NFTs are evolving at a breakneck pace as the technology quickly matures beyond simple pfp (profile picture) projects focused on digital art. NFT developers now have a much larger use case in their sights – tokenizing real world assets.

Origin Protocol has led this charge by launching the first ever NFT marketplace for decentralized physical real estate exchange. The platform has been built in partnership with US real estate firm Roofstock to improve the investor experience.

How NFTs Revolutionize Real Estate Brokerage

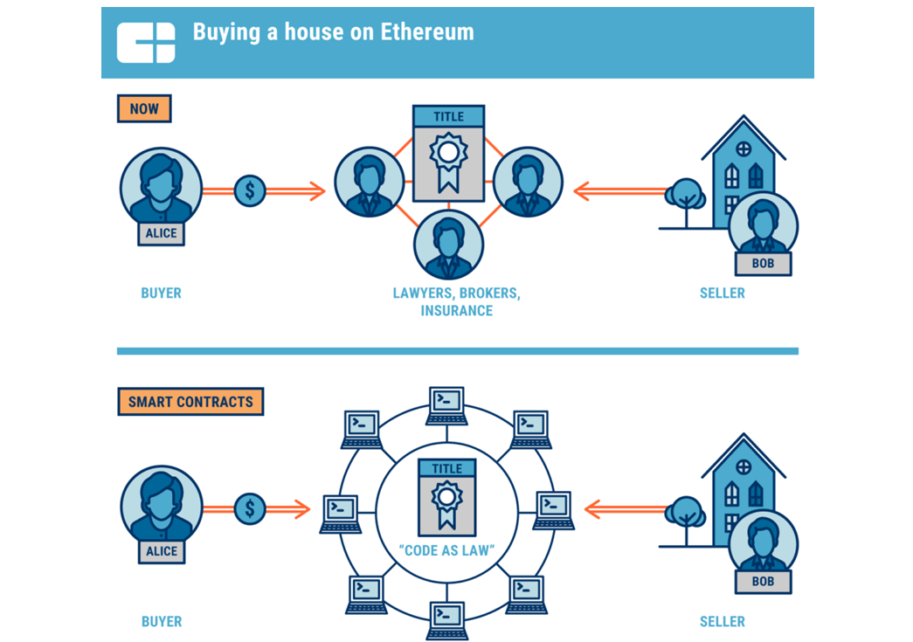

The $11T physical real estate market is fraught with redundancies. Any potential property deal involves a host of third parties each claiming their own fees.

As a result, home sellers may often incur fees in excess of 10% of a home’s valuation upon sale. Additionally, transferring ownership of a property is a slow process, taking between 30-60 days. These obstacles are even more significant in a macro climate where most individuals are facing the pressure of high inflation and interest rate hikes.

Roofstock’s marketplace, powered by Origin, directly addresses these inefficiencies to deliver greater savings to homeowners and buyers alike.

The platform’s first sale was finalized in October. Both parties enjoyed the benefits that stem from real estate NFTs. The three bedroom home in Columbia, SC, sold for $175,000 using USDC. Total fees incurred amounted to only 3%. Fees consisted of a 0.5% marketplace fee and a 2.5% brokerage fee.

This sale marked the first instant sale and settlement of a physical property via an NFT marketplace.

Non-fungible Token Utility for the Real World

NFTs are primed to disrupt vast real world asset classes, as has been evidenced by Origin’s latest offering. The redundancies in traditional real estate are commonly found throughout established real world asset classes.

Origin is committed to building comprehensive white label marketplaces with rich feature sets. This provides strong foundations for projects to launch cutting-edge utility that truly challenges established norms.

Generic marketplaces like Opensea and Looksrare are built to cater to the current wave of art-based NFT utility. However, such platforms simply lack the capabilities to serve an increased hunger for bespoke, product-first platforms. As tokenizing real-world assets gains further traction, projects leading this charge will likely require their own marketplaces given the complexities of exchanging these assets.

White-label marketplaces are primed to support previously untapped use cases. Origin’s marketplaces are with careful attention to partners’ core value propositions, ensuring full functionality for innovative NFT projects. Partners are thus able to focus on what matters most – their products.

Future Applications of Real Estate NFTs

Real estate is a sprawling industry with many moving parts. For the majority, property ownership is an investment driven by necessity rather than speculation. The industry’s current inefficiencies make already exorbitant listings even less accessible. These hurdles impact all participants by reducing affordability and eating into investors’ potential profits.

