For reasons I have not yet come to grips with, I’ve been saying this phrase a lot in 2026: “I’m old enough to remember when…” And now, I’ll do it again. Because I’m old enough to remember when very few investors knew what master limited partnerships (MLPs) were. Or, simply confused them with private funds.

But this industry has come a long way in terms of investor recognition. And from my chart work, it looks poised to again capture some hearts. One in particular, a stalwart in the group, is the Alerian MLP ETF (AMLP).

It is proving to be a durable choice in a volatile market, primarily because its underlying businesses operate like essential infrastructure rather than speculative energy plays. As a pure-play on midstream MLPs, the fund focuses on the pipelines and storage facilities that act as the physical arteries of the U.S. economy.

It's Nice To Be the Toll Collector

The stability seen currently in AMLP stems from its fee-based business model. Unlike oil producers that lose money when prices drop, midstream MLPs charge a flat fee for every barrel or cubic foot of gas that moves through their system. This makes them less sensitive to the wild swings in energy prices and more like a toll road for oil and gas.

A major new driver in 2026 is the boom in data-center construction. Massive facilities operated by companies like Oracle (ORCL) require vast amounts of electricity. And MLPs are signing long-term contracts to transport the natural gas needed to power them.

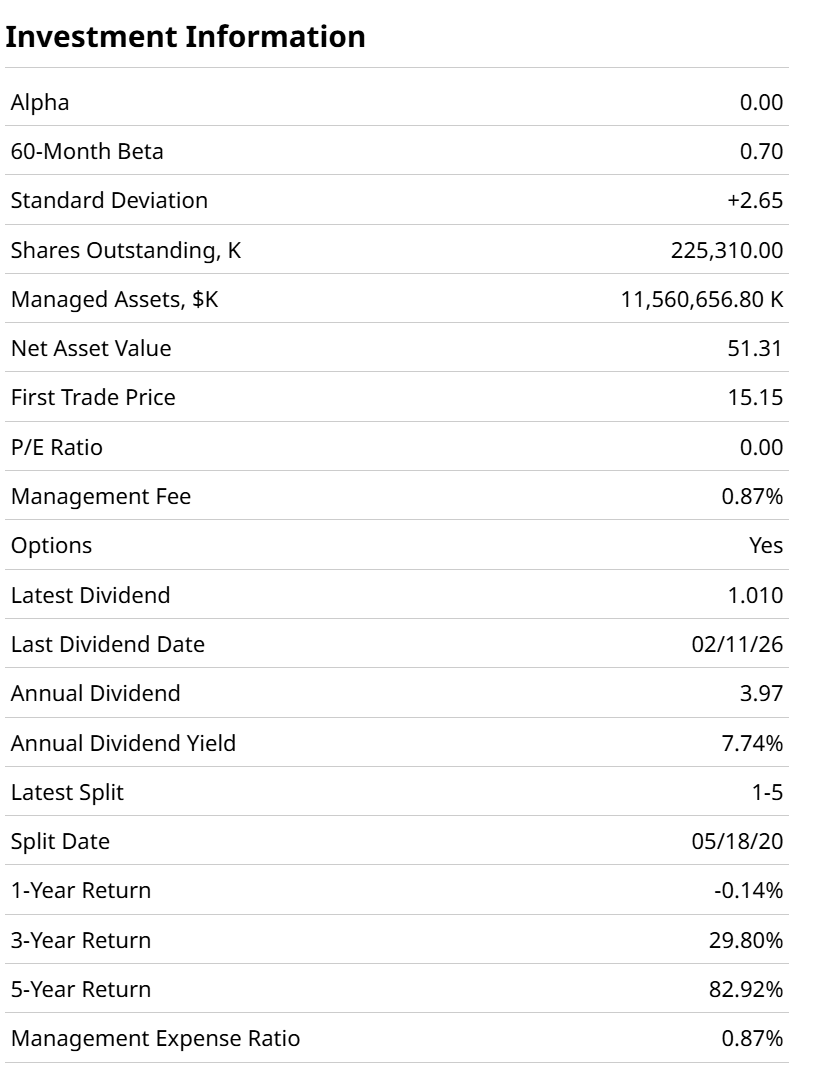

AMLP just continued a streak of 61 consecutive quarters of payouts. This steady income acts as a major shock absorber when the broader stock market wavers.

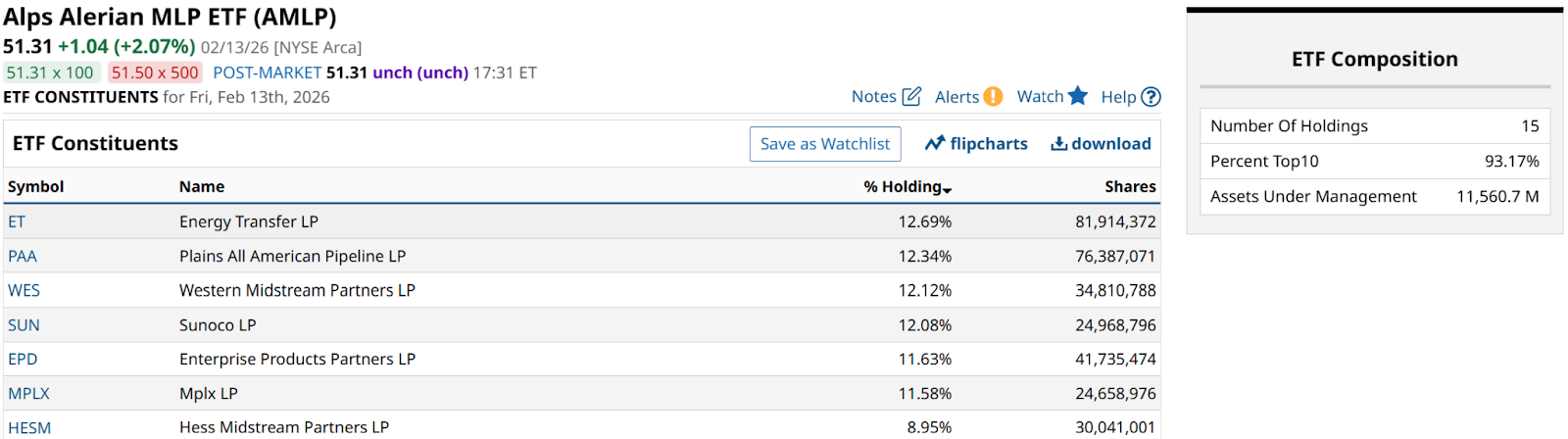

I like concentrated exchange-traded funds (ETFs). With an industry like MLPs, with a relatively few number of listed companies, this ETF has only 15 names. And these seven make up a vast majority of assets under management.

Why MLPs Work When The Stock Market Doesn’t

MLPs provide a unique hedge. In the specific case of AMLP, it has a beta of just 0.7x. That means it has historically been 30% less volatile than the S&P 500 Index ($SPX). In a risk-on, risk-off market, this defensive posture allows investors to earn income without the swings of tech or growth stocks.

One of the biggest hurdles for MLPs has always been the K-1 tax form. AMLP solves this by being structured as a C-Corporation, meaning it handles the complex tax filings internally and sends you a simple 1099 form. You own the fund that holds MLPs, not the MLPs directly. Back when funds of this type debuted, they sold like a proverbial “oil rush.”

