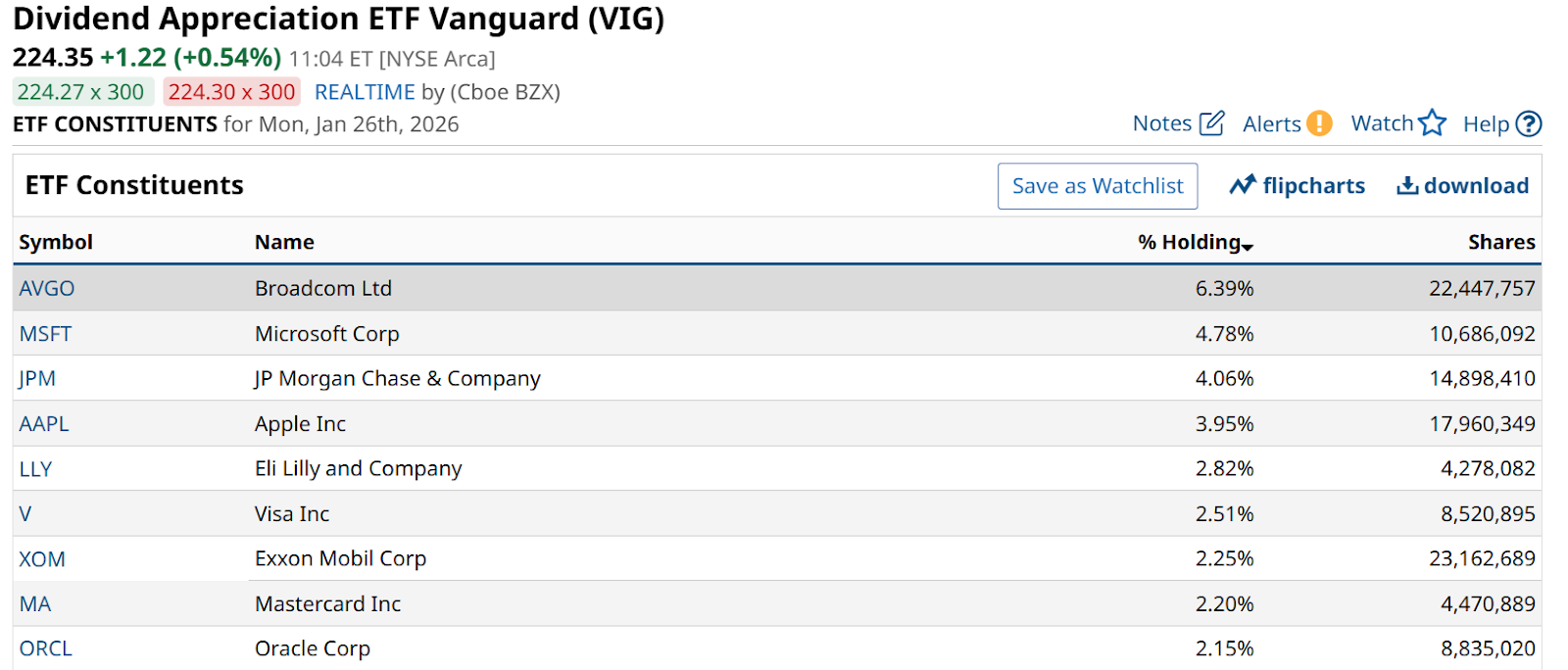

Within those top 20 ETFs, sitting in the very last spot on the list, is a single dividend-focused ETF. But that one, Vanguard Dividend Appreciation ETF (VIG), is essentially a growth fund that includes stocks that happen to pay a dividend, and it grows each year. But the percentage payout is skinny.

Sure enough, at 25x trailing earnings and yielding just 1.6%, this is a growth fund with lighter-than-normal Magnificent 7 exposure — not a dividend fund. And yes, this is the only one in the top 20. Which means ETF investing is decidedly oriented toward growth stocks.

If we want to find yield in stocks outside the U.S., we can’t look at the biggest ETFs. That makes sense, because when investors flee the U.S. and head for the exits, they aren't looking for speculative tech abroad. They are more likely looking for income and relative stability.

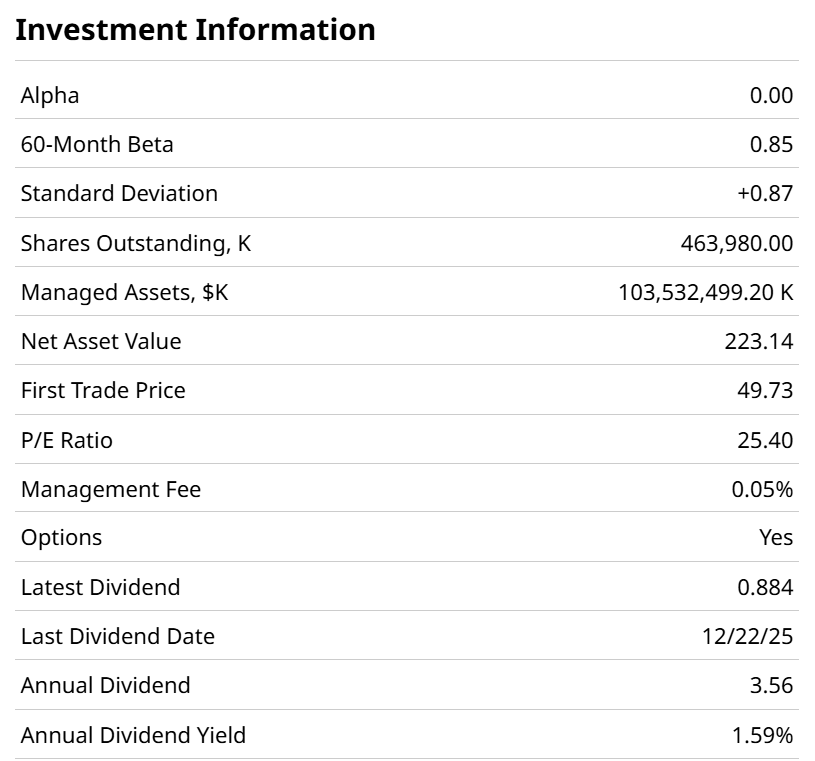

This is where international dividend and emerging market ETFs become the safe harbor in the rotation. Here are two to check out, with the largest non-U.S. ETF listed for comparison.

2 International Dividend Stocks To Watch

The iShares International Select Dividend ETF (IDV) is the classic choice for this trade. It focuses on developed markets (Europe and Asia) and currently boasts a trailing 12-month yield of 4.7%, about 35% higher than the giant benchmark ETF to the far right in the table.

WisdomTree Emerging Markets High Dividend Fund (DEM) covers the smaller non-U.S. markets and carries a similar yield to IDV. During 2025, many emerging market dividend funds returned nearly 30%, easily outpacing the S&P 500 Index.

Buying international dividends is for some (not me), an investment bias. Buying them because you want uncorrelated income is a strategy. Just be aware that most of these (IDV and DEM included) are unhedged. This means if the dollar suddenly spikes, your international gains could be wiped out by the currency translation.

I’ve used IDV and DEM in the past, but not recently. Still, they are the first two places I’d look if I decided to return to that genre of investing. And while I acknowledge the spirited run they’ve had since last April, I see them thus far as more different than better, and owing more to the U.S. dollar decline than a sudden increased attractiveness from a fundamental standpoint.

Rob Isbitts is a semi-retired fiduciary investment advisor and fund manager. Find his investment research at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app. His new blog on racehorse ownership as an alternative asset is at HorseClaiming.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart