New York Times (NYT) shares inched higher on Wednesday after Berkshire Hathaway (BRK.A) (BRK.B) confirmed it has built a new sizable stake in the mass media company. According to its latest 13F filing, the conglomerate now owns some 5.07 million NYT shares, an investment that’s worth roughly $38 million at the time of writing.

Including today’s surge, New York Times stock is up more than 10% versus its low on Feb. 3.

Does Berkshire’s Stake Warrant Buying NYT Shares?

Berkshire’s announcement drove NYT stock up this morning, primarily because it serves as a powerful validation of the firm’s “digital-first” transformation. The conglomerate’s sizable stake signals New York Times has successfully built an economic moat around its brand in an era of fragmented media.

Investors may read it as a bet on the company’s unique ability to maintain pricing power and brand authority.

All in all, amassing a nearly 3% stake, Berkshire Hathaway is indicating that it no longer sees NYT as a newspaper only, but rather a durable, high-margin digital platform capable of generating consistent cash flow.

Note that the Times’ relative strength index (14-day) sits at about 65 currently, reinforcing that it’s not overbought yet.

Why Else Are New York Times Stock Attractive in 2026

NYT’s fundamentals paint a picture of a robust growth engine as well. In Q4, the company saw revenue grow by 10.4% year-over-year, as it added roughly 450,000 net new digital-only subscribers.

Moreover, its commitment to diversifying its ecosystem through “The Bundle,” integrating news with high-engagement products like games, recipes, and The Athletic, may also drive its share price higher.

Meanwhile, an expanded partnership with “Magnite” on mobile ads positions NYT to enjoy higher advertising yields. With a clean balance sheet featuring over $700 million in net cash, New York Times shares are strongly positioned to navigate the artificial intelligence (AI)-driven shift in content consumption.

NYT is trading decisively above its major moving averages (MAs) as well, which further confirms that it’s currently in a strong uptrend.

Wall Street Remains Bullish on New York Times

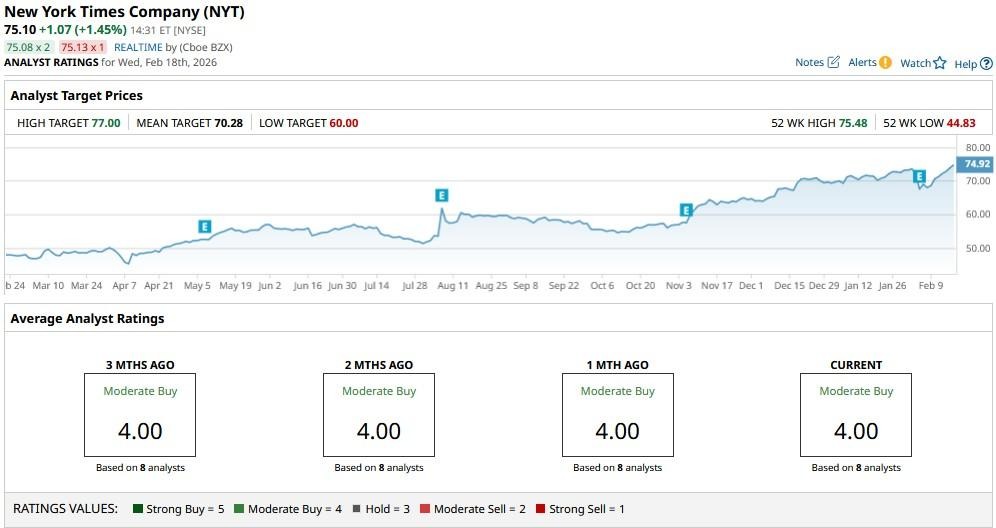

Wall Street analysts also rate New York Times at a “Moderate Buy” for 2026.

While the mean target of about $70 sits below the company’s current stock price, it’s reasonable to assume that at least some analysts will upwardly revise estimates for NYT shares following the Berkshire news.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Moderna Jumps Above 20-Day Moving Average on FDA Flu Vaccine Review. Should You Buy MRNA Stock Here?

- This Is the Cloud’s Olympic Moment. Will It Medal or Bust?

- Cadence Stock Is Challenging Its 50-Day Moving Average After Earnings. Should You Buy CDNS Here?

- Warren Buffett Says This One Thing Is What Makes a Good Money Manager: ‘We Are Here to Make Money With You, Not Off You’