- LegalShield Index rises 10% in 2025, reaching highest sustained level in years as Americans rely on credit to maintain spending

- Consumer Finance Subindex surges 6.7% in Q4 as households increasingly struggle with $17.5 trillion in total debt

- Bankruptcy inquiries rise 15.6% year-over-year, serving as a leading indicator for federal court filings

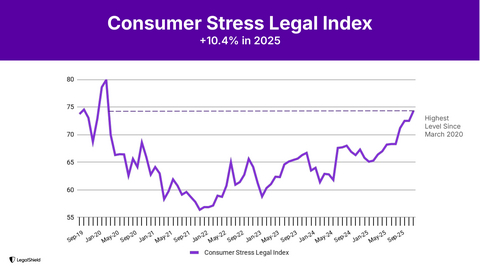

Financial strain has settled into a new normal for American households, with the LegalShield Consumer Stress Legal Index (CSLI) rising 4.4% in the fourth quarter of 2025—the third consecutive quarterly increase that pushed the index 10.4% above 2024 levels to its highest sustained point since the early pandemic.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20260218773628/en/

LegalShield Consumer Stress Legal Index (CSLI) rose 4.4% in the fourth quarter of 2025—the third consecutive quarterly increase that pushed the index 10.4% above 2024 levels to its highest sustained point since the early pandemic.

“Rising consumer stress seems to be a new normal,” said Matt Layton, LegalShield senior vice president of consumer analytics. “Increased consumer debt is fueling consistent spending and driving up the CSLI quarter over quarter over quarter.”

The CSLI is built from LegalShield's position as one of North America's largest legal services platforms, tracking actual legal activity through more than 150,000 monthly consultations with its nationwide network of provider law firms. The index measures three core areas — Consumer Finance, Foreclosure, and Bankruptcy — compiled from a database of more than 36 million records dating to 2002. Unlike traditional sentiment surveys that track how consumers feel about the economy, the CSLI captures the concrete steps Americans take to seek legal help to relieve the financial pressure.

Consumer Finance: Spending Resilience Masks Record Debt

The Consumer Finance subindex grew 16.3% since January 2025, reflecting a sharp rise in legal inquiries tied to billing disputes, collections, and creditor negotiations.

While consumer spending continues to rise (2.8% YoY in September 2025, 2.7% in October and 2.8% in November according to the Bureau of Economic Analysis), this resilience is increasingly funded by debt rather than disposable income. According to the latest report from the Federal Reserve at the end of Q3 2025, total U.S. household debt climbed above $18.59 trillion, up more than $650 billion year-over-year, with delinquency rates on the rise.

- Credit Reliance: Households are increasingly using credit and Buy Now, Pay Later (BNPL) services for essentials like groceries and utilities, as shown in a LegalShield study in 2025.

- Rising Delinquencies: Serious delinquencies in credit cards and auto loans are rising as average credit card interest rates remain near 21–22%, prompting the White House to propose a 10% interest rate cap. Outstanding debt in some stage of delinquency reached 4.5% in the latest report from the Federal Reserve Bank, up from 3.5% a year prior.

Bankruptcy: A Leading Indicator for U.S. Courts

The LegalShield Bankruptcy subindex is up 19.9% in the second half of 2025 and rose 15.6% year over year. LegalShield’s bankruptcy data has historically served as a leading indicator, preceding actual non-business bankruptcy filings in the U.S. Courts by two quarters with a .95 correlation since 2006.

The Administrative Office of the U.S. Courts reported 13% year-over-year increases in filings in Q4 2025, validating the upward trend first captured by the CSLI. This sustained pressure suggests that the current wave of bankruptcy stress is driven by rising debt, even in a stable job market.

Foreclosure: Pressure Managed, Not Resolved

The Foreclosure subindex was up 15.0% year-over-year. The high volume of legal inquiries suggests that homeowners are seeking help to manage rising housing costs.

- Escalating Costs: Inquiries to LegalShield provider lawyers indicate homeowners face structural pressure from elevated insurance, tax, and escrow costs, even on fixed-rate mortgages.

- Delayed Impact: LegalShield providers share that foreclosure stress is being managed through modifications and forbearance, buying time rather than solving the underlying affordability crisis.

"Helping families secure immediate relief through modifications is essential for keeping people in their homes," said Christopher Peoples, a LegalShield provider attorney in Kansas with Riling, Burkhead, & Nitcher. "But that temporary relief comes with a long-term reality, and we counsel clients that today's breathing room likely leads to even higher, unmanageable debt down the road."

About LegalShield

For more than 50 years, LegalShield has provided everyday Americans with easy and affordable access to legal advice, counsel, protection, and representation. Serving millions, LegalShield is one of the world's largest platforms for legal, identity, and reputation management services protecting individuals and businesses across North America. Founded in 1972, LegalShield and its privacy management product IDShield equip individuals, families, businesses, and employers with the tools they need to affordably live a just and secure life. Through technology and innovation, LegalShield is transforming how people access legal guidance, with hundreds of qualified attorneys and law firms across the country. To learn more, visit LegalShield.com and IDShield.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260218773628/en/

Contacts

Media Contact:

Cameron Penn, Director of Communications

CameronPenn@pplsi.com