The J. M. Smucker Company (SJM), headquartered in Orrville, Ohio, is a leading American manufacturer of branded food and beverage products. With a market cap of $11.8 billion, the company has evolved from its origins in apple butter production to encompass a diverse portfolio of consumer goods. Smucker operates through four primary segments: U.S. Retail Coffee, U.S. Retail Frozen Handheld and Spreads, U.S. Retail Pet Foods, and Sweet Baked Snacks.

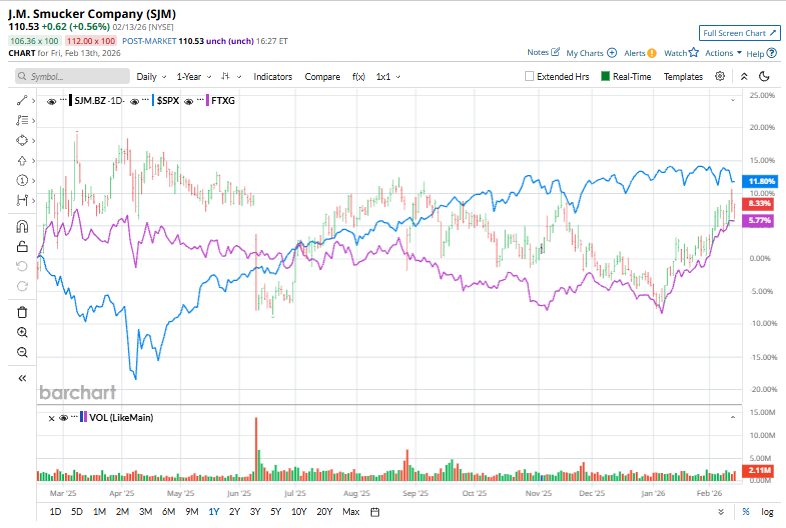

Shares of this leading consumer packaged goods company have underperformed the broader market over the past year. SJM has increased 5.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 11.8%. However, in 2026, SJM’s stock soared 13%, compared to the SPX’s marginal decline on a YTD basis.

Zooming in, SJM has trailed the First Trust Nasdaq Food & Beverage ETF (FTXG). The exchange-traded fund has surged 5.2% over the past year, and but has outpaced the ETF’s 12.8% on a YTD basis.

On Jan. 16, J.M. Smucker approved a $1.10 per share dividend on the common shares of the Company. The dividend will be paid on Monday, March 2, 2026, to shareholders of record at the close of business on Friday, February 13, 2026. SJM shares rose 1.1% in the next trading session.

For the current fiscal year, ending in April 2026, analysts expect SJM’s EPS to fall 99.1% to $9.02 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters while missing the forecast on two other occasions.

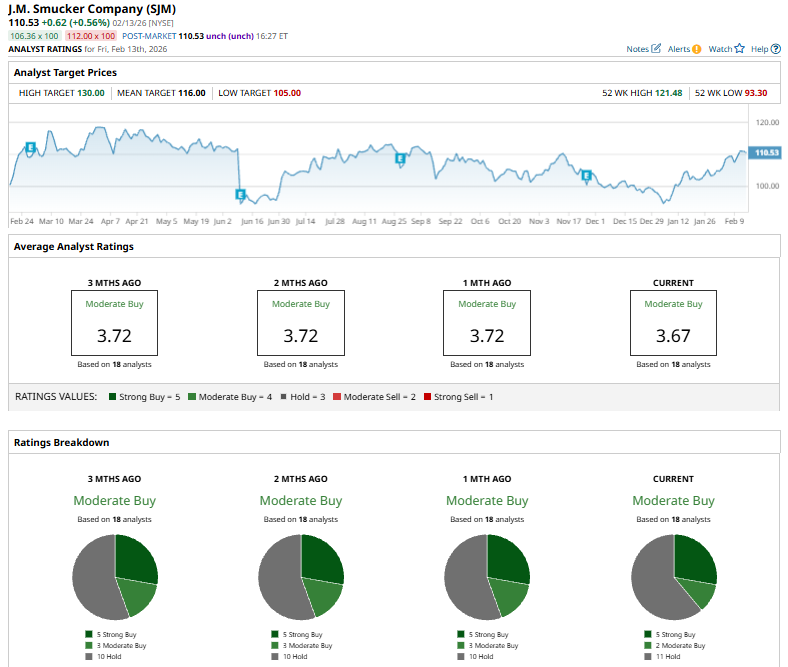

Among the 18 analysts covering SJM stock, the consensus is a “Moderate Buy.” That’s based on five “Strong Buy” ratings, two “Moderate Buys,” and 11 “Holds.”

On Jan. 16, Morgan Stanley downgraded J.M. Smucker to “Equalweight” from “Overweight” and cut its price target to $105 from $115, bringing it close to the stock’s trading level. The downgrade followed a period of strong relative outperformance versus center-store peers and reflected emerging competitive risks and profitability pressures, with the bank noting that Smucker’s expected organic sales outperformance is now largely priced in.

The mean price target of $116 represents an 4.9% premium to SJM’s current price levels. The Street-high price target of $130 suggests an upside potential of 17.6%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart