SoftBank Group (SFTBY) just announced in its latest 13F form that it has completely divested its holdings in Nvidia (NVDA), selling its shares that were valued at $3.59 billion as of the end of the prior quarter. The announcement has naturally caught everyone’s attention. The question that naturally comes to mind is, should we follow their lead?

The timing of this announcement is particularly interesting. NVDA stock has still been rising sharply over the past 12 months, even after pulling back from its 52-week high of $212.19. As AI spending continues to dominate capital allocation among Big Tech companies, Nvidia remains very much in focus. Should we read into this announcement that SoftBank is anticipating trouble ahead or just taking profits?

About Nvidia Stock

Nvidia is a semiconductor giant based in Santa Clara, California. The company is perhaps best known for its GPUs that power AI training and inference workloads. With a market capitalization of $4.49 trillion, Nvidia is currently among the top publicly traded companies in terms of valuation.

The current NVDA stock price of $185 represents an increase of over 35% over the past 12 months, even after this consolidation. The stock has moved between $86.62 and $212.19 over this period. This hasn't quite been as impressive as its 159% and 694% gains over the last two- and three-year periods, respectively. Or the even more dramatic 1,000%+ and 20,000%+ gains the further back you look.

From the valuation point of view, NVDA stock currently has a trailing P/E of 47.48 and a forward P/E of 26.59. The forward P/E has declined considerably due to the explosive growth in earnings. The stock also has a price-sales ratio of 24.30, which is on the higher side when compared to the overall semiconductor industry.

However, the profit margins of 55.85% and return on equity of close to 99% also justify the premium valuation to some extent. The stock also offers a quarterly dividend of $0.01 per share; however, this is not the primary attraction for investors.

Nvidia Beats on Earnings

Nvidia’s recent quarterly earnings are not indicative of a company declining. In its recent quarter, i.e., the third quarter of fiscal 2026, Nvidia reported record revenue of $57 billion, which is up 22% sequentially and 62% year-over-year (YoY). Data center revenue came in at $51.2 billion and increased 25% from the previous quarter and 66% from the same period last year.

In addition, GAAP and non-GAAP gross margins were above 73%, reflecting the pricing power that Nvidia still possesses in its ecosystem. Earnings per share were $1.30 on both a GAAP and non-GAAP basis.

Management also stated that Blackwell GPU sales are off the charts. Cloud GPUs are sold out. AI compute demand is strong in training and inference. Nvidia is still enjoying the benefits of its expanding ecosystem. In the first nine months of fiscal 2026, Nvidia returned $37 billion in shareholder repurchases and dividends and still has $62.2 billion available under its existing repurchase authorizations.

Therefore, the recent sale of its shares by SoftBank does not appear to have anything to do with the fundamentals of the stock.

What Do Analysts Expect for NVDA Stock?

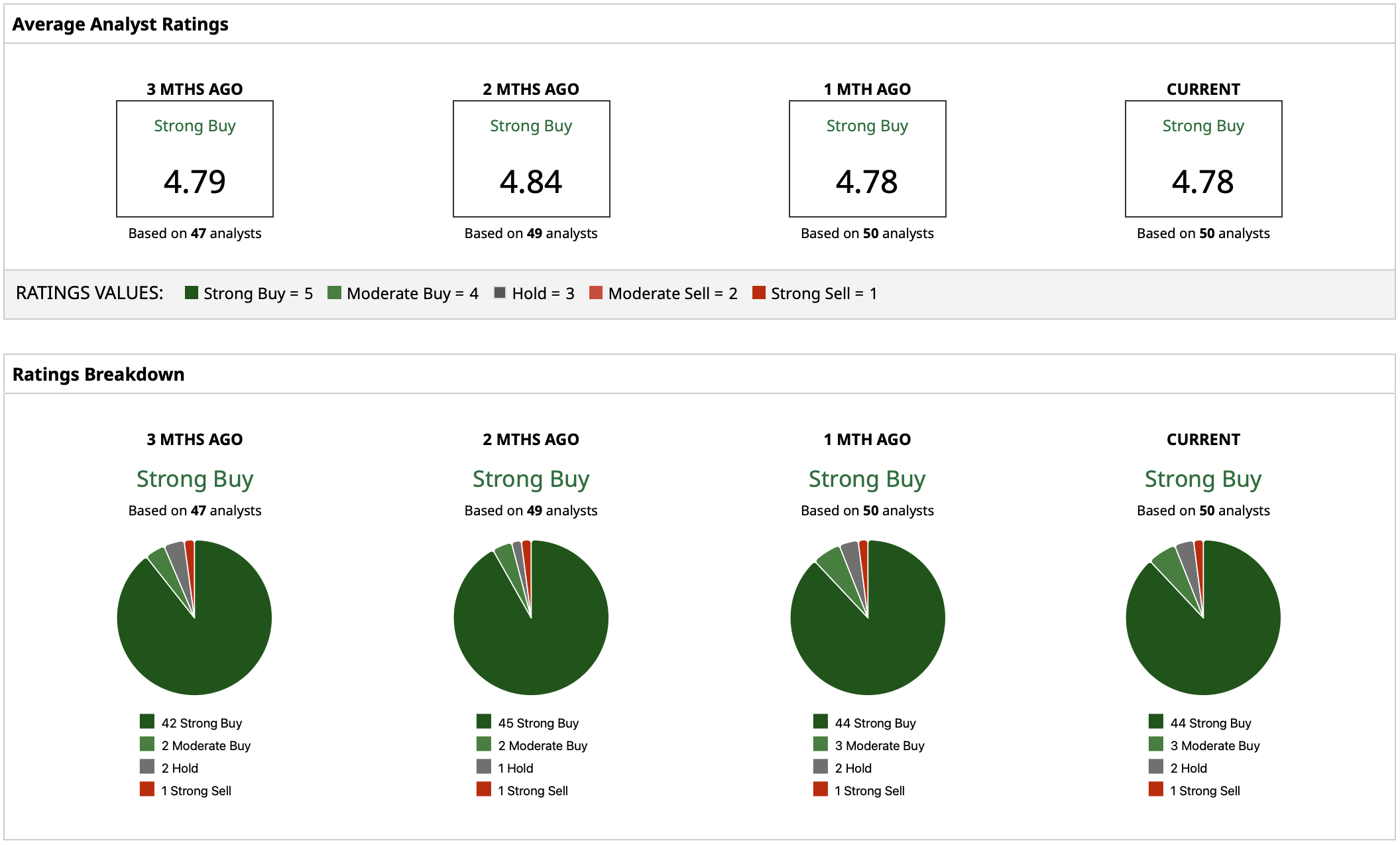

Wall Street's sentiment on the stock remains constructive. According to analysts, NVDA has a consensus "Strong Buy" rating from a wide range of analysts. The mean target price on NVDA is $255.55. The mean target price of $255.55 implies upside of about 38% from current levels, which are about $185. The high target price of $352 implies even higher upside, while the low target price of $140 implies concerns about valuation and cyclicals.

In short, while SoftBank's sale of NVDA was highly publicized, Wall Street's consensus still implies upside.

On the date of publication, Yiannis Zourmpanos had a position in: NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.