Beyond retail real estate investment, NFTs offer a wealth of mechanics to further streamline the transacting experience.

Commercial Real Estate

Commercial real estate is ripe for disruption, from parking lots to offices and shopping malls. Given that this asset class is generally purchased by consortiums and companies, robust NFT infrastructure can offer major benefits through novel mechanics.

Mortgage Notes

Much of the documentation in the sector can benefit from tokenization. Mortgage notes form key components of a property sale, detailing financing and repayment structures in legally binding contracts. By representing mortgage notes as NFTs, holders are granted the peace of mind that provenance is secure and immutable.

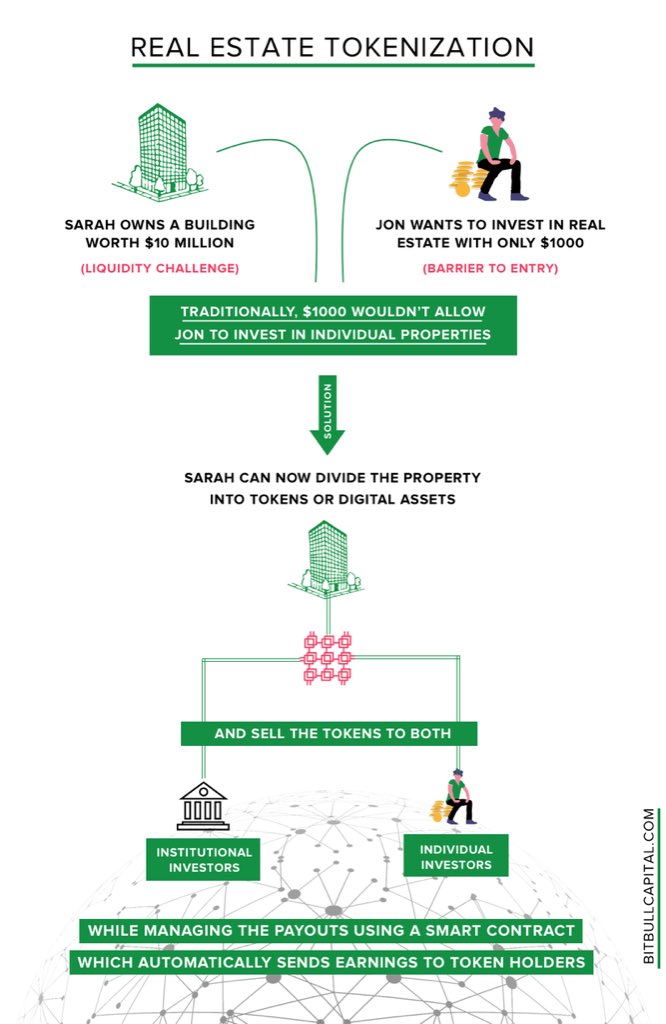

Fractionalization

Fractionalization offers yet another dynamic opportunity for investment. Put simply, fractionalization allows any NFT to be divided into a predetermined number of pieces. This mechanic has gained traction with blue-chip pfp NFTs. For example, those who can’t afford their own Bored Ape can still reap the rewards of an increase in floor price using capital they can afford.

Real estate NFTs purchased by multiple entities can be broken down into fractional allocations proportional to each contributor’s investment. This opens the door for transparent, on-chain shared investment in real estate. This use case is perhaps best suited for commercial real estate.

The beauty of non-fungible technology lies in its adaptability.

Creative innovation in NFTs makes it likely that vast classes of real world assets will trend toward tokenization. The nascent technology has the potential to streamline the efficiency of multi-trillion dollar markets. This could deliver significant value to people across the globe, regardless of their crypto expertise.

FAQ

How does buying and selling real estate as unique digital assets benefit individuals?

By trading NFT property, both parties are able to benefit from far lower fees and near-instant finality.

Is Real Estate the only industry NFTs can disrupt?

Not at all. Vast industries from entertainment to loyalty programs, automotive, and more, can benefit immensely from tokenizing their offerings and processes.

Read more investing news on PressReach.com.Subscribe to the PressReach RSS feeds:- Featured News RSS feed

- Investing News RSS feed

- Daily Press Releases RSS feed

- Trading Tips RSS feed

- Investing Videos RSS feed

Follow PressReach on Twitter

Follow PressReach on TikTok

Follow PressReach on Instagram

Subscribe to us on Youtube