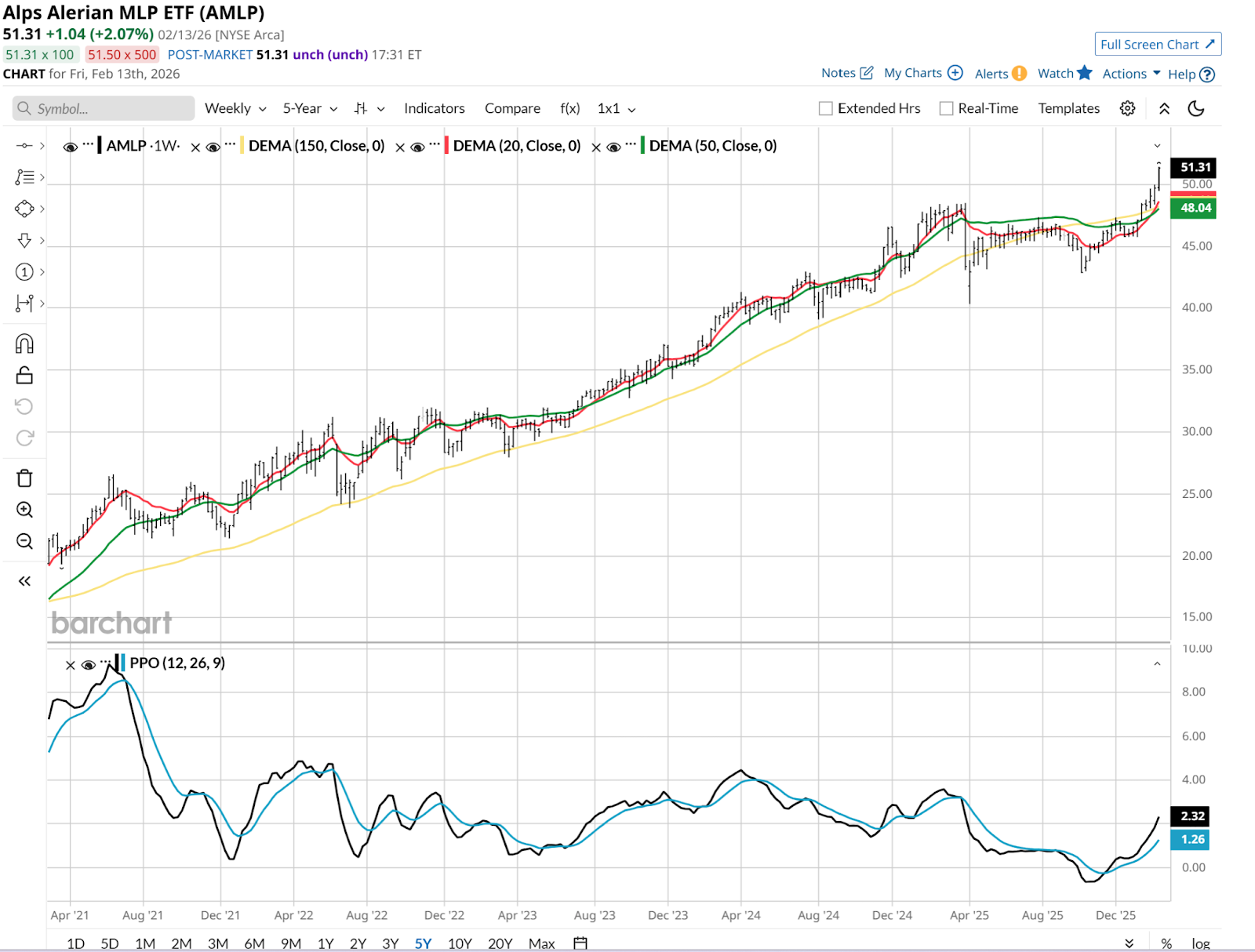

This is a good-looking chart in an average market. But to me, this is a well-below-average market. That makes AMLP a needle in a haystack. Or an oil field, if you will.

Here’s the weekly chart. What I see is that the main risk here is the same thing that has befallen nearly every market segment that has broken out like AMLP has. Specifically, that the market just refuses to reward anything for very long.

However, in this case, the yield might be a good backstop. That, and the nature of AMLP to typically avoid whipsaw reversals, bode well for this rare ETF gem in a market that gets tougher to navigate each week.

Rob Isbitts created the ROAR Score, based on his 40+ years of technical analysis experience. ROAR helps DIY investors manage risk and create their own portfolios. For Rob's written research, check out ETFYourself.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart